Economic shutdowns changed everyday life. As vaccines promise a return to normalcy, investors should consider which sectors will benefit from that trend.

One obvious candidate is clothing stores. In the pandemic, Zoom calls replaced office conference rooms. Suits were replaced, in some cases, by a single shirt that was kept ironed and ready to go.

Instead of buying business attire, consumers turned to leisure wear. With a return to offices looming, and a resumption of dining out and socializing in public, new clothing might be needed.

Clothing stores are likely to benefit from two sources of demands.

After a year of quarantine, many consumers need different sizes. Some spent the last year working out at home and are in the best shape of their lives. Others, perhaps most, spent the last year marveling at the vast expansion of potato chip flavors and wondering how engineers keep discovering new varieties of Oreos.

Either way, many are discovering old pants don’t fit.

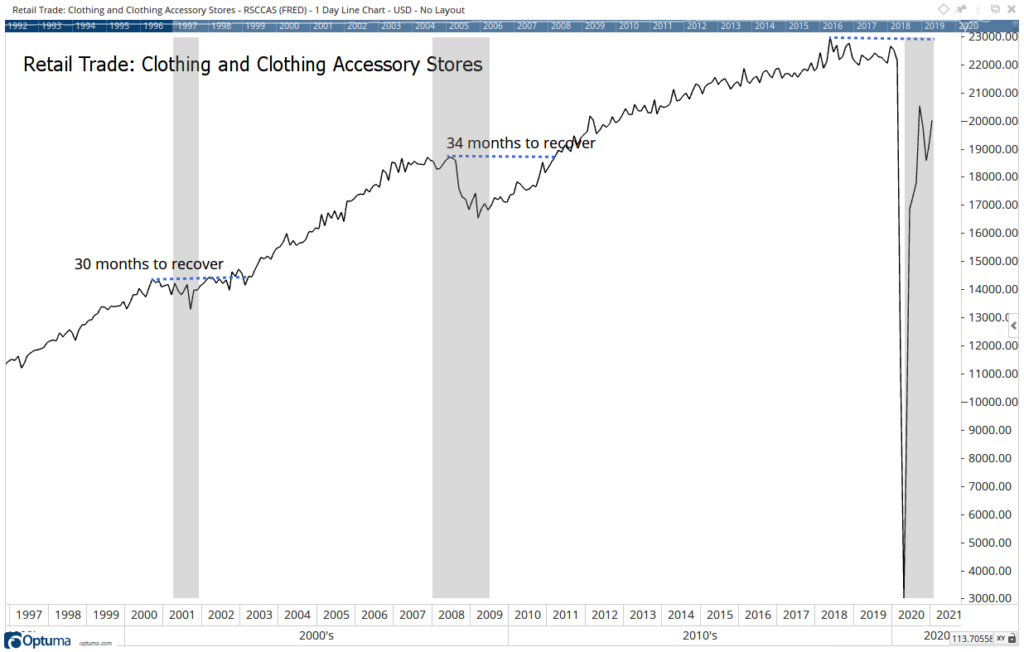

Another source of demand comes from the fact that clothing sales have been in decline for almost three years. The chart below shows retail sales at clothing stores. This data is reported monthly by the Census Bureau. Sales peaked 32 months ago, long before the pandemic shut down offices.

Retail Trade and Recession

Source: Optuma.

Economic Recovery Is on Schedule: Watch Retail

Recessions are marked with grey bars in the chart. In the past, clothing sales contracted as the economy slowed and took about two and a half years to recover.

This time, sales of clothing peaked as the economy slowed. COVID-19 shut down economies that were already showing signs of recession. In the U.S., the National Bureau of Economic Research decided the recession officially began in February, a month before the government declared the coronavirus a national emergency.

Recent data indicates the country is reopening, which will drive demand for business attire and casual clothing for social events — keeping the recovery schedule consistent with the last two recessions.

This should lead to strong earnings growth for clothing retailers, and investors should consider this sector now, ahead of the earnings surprises that will be announced in June.

And speaking of returning to work…

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.