Investors hailed last week’s Consumer Price Index (CPI) report as proof that the worst of inflation is behind us.

The index increased 8.5% in July from the same month a year ago, down from 9.1% in June.

Wall Street celebrated by pushing stock prices up.

I dug into the numbers. There does seem to be a reason to celebrate, but maybe not as much as we hoped.

What Changed in the July Inflation Report

Core CPI, which excludes more volatile energy and food prices, held steady in July. It’s up just 5.9% in the past year.

That indicates price pressures could be easing in the economy.

Contributing to the inflation report’s good numbers was a 7.7% drop in the price of gasoline.

After that decline, gas prices are “only” 44% higher than they were a year ago.

Also contributing to low inflation was housing data.

Home prices are up just 5.8% in the past twelve months. Rents are up 6.3%, according to the report.

In the real world, we see double-digit increases, but the Labor Department uses a complex formula to calculate what housing should cost.

While the slowdown in inflation is good news, consumers aren’t celebrating as much as Wall Street.

Consumers Aren’t Spending Less

There are signs the report might not accurately reflect the consumer experience.

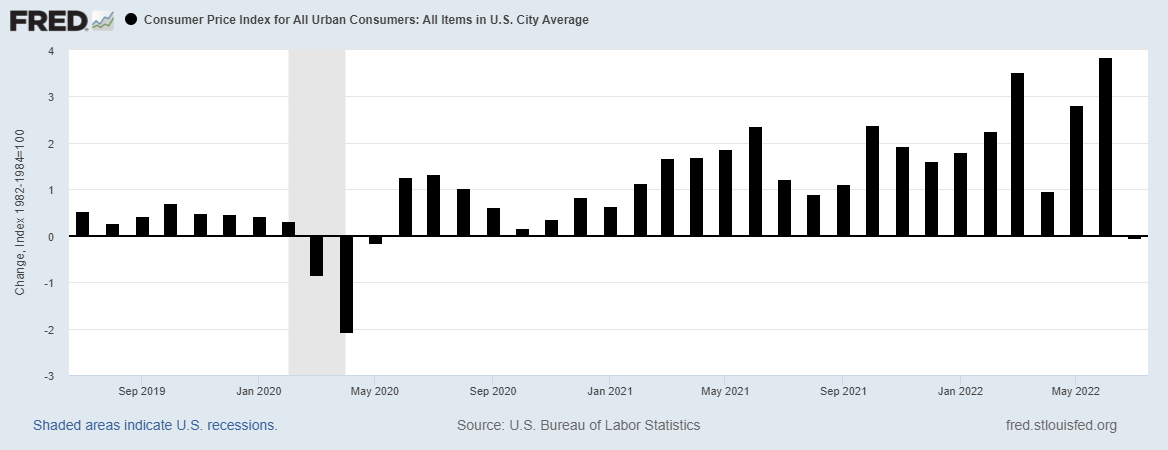

The Consumer Price Index for All Urban Consumers below shows that the CPI dropped in July:

July Price Index Drop Does Not Reflect Consumer Experience

Source: Federal Reserve.

The price index is the sum of all of its components.

It seems safe to say the average consumer did not spend less than they did in June.

But somehow, the index shows that’s what happened.

The CPI involves thousands of measurements and almost as many assumptions.

The economists producing it do their best.

But it seems like last month’s report is wrong.

The basket of goods and services bought costs more in the real world — not less, as the data shows.

Bottom line: We should expect revisions and new data next month showing prices did rise.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.