Official inflation is still low. In January, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3%, according to the Bureau of Labor Statistics. Over the last 12 months, the index shows a 1.4% increase in prices.

One analyst told The Wall Street Journal the data indicates that “there’s just no real significant underlying inflationary pressure.” This confirms the outlook of Treasury Secretary Janet Yellen and Chairman of the Federal Reserve Jerome Powell.

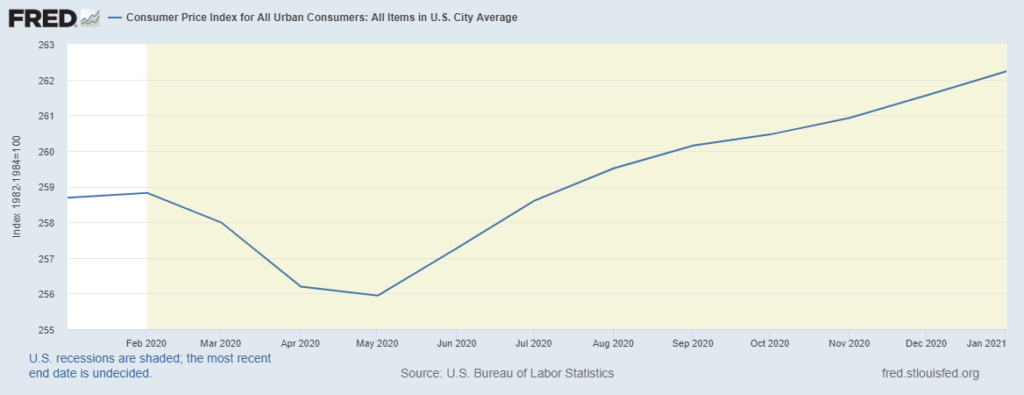

But a quick glance at a chart of the CPI-U shows that inflation is almost certain to rise above 2% in the next few months.

Consumer Price Index Foreshadows 2% Inflation

Source: Federal Reserve.

Stimulus Could Make Inflation Spike

As the economy shut down last year, prices plunged. In May 2021, if the CPI-U is unchanged from its current inflation, inflation will top 2.5%.

Of course, this will be easy for the Fed to ignore; it will attribute the surge to one-time factors. This known issue could even be why the Fed announced a major policy shift last August.

CNBC noted at that time that, “In a move that Chairman Jerome Powell called a ‘robust updating’ of Fed policy, the central bank formally agreed to a policy of ‘average inflation targeting.’ That means it will allow inflation to run ‘moderately’ above the Fed’s 2% goal ‘for some time’ following periods when it has run below that objective.”

Traders seem to be increasingly worried. The interest rate on 10-year Treasury notes more than doubled from its March low. At 1.1%, the yield is still low, but the Fed is actively buying Treasurys in part to keep yields low.

Adding to the worries is the fact that a $1.9 trillion stimulus bill is on the way. Combined with previous stimulus bills, the government will have pushed money worth more than 20% of GDP into the economy. Under normal circumstances, this would be inflationary.

But these aren’t normal circumstances. These are circumstances when inflation is already certain to rise. History shows low inflation suddenly becomes high inflation, and there is every reason to believe policymakers will be surprised by high inflation later this year.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.