Friday’s market rout dragged down almost every sector, with just utilities managing to come out ahead, closing the week 1.5% higher.

When you see only one sector hold up in a broad sell-off like that, it’s natural to get a little curious. You want to know what’s going on.

Luckily, with my Green Zone Power Rating system in hand, we can do exactly that in a matter of seconds.

Let’s run the numbers to determine how investable the utilities sector appears to be going forward…

Utilities Sector X-Ray

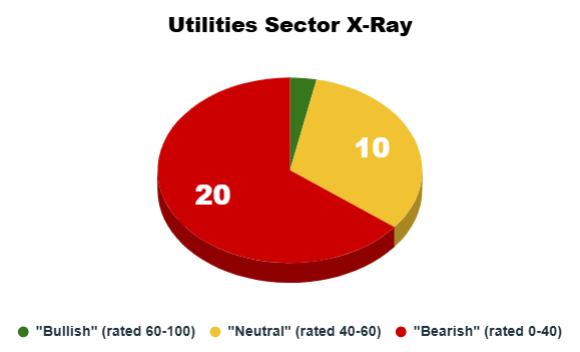

When running my Green Zone Power Rating “X-ray” on any given sector, we’re given a snapshot showing how many stocks land in each of three categories:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

If most of the stocks are rated “Bullish,” that means we have a greater chance of finding stocks that should outperform in the coming months. The opposite is true if there’s a greater number of “Bearish” stocks.

And that’s what I’m seeing after screening the 31 stocks in the utilities sector:

With roughly two-thirds of stocks landing in that “Bearish” category, and only one rated “Bullish,” this tells me it’s best to tread lightly if you’re looking for new utility stocks to buy.

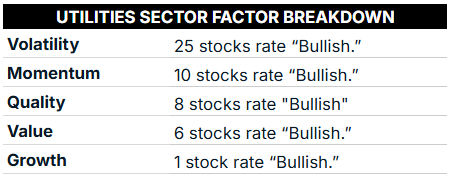

If you’re wondering why there’s only one “Bullish” stock in the entire sector, the individual factors within my system are incredibly telling:

What really stands out to me here is the lack of utilities stocks that rate well on my fundamental factors:

- Only 25% rate “Bullish” on Quality.

- Roughly 19% rate “Bullish” on Value.

- And only one stock (3%) rates “Bullish” on Growth.

This sector lacks growth, trades at a premium, and a vast majority of the companies aren’t managing their profits and debts efficiently.

I will say, with 25 out of 31 stocks rated “Bullish” on the Volatility factor, at least this sector is relatively calm in terms of price action. And perhaps if we can pair that “Bullish” Volatility with “Bullish” Momentum, we can find some outliers in the data.

Let’s do just that!

You Need More Than 2 “Bullish” Factors

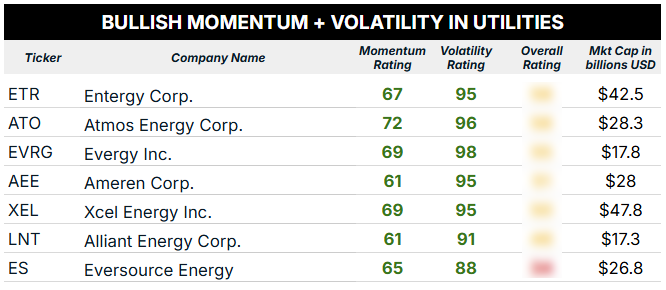

I went ahead and screened the utilities sector, looking for stocks that rate 60 or higher on both Momentum and Volatility in my Green Zone Power Rating system.

And this illustrates the problem of only focusing on one or two factors:

While each of these seven stocks has incredible Volatility ratings and solid Momentum, none are rated “Bullish” overall.

Maybe they’re trading at a heavy premium, denoted by a low score on Value…

Or maybe the company has ballooned its debt load, which, in turn, tanks its Quality score…

Or it could be reporting slower revenue growth, or even declining revenue, knocking its Growth rating into the “Bearish” zone…

Heck, maybe it’s all three!

The bottom line is that something is holding each of these stocks back, and it’s best to use my Green Zone Power Rating system to find those stocks that are more well-rounded. Wouldn’t you rather have a stock in your portfolio that’s steadily rising and paired with a solid business that points to more outperformance ahead?

To look any of these tickers up and find out which factors are holding them back, click here to see how you can join up in my flagship Green Zone Fortunes investing service. Unlimited access to my system, where you can look up thousands of tickers (not just the seven above), is just one of many perks that come with that membership.

I hope to see you there!

To good profits,

Editor, What My System Says Today