Yesterday, we saw that only two U.S. sectors beat the S&P 500’s screaming 5.7% rally last week: technology, which was up 8.8%, and industrials, which was up 6.6%.

We’d previously done a sector “X-ray” on technology stocks, which showed they can be characterized as high-quality, high-growth companies that aren’t cheap.

Today, we’ll see if large-cap industrial stocks can give investors a different flavor of exposure.

As a quick refresher, here’s my process for sizing up a sector’s stocks:

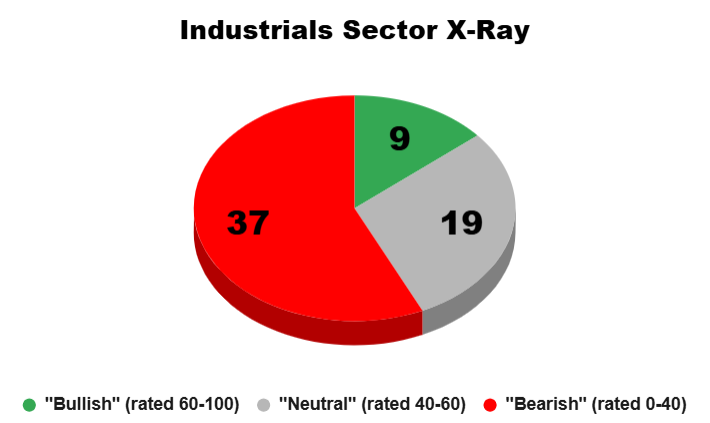

- I’ll “X-Ray” this sector’s S&P 500 members to see how many stocks are currently rated “Bullish,” “Neutral,” or “Bearish” on my Green Zone Power Rating system. You’ll see this analysis in the pie chart below.

- I’ll show you which Green Zone Power Rating factors the sector’s stocks rate well or poorly on. Specifically, we’ll be looking at Momentum, Volatility, Value, Quality and Growth.

- I’ll point you toward valuable opportunities and point out pitfalls you should do your best to avoid.

Let’s get to it!

Sector “X-Ray”

Generally, sizing up a sector’s strength involves two steps…

In the first step, we note the general direction of its trend — is it “up” or “down”?

The second step involves judging individual stocks within the sector, which is generally called “breadth” analysis.

Most of the time, if a majority of individual stocks within a sector are sending a “bullish” message, a bullish trend in the sector’s market prices can be trusted. The opposite is also true. A sector that is overweight “bearish” stocks is not on solid ground.

Seeing the industrial sector beat the broad market’s strong gains last week was encouraging. But the real question to ask is … should we buy the whole sector or be more selective?

First, we’ll consider my Green Zone Power Rating system’s Overall rating, which can broadly be categorized into one of three buckets:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

There are 65 industrial sector stocks in the S&P 500, and here’s how they currently rate:

Key Insights:

- Only 13.8% of the sector’s stocks rate “Bullish” (60-100). This compares to 25% of stocks in the broader S&P 500.

- A full 57% of the S&P’s industrial stocks rate “Bearish” (0-40). This compares to 46% of stocks in the broader S&P 500.

All told this analysis shows that the industrial sector’s stocks are not as strong as last week’s market-beating performance suggests.

We can conclude one of two things from this…

Either the sector’s recent rally is not to be trusted, or investors will be better served by being highly selective — buying only the best industrial stocks and avoiding the worst.

Before we have a closer look at individual stocks, let’s continue our X-ray analysis to characterize the sector…

What Are You Buying When You Buy Industrials?

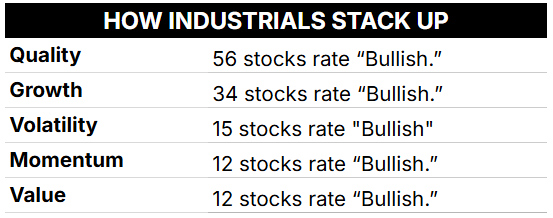

Here, we’re simply asking: “How many S&P 500 industrials stocks rate ‘Bullish’ (60-100) on Momentum … on Volatility … on Value … and so on?”

Listed in order, from the factor with the most “bullish” stocks down to the factor with the least number of bullish stocks, here’s how the consumer staples shape up today:

Interestingly, the broad industrial sector performs similarly to the technology sector … Quality and Growth are driving the sector’s bullish nature, while a low number of favorable Value ratings are holding it back.

Seeing this, it’s clear that investors will want to avoid the industrial sector’s most expensive stocks.

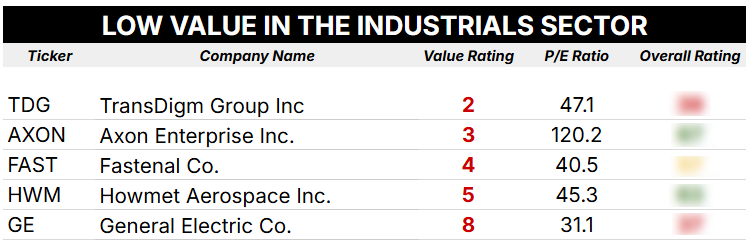

To that end, we present a table of five stocks with the worst rating on my system’s value metric:

As you can see, each of these stocks is rated 10 or lower on the Value factor and sport price-to-earnings (P/E) ratios of between 31 and 120.

Axon Enterprise (AXON) shares have gained 32% since Trump’s election win last November and earns bullish ratings on my Momentum, Quality and Growth factors. But with a P/E of 120 … the stock is now richly priced!

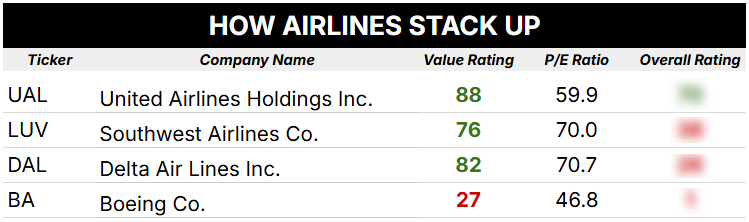

Lastly, for today, I asked my team to take a closer look at the airline industry, a subset of the broader industrial sector that is most definitely exposed to the global economy and, thus, the ongoing trade war.

Have a look at what we found…

With a market cap of nearly $120 billion, Boeing (BA) is far larger than the three U.S. carriers listed above. It’s also the most poorly rated of the bunch — on Growth, Quality, Value … and Overall, with a pathetic Overall rating of 1 out of 100!

Considering that and this headline out of China this morning, Boeing is not a stock to own right now:

Alongside this latest news, we reported last week how Delta (DAL) pulled earnings guidance, citing uncertainty over tariffs.

While you’ll see United Airlines is rated bullish on growth, momentum, value and overall … our earnings screen from Friday revealed the company is expected to post a decline in earnings per share (EPS) when it reports after the close today.

We suggest waiting to see how the market reacts to the company’s latest numbers and any forward guidance it provides (or doesn’t).

To good profits,

Editor, What My System Says Today

P.S. Paid-up Green Zone Fortunes subscribers are sitting on an open gain of over 750% on one small-cap industrial-sector stock that currently rates bullish on quality, growth and value … and a “strong bullish” 82 overall. Click here to gain access to our detailed analysis of this opportunity.