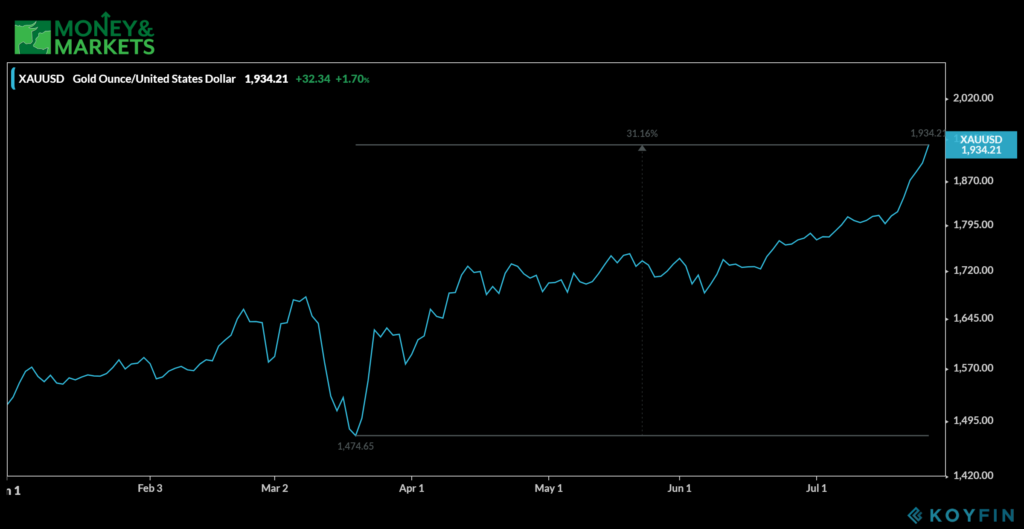

Gold and gold ETFs are hitting new all-time highs. Gold soared above $1,930 an ounce on Monday.

And the precious metal has gained more than 30% since recent lows in March.

Gold Soars to New Highs

It’s easy to understand why.

You see, the federal budget deficit is already clocking in at $3 trillion this fiscal year (with more to come). And the Federal Reserve is buying $80 billion per month in Treasurys alongside tens of billions more in other assets.

For the first time in ages, investors are starting to worry about the stability of the dollar and paper currencies in general. And for lack of anywhere else to go, they are flocking to the barbarous relic.

A gold exchange-traded fund (ETF) is a great option to capitalize on the rally.

Gold ETFs: Cheap and Efficient

Investors flock to gold ETFs for the same reasons they buy stock ETFs.

They’re cheap and efficient.

Buying physical gold in the form of coins or bars generally comes at a premium of a couple of percent over the spot price. That premium blew out to the highest levels in decades during the March COVID-19 panic.

Plus, once you own the gold, you have to do something with it. Keeping it at home exposes you to the risk of theft or natural disaster. I live in Texas, and I don’t like the idea of a tornado carrying away a literal chunk of my net worth.

It’s not too expensive to rent a safe-deposit box at a bank. But it’s also not convenient to cart it back and forth.

Meanwhile, buying a gold ETF is easy. It’s a few clicks of a mouse or touchscreen, and most online brokers are now commission-free. Plus, you can own it in an IRA or Roth IRA without the hassle and expense of using a specialty broker.

Yes, gold purchased via an ETF leaves a paper trail. It can’t be “off the books” like physical gold. But I question how valuable it is to keep your gold off the books. If the government ever tries to confiscate gold again, do you want a large chunk of your nest egg to be contraband?

And if you sell it, you’ll have to declare it on your taxes. That is, unless you plan to get paid in cash and stuff the bills under your mattress.

It’s better to keep it above board. And the easiest way to do that is via a gold ETF.

4 High-Quality Gold ETFs

One of the reasons investors love gold bullion is its uniformity. One gold bar is no different than another gold bar of the same size and purity. Gold is gold.

For the most part, the same is true of gold ETFs. They’re all essentially the same. The ETF owns a large pile of gold bricks that it pays to store in a bank vault. The holdings are regularly audited to ensure that the ETF owns what it says it owns.

And that’s it. The only meaningful difference between gold ETFs are size, liquidity and — importantly — expenses.

The SPDR Gold Trust (NYSE: GLD) is the oldest and best-known gold ETF. It has the most under management at $67 billion. It’s large and liquid, making it easy to get in and out of large positions. The only downside is that it is relatively expensive for a passive gold fund, with an expense ratio of 0.4%.

An expense ratio measures how much of a fund is used on operating and administrative expenses.

The iShares Gold Trust (NYSE: IAU) is slightly cheaper, with an expense ratio of 0.25%, but still plenty large and liquid with $28 billion in assets.

The GraniteShares Gold Trust (NYSE: BAR) is the absolute cheapest of the lot. Its expense ratio is a miniscule 0.17%. But it has only $1 billion in assets and it trades only a couple of hundred thousand shares per day. So, if you’re a large investor, it’s hard to get in and out of the position.

My favorite today is the SPDR Gold MiniShares (NYSE: GLDM). Its expense ratio is among the cheapest, at 0.18%, but it has $2.5 billion in assets and trades a couple of million shares per day. For that extra 0.01% in expenses, you get an easier asset to trade.

P.S. — Money & Markets Chief Investment Strategist Adam O’Dell has another way you can play the gold rally. He calls them “A9 gold stocks” and they have the potential to gain up to nine times more profit than gold coins, ETFs or bullion. Read about it — here.

• Money & Markets contributor Charles Sizemore specializes in income and retirement topics, and is a regular on our podcast, The Bull & The Bear. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.