Growing up in the Midwest, one company dominated my entire family’s lifestyle.

My grandfather worked as an engineering supervisor for this company, and my step-father worked in its transportation division.

Heck, this company played a huge role in my wife’s family (both her parents worked there — her mom for 30 years).

Boeing Co. (NYSE: BA) was part of the fabric that made up Wichita, Kansas, ever since 1929, when the Stearman Aircraft Co. became a subsidiary of the Seattle-based Boeing Aircraft Co.

During World War II, Boeing’s Wichita division produced the B-29 Superfortress bombers. It later produced 467 B-52 bombers before transitioning to construct aircraft for both military and commercial use.

Boeing continued its long history within my hometown until 2005 when it spun off its Wichita and Oklahoma operations to Spirit AeroSystems (NYSE: SPR).

It seemingly closed the door on more than 70 years of history with the Wichita community.

Until now…

Spirit’s Problems Become Boeing’s Problems

Following the spin-off, Spirit Aero and Boeing’s relationship was smooth as Spirit built fuselages for Boeing’s popular 737 and new 787 commercial aircraft.

But then an incident in January 2024 … when the panel of an Alaska Airlines 737 Max 9 blew off while traveling at 16,000 feet over Oregon … triggered more turmoil at Boeing.

That incident came five years after two 737 Max 8 aircraft crashed due to a malfunction in the plane’s MCAS flight control software, resulting in the deaths of 346 passengers and crew.

Those are just three of the many issues Boeing has had to contend with related to production at Spirit’s facilities.

Everything came to a head this week as Boeing announced a $4.8 billion all-stock deal to buy Spirit’s operations and bring it back under the Boeing umbrella. Boeing’s CEO is also stepping down at the end of the year.

In an essay I wrote almost a year ago, I noted Boeing had seemingly come out of its issues related to software problems with more than 500 aircraft orders that year.

But I also mentioned that our Green Zone Power Ratings system signaled Boeing’s stock wasn’t nearly as good of an investment as those delivery headlines would suggest.

It turns out I was right.

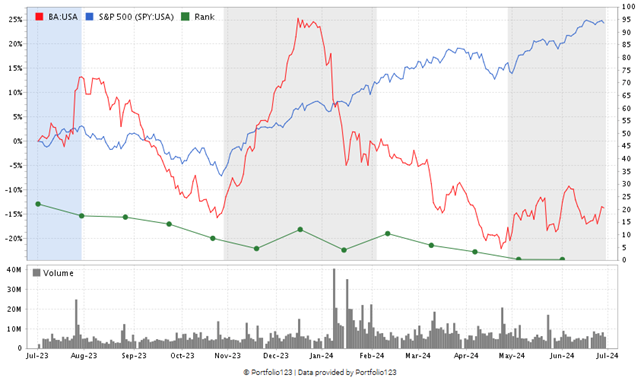

We published my essay after the stock had risen 78% from its September 2022 lows. Since then, Boeing stock hasn’t maintained its momentum:

As you can see, BA has fallen more than 16% since that essay was published. More importantly, the stock is down more than 30% since a run in December 2023 that pushed the stock to new highs.

With Boeing reacquiring Spirit Aero, it’s the perfect time to see how BA stock has fared in Adam’s Green Zone Power Ratings system … and what it tells us about the stock now.

BA Stock’s Ratings Journey

Boeing’s history in Wichita and the global aircraft manufacturing community has been storied — and not always on the positive side.

The company is coming back to Kansas after a nearly 20-year hiatus with its purchase of Spirit Aero. However, it’s coming with some baggage.

Even before these recent issues, the Green Zone Power Ratings system knew BA was a stock in rough waters:

BA “High-Risk” in Green Zone Power Ratings

Shortly after I wrote a warning about Boeing’s prospects, the stock dipped from “Bearish” to “High Risk,” represented by the green line in the chart above … and it’s been sliding lower ever since.

A “Bearish” or “High-Risk” outlook on a stock means we expect that stock to underperform the broader market over the next 12 months.

BA has certainly underperformed…

Despite the stock’s bullish run in late 2023, BA (the green line in the chart above) has fallen more than 14% in the last 12 months.

The S&P 500 (red line), however, has advanced more than 24% over the same time.

By watching the Green Zone Power Ratings system, you likely would have avoided any headaches associated with Boeing’s recent performance.

Bottom line: Boeing has always been a stalwart when it comes to commercial and military aircraft.

However, its recent challenges have not done its stock price any favors.

Boeing’s strong status in the global aircraft community, as well as in Wichita, isn’t going away anytime soon.

Bringing Spirit Aero back under its umbrella may help repair Boeing’s image, but our Green Zone Power Ratings system says this stock should be avoided for now.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets