Traders were shocked last week when data showed that inflation was rising again.

This time, the Federal Reserve’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) Price Index, contained the bad news.

PCE is calculated based on data obtained from businesses. The more popular Consumer Price Index (CPI) gets data from consumers. That difference explains why the Fed prefers PCE.

Here’s why…

The CPI might show that the price of beef is significantly higher than it was last month. Consumers often buy cheaper cuts of beef or substitute other proteins in response. How they react isn’t captured by CPI.

On the other hand, PCE measures how much consumers spend at the grocery store. If they substitute tofu for beef, spending will drop. That will lower the inflation measured by PCE relative to CPI. But PCE is a more accurate measure of the realities of inflation since consumers have to make choices.

That’s where we are now.

Food Prices Force Consumers’ Hand

At the grocery store, we are being forced to consider alternatives as prices rise.

The Fed’s preferred measure ignores food and energy prices. Economists say these prices are too volatile and including them distorts the picture of inflation.

Volatility implies prices go up and down. That’s true for energy prices. Gas prices do move up and down.

But that’s less true for food prices.

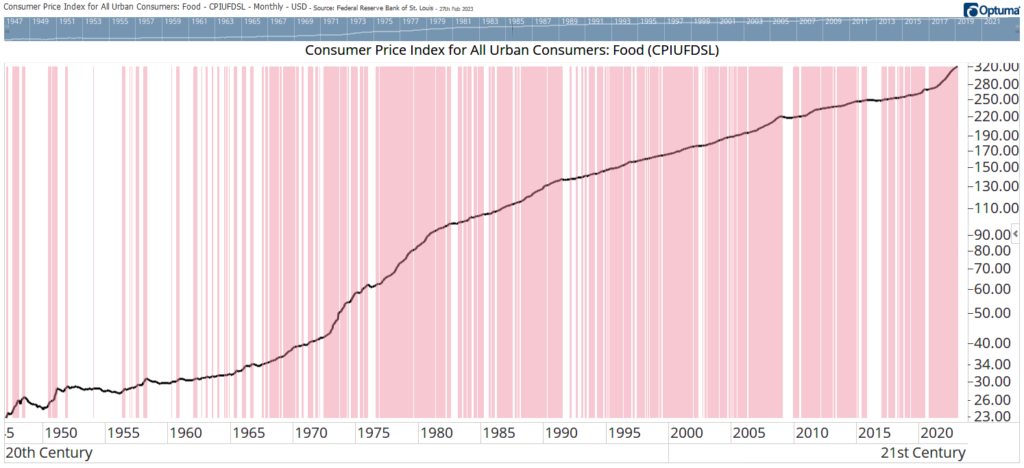

The chart below shows the CPI for food. Red bars highlight times when the index was higher than it was six months earlier.

Food Prices Keep Rising

Source: Optuma.

Food prices declined for extended periods in the 1940s and 1950s. This was most likely associated with changes in the economy driven by demobilization after World War II and the Korean War.

Since 1970, food prices have consistently marched higher.

Even when inflation was near 2% for much of the 2010s, food costs continued to climb.

Bottom Line: The rate of inflation may slow in coming months if the Fed’s policies are successful. But higher prices are here to stay. That means family budgets will remain stretched for some time. And corporate earnings will reflect that stress.

Michael Carr, CMT, CFTe is the editor of two investment trading services — One Trade and Precision Profits — and a contributing editor to The Banyan Edge. He teaches Technical Analysis and Quantitative Technical Analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.