My friend Josh was in serious pain last month.

Doubled over and barely able to move, he rushed to an urgent care center.

After doctors ruled out several other conditions, Josh found out he had irritable bowel syndrome (IBS).

Josh’s saga triggered me to do what I always do: research the problem.

We’ve come a long way from the turn of the 20th century, when gastrointestinal (GI) infections were the third-leading cause of death in Americans.

However, according to the GI Alliance, 62 million Americans are diagnosed each year with digestive disorders.

Allied Market Research studied the growth of the IBS treatment market.

By 2026, analysts expect the market to almost double — increasing at a compound annual growth rate of 8.2%! That’s not 8% total, folks — that’s 8% every year.

Today’s Power Stock should see solid gains as it capitalizes on this medical trend: Ironwood Pharmaceuticals Inc. (Nasdaq: IRWD).

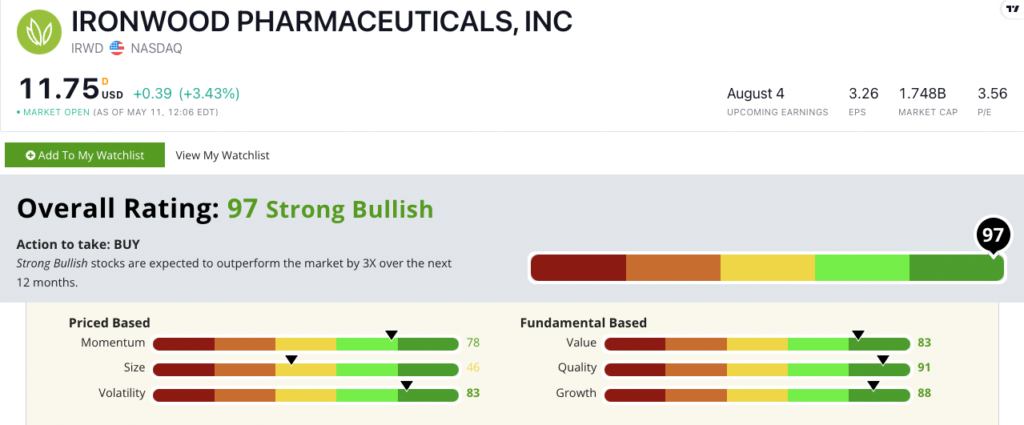

IRWD Stock Power Ratings in May 2022.

Ironwood is a biopharmaceutical company that develops drugs to combat gastrointestinal issues, including IBS.

IRWD scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

IRWD Stock: Strong Quality and Solid Growth Potential

I wanted to find out more about Ironwood Pharma stock, and a couple of items stood out:

- Sales of Linzess, its IBS treatment, exceeded $1 billion in 2021 — 8% more than the previous year.

- The company has advanced its development of a pediatric version of Linzess.

Ironwood’s quality puts it far ahead of its peers. As you can see in its Stock Power Ratings above, it earns a 91 on that metric.

Its return on equity (ROE) is 167.9%, blowing its peers out of the water: Their average ROE is a 68.2% loss!

Ironwood’s Pharma’s net margin is a similar story: IRWD reports an impressive 124.8%, while the system-specific biopharma industry average is negative 646%!

As you can see, IRWD stock’s quality far exceeds the rest of the industry.

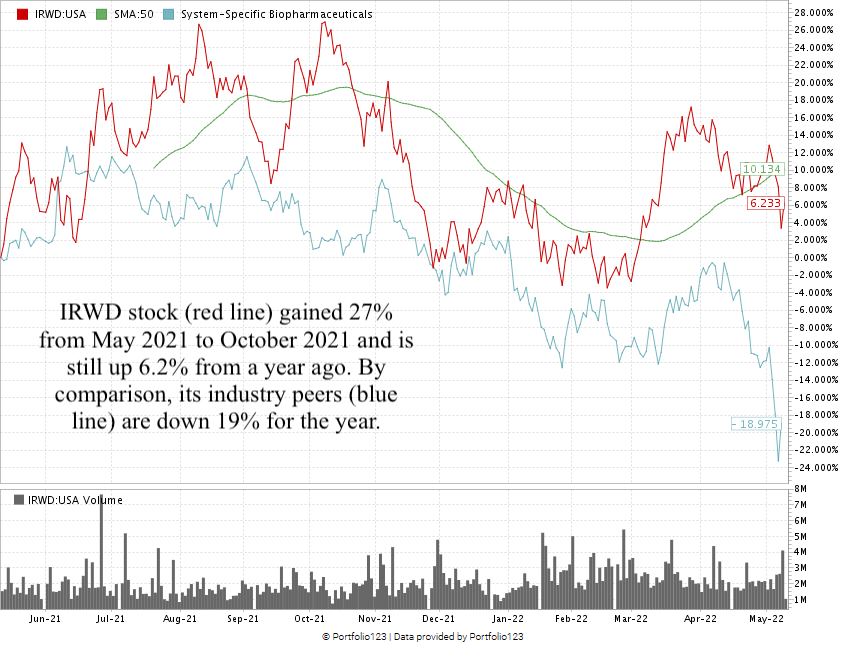

IRWD stock gained 27% from May to October 2021.

The stock chart above shows that it pared those gains later in the year but rose to start 2021.

Despite broader market headwinds hitting all stocks, it remains 6.2% above where it started a year ago.

It should come as no surprise, based on its quality, that IRWD outperforms its peers by a wide margin. The system-specific biopharma industry is down an average of 19% over the same time.

Ironwood Pharmaceuticals Inc. stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Millions of Americans — including my friend Josh — stand to benefit, thanks to companies such as Ironwood developing drugs to help them live more pain-free, normal lives.

Stay Tuned: Supply Chain Issues? Buy Air Cargo Transport Co.

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on one cargo transporter that operates in a niche critical for Amazon: air transport.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Want to share your thoughts with my team and me? Reach us anytime at Feedback@MoneyandMarkets.com.