I recently bought a new car.

It was time to trade the first car I bought here in Florida for something a little more practical … with better gas mileage and more space.

So I took the plunge.

Once I found my dream car, one of the first questions the dealer asked me was: “What’s your insurance?”

That’s because anytime you have a lien (loan) on any property, the lien holder (bank) requires a level of insurance coverage on whatever you are buying.

Until you pay off the item, it technically belongs to the bank. And it wants its property insured against any damage.

Sounds like a lucrative business, and that got me thinking about ways to invest…

Today, I’m going to use our proprietary Green Zone Power Ratings system to highlight a small property and casualty insurer that is more diverse than you can imagine.

Insurance Market on the Rise

Aside from health insurance, you’re likely familiar with property and casualty insurance.

This is broad insurance that covers property and belongings in the event of vandalism, theft and more.

If my car gets stolen or damaged, the insurance company will pay for the damage — less the deductible of my insurance premium.

And this particular insurance market is growing at a good clip:

In 2012, the property and casualty insurance market in the U.S. was valued at $619 billion.

That value grew 36% to $843.6 billion last year.

It means there is much more profit for companies who operate in this space.

Insurance… And Much More

The company I’m sharing with you today is Biglari Holdings Inc. (NYSE: BH).

It’s a $590 million company that operates two insurance companies — First Guard Insurance and Southern Pioneer Property & Casualty.

But it holds much more than insurance. It also operates in the oil and gas as well as restaurant industries. Here are some of its other subsidiaries:

- Abraxas Petroleum Corp.

- Southern Oil Co.

- Steak-N-Shake Inc.

- Western Sizzlin Corp.

That diversity means BH isn’t locked into finding profit from just one sector — and that’s a good thing.

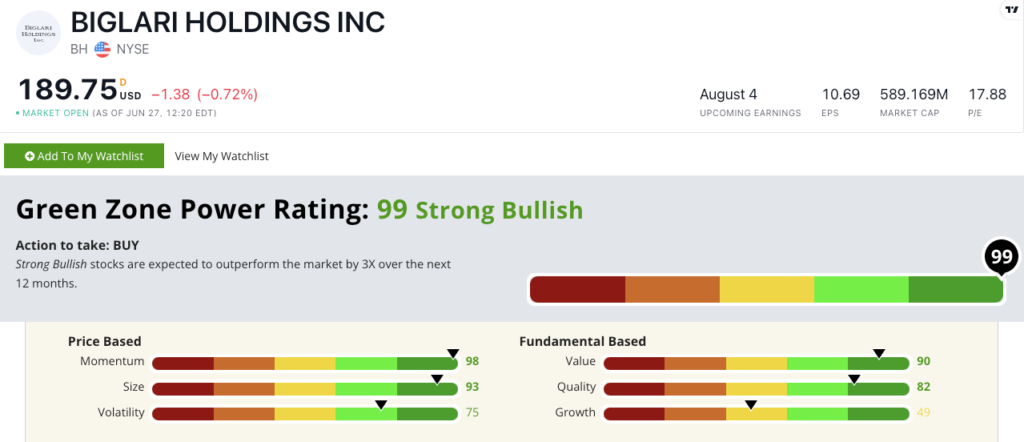

Green Zone Power Ratings: Biglari Holdings Stock

Biglari Holdings rates a 99 out of 100 on our proprietary Green Zone Power Ratings system. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by 3X over the next 12 months.

The stock rates the highest on Momentum (more on that in a sec). But it also is strong on Value … where it rates a 90.

Its price-to-earnings ratio is 17.9 compared to the industry average of 22.1. BH’s price-to-sales, price-to-cash flow and price-to-book value ratios are also lower than the industry averages.

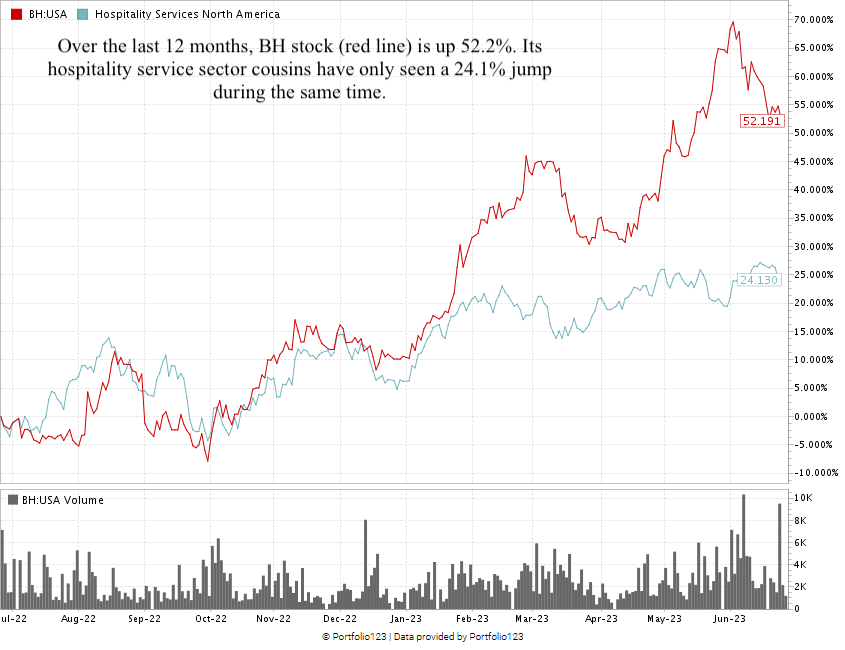

Now, about that market-breaking momentum:

Created in June 2023.

Over the last 12 months, BH stock has climbed more than 52%. Stocks in its industry, the hospitality services sector, have risen 24.1% over the same time.

That kind of momentum is what I love to see in stocks.

BH is trading 14% below its 52-week high which tells me the stock has even more room to run higher!

Bottom line: Biglari is one of the most diverse companies I’ve seen in a while.

That diversity of holdings means the company can find profits from different industries: insurance, oil and gas and restaurants.

It rates in the top 1% of all the stocks we rate on our Green Zone Power Ratings system and shows signs of even more growth ahead.

That’s what makes it a compelling potential for your portfolio.

This was just one stock that Adam O’Dell’s Green Zone Power Ratings system revealed, but Adam has reserved his highest-conviction stock recommendations for his Green Zone Fortunes subscribers.

If you want to gain access to that model portfolio, including Adam’s “Blacklist” of almost 2,000 stocks to sell now, click here.

Stay Tuned: 3 Stocks as We Mull Recession Chances

Tomorrow, our managing editor, Chad, is curious about the chances of a recession.

He’s going to use Green Zone Power Ratings to find out how certain consumer stocks look as the economy heads into the second half of 2023.

Until then...

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Market