Financial markets — and, more so, the pundits who analyze them — are always trying to sniff out the “bogeyman” that’s just around the corner.

Inflation is a popular one.

It’s demoralizing to watch your $1 yesterday be able to purchase just 97-cents worth of goods today. But that’s the “normal,” 2% to 3% type of inflation. We accept that as a fact of life.

Hyperinflation is the real bogeyman.

We’ve all heard stories of Argentina, where loaves of bread got re-priced higher by the minute … and of Zimbabwe’s 100-billion-dollar banknotes.

It’s a stretch to make a credible claim that inflation in the United States could ever reach such disastrous heights as the third-world’s most egregious anecdotes.

But, to be fair … the U.S. money supply has gone vertical recently.

The U.S. Money Supply’s Surge

And it’s only natural to assume there will, at some point, be a price to pay.

Inflation Concern Is Consensus

Here is another provocative chart in circulation:

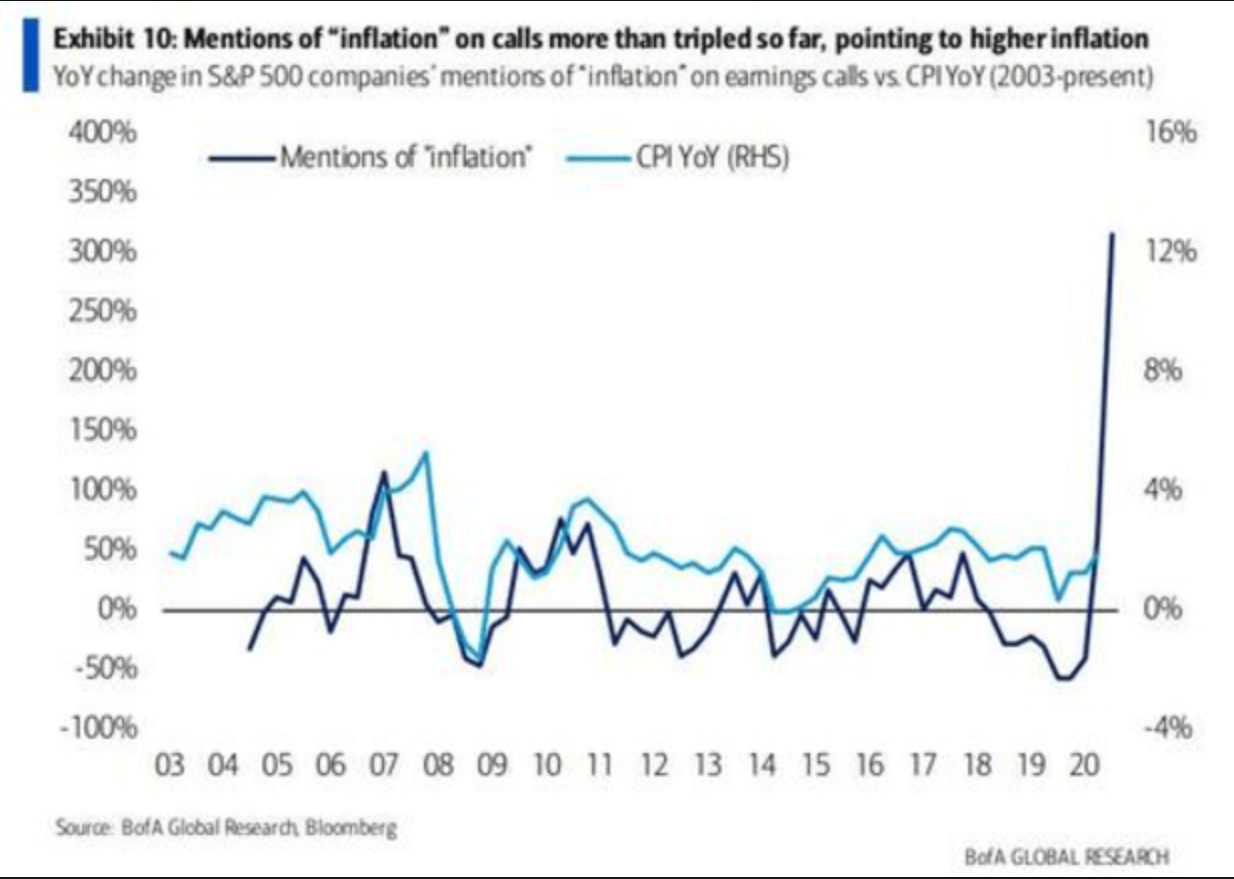

According to a recent Bank of America research note, earnings-call mentions of “inflation” are up 300%.

The chart shows a (loose) correlation between executives’ mentions of inflation and actual inflation, as measured by the Consumer Price Index (CPI).

And if you believe the chart is helpful in forecasting the magnitude of CPI’s increase, you’d be bracing yourself for a massive 12% or more rate of inflation!

I don’t believe the relationship between mentions and CPI, as charted, can so precisely forecast future CPI levels.

But from a 30,000-foot view, it’s clear that inflation concern has become consensus.

And whether you point to the massive growth in the Fed’s balance sheet … or the six-odd trillion dollars’ worth of fiscal stimulus the Biden administration is putting in play … or the skyrocketing price of lumber … I think concern over future inflation is warranted.

Here’s One Thing You Can Do About It

As a trader and investment strategist, I’m all about preparation over prediction.

I can’t predict the future. But I can prepare for scenarios that could happen … particularly scenarios that would significantly impact my investments.

One way to prepare your portfolio for inflation is to gain exposure to two infamously inflation-driven asset classes: commodities and bonds.

You want to be long commodities and short bonds when inflation strikes.

See, “hard assets” tend to benefit from inflation. This includes land and home prices, but also commodities — everything from gold and oil to corn and cotton.

On the flip side, inflation is a bond’s worst enemy. As inflation rises, the current value of a bond’s future cash flows becomes less and less. So investors require higher and higher yields … and the price of previously-issued bonds tumble lower.

Of course, if getting long commodities and short bonds sounds a little more complicated than buying 100 shares of Apple (Nasdaq: AAPL) on your broker’s app … I don’t blame you for thinking that.

Though I’ll recommend you have a look at the WisdomTree Managed Futures Strategy Fund (NYSE: WTMF).

This fund isn’t specifically designed to be an inflation hedge. It can actually go long or short commodities … long or short bonds … and long or short foreign currencies.

And I think that’s a good thing.

Remember, no one can be certain the inflation bogeyman is just around the corner. But, if it is … this fund will ride that wave with long positions in rising commodity markets and short positions in falling bond markets.

And for what it’s worth, that’s how the fund is positioned right now. You can see this for yourself when you visit the fund’s website and click “All Holdings.”

You’ll see the fund is currently …

- Short: 30-year Treasury bond futures and 10-year Treasury note futures.

- Long: crude oil, heating oil, gasoline, wheat, corn, soybeans, copper, live cattle, cotton, sugar and cocoa futures.

Looks like an “inflation-is-coming” stance, to me!

Again, WTMF is not specifically designed to combat inflation. But it will ride the major trends in commodities, bonds and currencies. These trends will be driven up and down by the inflation factor — whether that’s deflation, disinflation, “normal” inflation or hyperinflation.

As I see it, WTMF is a great “one-click” way to hedge against inflationary changes ahead, no matter what form they take.

Call it preparation, without the need for prediction.

To good profits,

Adam O’Dell