Money market funds were a popular investment many (maybe not that many) years ago.

Investors held cash reserves in money market funds before interest rates fell to almost zero.

These are safe investments with a constant value of $1 per share and monthly interest payments.

Now rates are rising.

That makes money market funds more attractive.

Higher Rates Great for Money Market Funds

Crane Data runs an index fund of the 100 largest funds. It reported to Financial Times that “yields have climbed on average to 2.77% from 0.02% at the start of the year.”

That’s the highest level since 2008!

Fidelity’s $240 billion government money market fund yields about 2.6%.

Investors have placed almost $220 billion in Vanguard’s version of that fund for a 2.8% yield.

Two decades ago, we considered these yields low.

In the current environment, individual investors seem to disagree as they pour billions of dollars a month into the funds.

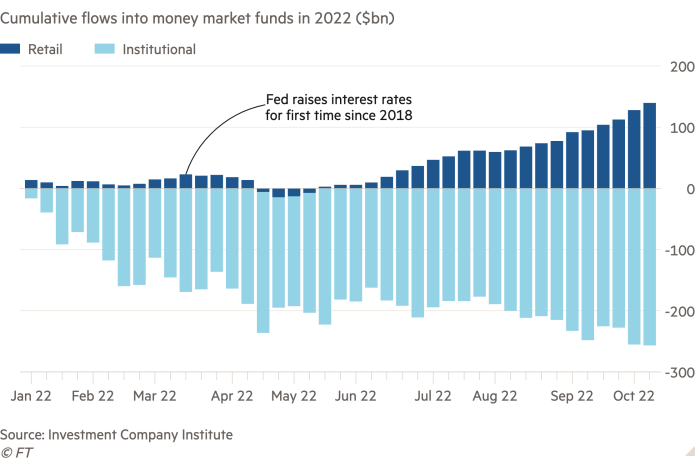

Americans Shifted Billions Into Money Market Funds

Source: Financial Times.

While individuals added $140 billion to safe money market funds in 2022, institutional investors have withdrawn about $250 billion.

The divergent behavior makes sense.

Why Big Money Flees

Declines in global stock markets have cost large funds trillions of dollars.

Pension funds may demand cash to meet their current obligations so they don’t have to sell into a decline.

Hedge funds invested in the funds may need cash to meet margin calls in other markets.

Other institutions may want to add to equities believing that the decline is near an end.

Individuals seem to be welcoming the end of the “no alternative” market.

For more than a decade, they have bought stocks because they were the best for returns.

Now there is an alternative when money market funds offer yields that are higher than the dividends of many blue-chip stocks.

Bottom line: As rates continue rising, demand for stocks should continue to fall.

That’s bearish in the long run.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.