Stock market volatility has come back in a big way over the last few days, and if you don’t have a sound investment strategy you may be setting yourself up for disaster.

There have been a lot of storylines on what’s been driving the recent run-up in the stock market.

Retail investors using apps like Robinhood to boost stock market indexes higher has been a popular theory as millions of younger people open accounts in pursuit of easy gains. Robinhood reported 3 million new accounts were opened in the first quarter of 2020.

But Barclays looked into it and couldn’t find any substantial correlation between Robinhood customers and the S&P 500’s moves up or down.

The study “casts doubt on the idea that retail holdings are the cause of market returns,” said Barclays analyst Ryan Preclaw in a statement to his firm’s clients.

What’s worse, the Barclays analysis shows that overall picks made by Robinhood clients are actually underperforming.

“More Robinhood customers moving into a stock has corresponded to lower returns, rather than higher,” Preclaw told clients. “And while it’s true that many high-return stocks have had a substantial increase in retail ownership, low-return stocks have also had a big increase.”

Cosmetic company Coty Inc. (NYSE: COTY) is a perfect example. The stock has lost 60% of its value since the beginning of February, but has increased its holding by Robinhood users sixfold, according to CNBC.

Look at how much the stock has fluctuated since the March lows.

Money & Markets Chief Investment Strategist Adam O’Dell warns of the effects emotion have in a trade like the one above — and highlights following an investment strategy is so important in a volatile stock market like we’re we’ve seen this year.

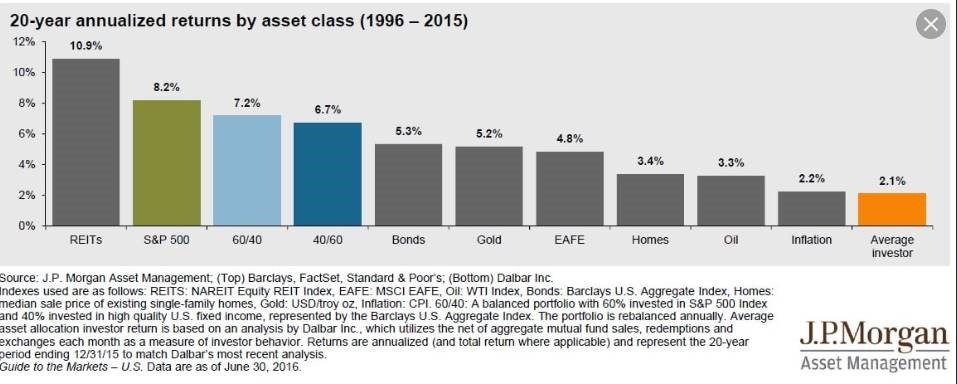

“The Dalbar study shows how investors consistently underperform,” O’Dell wrote via email. “Pick any asset class … all the average investor has to do to earn that asset class’ passive return is buy the asset and hold it. Yet most investors can’t do that. When they’re supposed to be ‘holding,’ they’re typically ‘folding.'”

Every year, Dalbar publishes its Quantitative Analysis of Investor Behavior, which shows emotion gets in the way far too often for investors to make the most of big stock market moves.

“That’s why the average investor actually earns less than stocks, less than REITs, less than the 60/40 portfolio, less than bonds, less than gold, less than home-price appreciation, less than oil and typically even less than inflation,” O’Dell said.

“It’s cruel.”

O’Dell, a Chartered Market Technician who specializes in finding opportunity during market volatility, argues that “emotionally charged decisions, that are almost always suboptimal,” get in the way of finding good gains.

We are all humans, and wanting to get in on the action as the stock market pops off its March lows is only natural. But O’Dell stresses the importance of a plan — especially in a volatile market.

“This current market environment is a perfect example … It’s emotion-stirring, and investors are reacting and overreacting, rather than following a well-defined investment strategy,” O’Dell said.

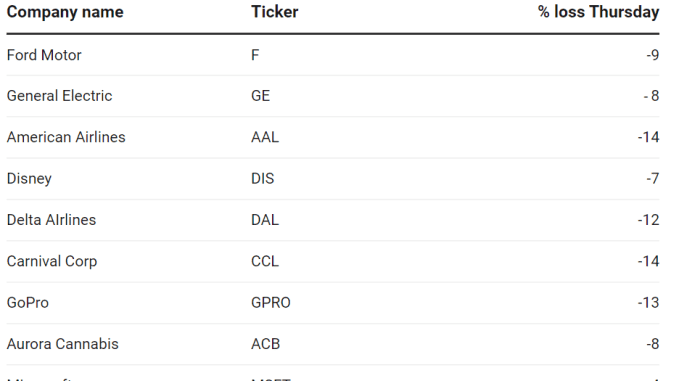

And following the crowd is likely only asking for trouble. According to RobinTrack, an unaffiliated program that tracks Robinhood transactions, the stocks bought most over 24 hours Wednesday were all trading in the red during Thursday’s massive sell-off.

This is an emotion-driven stock market, and having a sound investment strategy that works in times that are rocky or smooth will lead to more consistent gains in the long run.