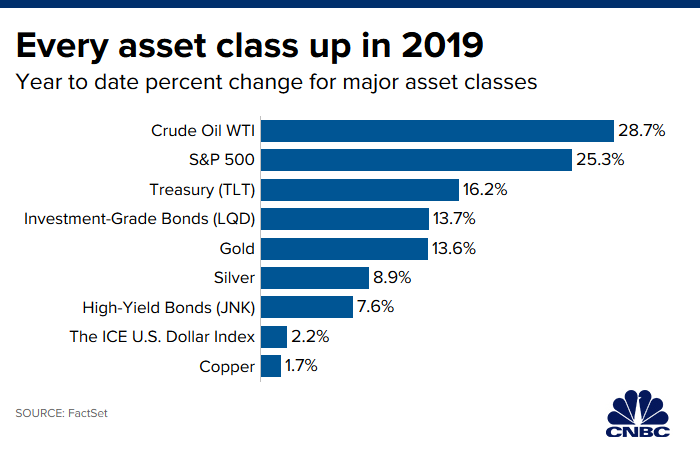

This has been a winning year for investors as almost every asset class is trending toward a positive and, in some cases, stellar finish.

Profits everywhere are up, from stocks to commodities and even corporate bonds. The S&P 500 has rocketed up over 25% in 2019 and even Treasurys are in the green, which isn’t generally the case when risk assets are rally so hard.

Oil, corporate bonds and gold also have been big winners, scoring double-digit gains, but as you can see from the chart above, investors have been getting something (even small gains) wherever they choose to put their money — aside from cannabis stocks, which have taken a beating in 2019 because of slow roll-outs and black market sales eating into profits in Canada.

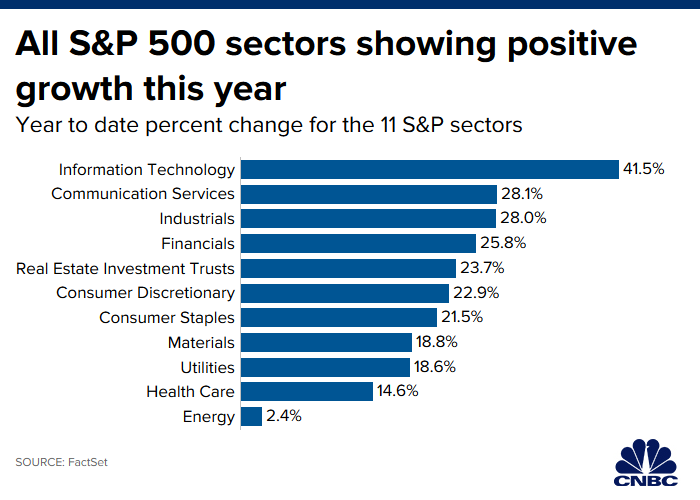

Taking a deeper dive into the S&P 500 shows that only 64 companies within the index, or a measly 12%, have been losers.

As far as individual sectors, all 11 within the S&P 500 are winning. Information technology is leading the charge with a whopping 41.2% gain. Six other sectors are up over 20% (check out the chart below), and every sector (outside of energy’s weak 3.2% gain) has seen a double-digit increase.

There have been some risks to market gains, mainly the ongoing trade war between the U.S. and China, but one entity has stepped in to keep this record-long expansion going: the much maligned Federal Reserve.

After raising interest rates multiple times in 2018, the Fed turned around and cut its benchmark rates three times down to a range of 1.5% to 1.75%. The central bank has also been pumping tons of cash into the system lately as part of an easing process that it claims isn’t quantitative easing, which is sending a huge buy signal.

“We’ve gotten three rate cuts as we know and a dramatic rise in the size of their balance sheet in a very short period of time,” Bleakly Advisor Group CIO Peter Boockvar told CNBC. “(We) see an expansion of the Fed’s balance sheet to the extent it’s grown and the only response is, it’s QE. Buy everything.”

Now the only worry is if it will hold up heading into 2020. The combination of it being an election year and the unresolved trade war has many analysts hedging their optimism slightly. Equity strategists polled by CNBC are seeing a 5% gain on average.

Many strategists think that as the markets enter late-cycle territory, investment selections will carry more weight. Morgan Stanley, in a note Monday, said investors should move to be more defensive and pick stronghold stocks like Coca-Cola (NYSE: KO).