Artificial intelligence (AI) is taking the world by storm. People are using software like ChatGPT and OpenArt in very creative ways.

But the technology has actually been around for decades.

The first successful AI program was written by Christopher Strachey in 1951.

It allowed a computer at the University of Manchester in England to play a complete game of checkers.

A year later, Arthur Samuel developed the first AI program to run on IBM machines in the U.S. It performed a similar function to Strachey’s.

Now, AI has entered the mainstream and anyone can use a simple English command to develop complex programs, images and even music.

And AI continues to transform technology. Companies like Microsoft and Google are pouring billions of dollars into research and development for its potential uses.

But you want to know if this is an investable mega trend…

I’ll tell you what our Stock Power Ratings system says about investing in AI-related companies.

But first…

AI Spending Expands at a Rapid Pace

Silicon Valley is plowing truckloads of cash into small AI companies at an alarming pace:

- Microsoft confirmed a $10 billion investment in OpenAI — the pioneers behind ChatGPT — and has started integrating the software into its Bing search engine.

- In addition to its own AI software, Google is investing $300 million into Anthropic — developed by former employees of OpenAI.

- AI-powered health care startup Komodo Health recently announced a $200 million venture capital raise.

Not only are companies racing to invest in AI, they’re also incorporating AI into their business model at an incredible pace.

HFS Research found that companies spent $3.1 billion worldwide on AI business operations in 2020.

And look at how that has grown since then in the chart below:

AI spending is projected to reach $10.8 billion by the end of this year.

That’s a 248.4% increase in just one segment of this innovative technology!

Revenue for the AI sector worldwide is set to explode:

Major research firms such as Tractica and GlobeNewswire are forecasting AI revenue to soar in the coming years.

GlobeNewswire found AI revenue was $87 million in 2020. It’s forecasting revenue to hit $1.6 billion by 2030.

Clearly there is money to be made in AI.

I Took AI for a Test Drive

I admit that I’m intrigued by what AI can do for content.

So I took a few programs for a spin.

The first one I tried was ChatGPT. It’s made headlines as millions of users pile in to see what it can do.

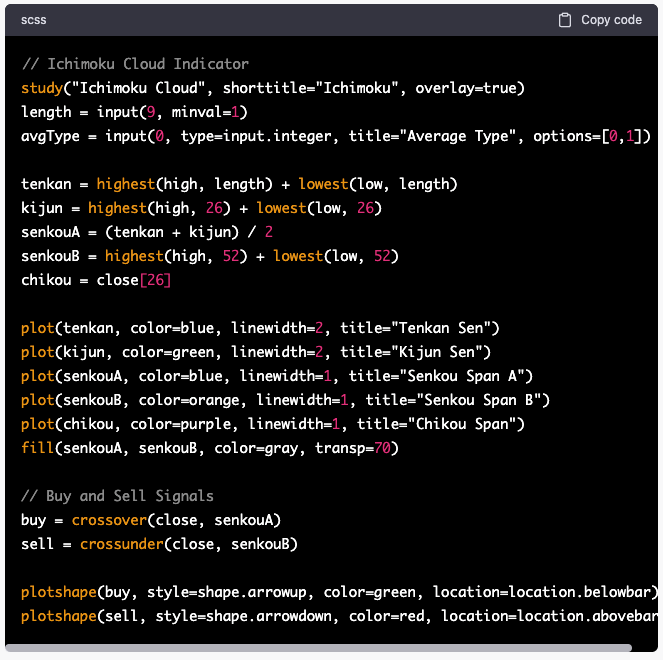

I wanted to do something a little more complex than composing a poem, so I asked the program to develop “buy” and “sell” signals using the Ichimoku Cloud indicator. (I said I wanted complex.)

Here’s what it kicked out for me:

Image from ChatGPT.

That looks like a bunch of gibberish if you aren’t familiar with coding language.

I tried the script within my preferred trading software, TradingView, but the program kicked back some errors. After working through those bugs, it still didn’t work.

However, it did provide me with a baseline of code to work with … which is more than what I had when I started.

I also tried an AI program called Boomy.

This is a website that uses AI to generate short music tracks. You can be as specific or as general as you like with your input.

I picked the style and the speed of each track and dove down into specific instruments and beats I wanted. Over the course of about an hour, I generated five different electronic dance tracks that were … well … kind of catchy!

What I found was that I didn’t get the exact results I was hoping for, but I was able to create a foundation to start refining … which is a nice benefit.

Now, the big question…

Is Now the Time to Invest in AI?

I turned to our Stock Power Ratings system to see how some of the big players in the AI space rated.

The first thing to mention is that there aren’t many publicly traded companies dedicated solely to AI.

But I did find the Global X Artificial Intelligence & Technology ETF (Nasdaq: AIQ) — an exchange-traded fund (ETF) with a basket of stocks involved in AI and Big Data. It holds companies such as:

- Nvidia Corp. (Nasdaq: NVDA).

- Oracle Corp. (NYSE: ORCL).

- Snap Inc. (NYSE: SNAP).

- Amazon.com Inc. (Nasdaq: AMZN).

- Microsoft Corp. (Nasdaq: MSFT).

- Alphabet Inc. (Nasdaq: GOOGL).

I ran all of the holdings through the ratings system and what I found was eye-opening.

Of the 85 stocks in the ETF, nearly half rated “Bearish” or “High-Risk.” Only two companies rated “Bullish” or above.

The average overall score of stocks in the ETF was a paltry 29 out of 100. This indicates we are “Bearish” on the ETF and expect it to underperform the broader market over the next 12 months.

Bottom line: AI is a burgeoning force in the tech space.

While it’s been around for a while, the ability to use some simple commands for a wide array of applications is only pushing this sector higher.

However, looking at our Stock Power Ratings system tells us that investing in the broader AI theme is risky, and it’s going to take time for industry leaders to emerge.

Stay Tuned: A Heavy Construction Stock Soaring Past Its Competition

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned tomorrow when I give you all the details on a heavy equipment construction stock that has been on a tear since October.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. Tell us what you think about AI. Are you investing in this latest technology craze? What is driving your decision? Email us at StockPower@MoneyandMarkets.com and let us know!