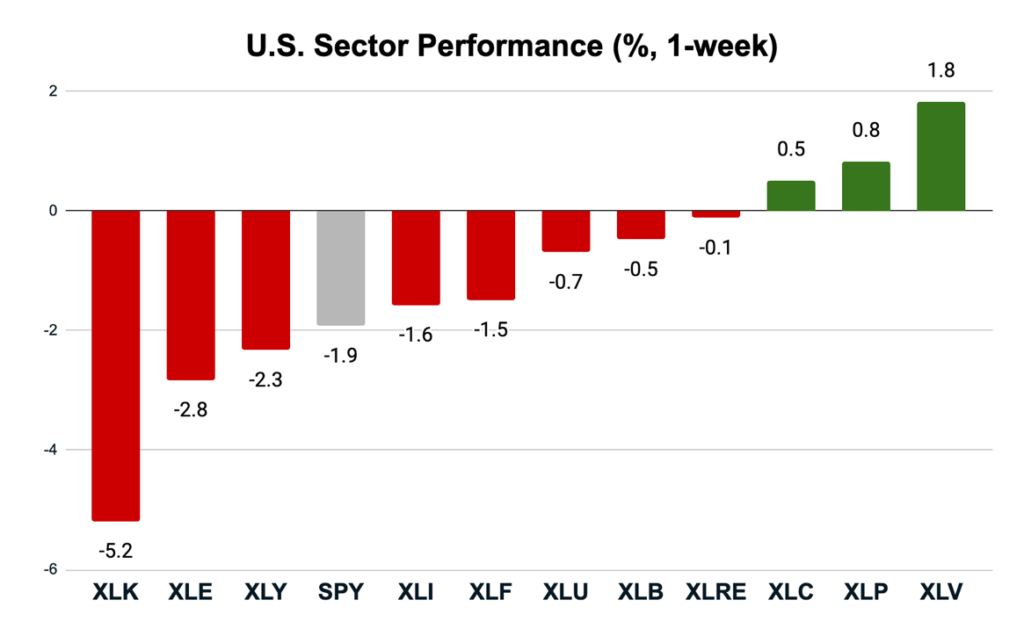

The defensive rotation continues…

For the second week running, the top performing sector was health care, which is today the most reliably defensive of all sectors. (Utilities used to hold that distinction, but the sector has become wrapped into the AI trade due to the massive amount of power needed to run AI datacenters.)

The SPDR Health Care Sector ETF (XLV) returned a very solid 1.8% last week, followed by consumer staples (XLP) at 0.8%. XLP was one of only three sectors in positive territory last week and also one of only four sectors in positive territory the week before.

The message here is clear.

Investors are concerned about the health of the tech-driven economy, or, at the very least, tech stock valuations… and so they’re playing defense right now.

There’s not a lot of economic sensitivity in health care. The economy can be booming… or contracting in violent convulsions… and demand for health services, pharmaceuticals or medical devices isn’t going to change all that much.

The same is true for consumer staple stocks. Demand for food, beverages and basic necessities doesn’t change all that much, even in recessions. Things have to really get bad before shoppers buy less branded food or cleaning supplies.

Meanwhile, it’s a bloodbath in tech…

The technology sector ETF (XLK) was down 5.2% last week. Energy (XLE) and consumer discretionaries (XLY) also fell harder than the S&P 500, down 2.8% and 2.3%.

This is the third week running that consumer discretionary stocks have taken losses.

We know that market sentiment can turn on a dime, and as I write this Monday morning, both technology and consumer discretionary stocks are leading the market higher.

But when I see the leading growth sectors really struggling for the past month, that tells me that caution is warranted.

Key Insights:

- Led by health care, defensive sectors are leading.

- Economically sensitive sectors still remain weak.

- Technology in particular is really taking a beating.

Finding Winners in the Healthcare Sector

Let’s do a deeper dive into the health care sector. I screened for the biggest winners of the week that are still trading within 10% of their 52-week highs.

There’s a lot to like here. Six of the stocks rate as “Bullish” on my Green Zone Power Ratings system (score of 60 or higher), and two – Merck & Co (MRK) and HCA Healthcare (HCA) – rate as “Strong Bullish.”

Merck is a repeat from last week’s list. It gained 5.2% last week after gaining close to 8% the week before.

Johnson & Johnson (JNJ) was also a holdover from the prior week as one of the best-performing stocks in the best-performing sector.

That’s the sort of thing that gets my attention, so let’s dig into the details.

Merck rates exceptionally well on quality, with a factor rating of 94. The company’s portfolio of patented therapies consistently generates high profit margins and high returns on equity, investment and assets.

That’s important. Quality always matters, but it matters all the more so during difficult times when investors are scared.

Merck also rates exceptionally well on growth, with a factor rating of 86, and on volatility, with a factor rating of 72.

Johnson & Johnson rates almost as well on quality, with a factor rating of 91. But it rates even better on volatility, with a factor score of 96.

These are high-quality growth companies that are far less volatile than the broader market. It shouldn’t come as a surprise that investors are flocking to them in this climate.

Too Soon to Go Bottom Fishing in Tech?

Given how badly tech had been beaten up this month, might there be some new opportunities popping up?

Let’s take a look and see.

I ran a screen of the worst-performing tech stocks last week that are still within 10% of their 52-week lows.

It’s not pretty.

Not a single stock on the list rates as “Bullish” on my Green Zone Power Ratings systems.

In fact, apart from Paycom Software (PAYC), which rates as “Neutral,” not a single stock on the list rates higher than 28. CoStar Group (CSGP) rates an abysmal 3.

Yes, you read that right. It rates a 3 out of 100, making it one of the worst-rated stocks in the entire market.

Now, there are a couple of points to be made here.

To start, the weakness in some of these stocks is nothing new. Salesforce (CRM) started falling around this time last year and never really stopped, and Workday (WDAY) has been struggling since early 2024.

So, this is not merely a case of AI darlings breaking down. But it could be a sign of business customers tightening their belts.

Regardless, the market is sending us a message. Defensive sectors are leading right now. So, that’s where we need to focus our attention.

Be sure to read tomorrow’s What My System Says Today, as I plan to do a deeper dive in the health care sector, looking for hidden gems.

And to gain access to my next Green Zone Fortunes recommendation – a recession-proof beverage juggernaut – click here to join us today!

To good profits,

Editor, What My System Says Today