Stock markets are still reeling as investors price in the impact of Trump’s radical new policies.

Today, we’re reviewing the impact of policies like widespread tariffs — and the risk of stagflation in the broader economy.

Click below to start the video:

Video transcript:

Welcome to Moneyball Economics. I’m Andrew Zatlin.

In case you haven’t noticed lately, the markets have been extra special, jumpy … and the reason is the uncertainty that Donald Trump is bringing forward.

In fact, it looks like he might be harming the economy in the near term, and that has investors concerned because what happens in the economy translates into what happens with interest rates from the Federal Reserve.

Markets want to see rate cuts, and so they’re laser light focused on what’s going on in the economy.

The markets are reacting to every little bit of economic news, and guess what? The mother of all economic data points comes out this Friday with payrolls.

So is the market right to be concerned about the economy? And what do I think is going to happen with payrolls on Friday because they will have an outsized impact on the stock and bond markets on Friday.

Starting off, what’s keeping Wall Street up at night is something called “stagflation” …

That’s when we’ve got a stagnant economy and high inflation. The combination’s really bad because it erodes consumer purchasing power.

Think about it, if you’ve got inflation going up, you’ve got egg prices surging, gasoline prices surging, but your wages aren’t growing as fast, well then you’re in “guns or butter” decision making, and you’re going to cut back on some of your discretionary spending. That’s really bad for a consumer economy like ours.

So is that possible? Are we going to see stagflation?

Well, if we do see it, it puts the fed in a bad place when it comes to interest rates

Start off with stagflation. We’ve got a stagnant economy. Typically, the economy slows. We want to stimulate it by cutting rates problem. In a stagflationary environment, you cut rates, you’ve created inflation, and so you’ve got this two steps forward, one step back where inflation’s going up and so is the economy.

Alright, well then you could target inflation. You do that by raising interest rates, so now inflation’s come down, but so has the broader economy as you’ve made it more expensive to function.

The fed’s in a lose-lose situation, and what makes it especially hard is that all of this economic movement is coming about because of fiscal policy, not monetary policy, meaning it’s not stuff the Fed can create and turn off. It’s coming out of the world of Donald Trump.

Is Donald Trump creating stagflation? Well, quite frankly, in the near term, he is certainly pushing it forward and enabling it.

The GDP is 2.8%. That is not a bad place to be, but it could come down quickly to 2% in the next quarter or two simply because of what Donald Trump is doing. Let me explain. His policies are stimulative. They are pushing up inflation, but at the same time, others of his policies are pulling back the economy.

Let’s start with the inflationary aspect. Tariffs. Tariffs aren’t really in place yet, but already we’re seeing inflation go up to some degree. This is good. What we’re seeing, if you take a look at this chart is that manufacturers are ramping up. That’s really good for the economy.

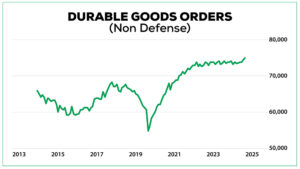

This is a chart showing you durable goods orders excluding the distortion that comes with defense spending and aircraft. Those tend to create these big movements, big swings up and down:

When we talk about these durable goods orders, we’re talking about demand for stuff and as you can see under the Trump administration, already we’re seeing demand for stuff go up. Some of this is a response to the feeling that there’s good news in America, but a lot of it is coming from tariffs. People trying to dodge the impact of tariffs because tariffs will make things more expensive, and so you want to get stuff in place and built as soon as possible.

We’re seeing this have an inflationary impact because prices are going up.

When factories operate more, they have some pricing power, but also when you start putting in tariffs or you expect tariffs to come in, your prices are going to go up. So we’re having inflation in advance of tariffs and in response to some demand out there for factories, we’re seeing the economy slow down because similarly, there’s advance concern about what Trump is doing in the broader economy when it comes to hitting government spending.

Now, a lot of the government spending that’s getting slashed, it’s a drop in the bucket in a multi-trillion dollar economy, but it’s still happening and it has a magnifying multiplier effect. You start cutting workers, okay, those workers, they’re going to pull back a little bit on their spending. You start cutting government programs.

What you’re really doing is you’re cutting spending in the private sector because spending on these contracts that Trump is going after is really you’re cutting back spending on Accenture and other companies that hire here in the us you’re cutting back on, for example, they announced no more travel and entertainment for a while.

These spending freezes trickle into the broader economy and as a result, you’ve got companies saying, we’re not sure what’s going on. Maybe we shouldn’t hire as much. Maybe we need to respond to these cuts with cuts of our own, and so on and so on. So you’re getting a ripple effect in advance.

Bottom line, if inflation’s going up a little bit and the economy is starting to slow a little bit, it’s the combination that knocks the GDP down that leads to stagflation. We’re not there yet, but in the short term, it’s definitely heading a little bit in that direction.

Certainly if we look at the durable goods scenario, we could grow our way out of this, but that’s a longer-term prospect In the near term, there’s economic pain and that’s why Wall Street is freaking out. So how we’ll know if stagflation is on the way is through payroll growth…

On the one hand, payroll growth has been pretty light the last 6, 7, 8 months and only last month did it kind of perk up. This month? The question is, was last month a one-off or are we actually possibly growing our way out of whatever kind of impact Donald Trump is going to out there?

And right now it’s not exactly Goldilocks, but it’s not bad news per se. Right now, consensus is expecting, say about 150,000 jobs. Not great, definitely soft, but better than it was most of last year. I’m actually looking for a little bit higher. What I believe is happening right now is we are seeing a slowdown, but some of that slowdown is kind of delayed.

For example, all these workers who got cut, well, they got cut mostly in February after the payroll survey was completed. Also, their severance packages and other things that say, even though I’ve been fired or laid off, I’m still counted on the books because I’m getting this paycheck for another couple of weeks, couple of months net.

I think payrolls are going to be surprising to the upside, not hugely not breaking 300,000, not breaking 200,000, but still at the higher end of the range that signifies things are going well because let’s face it, there were some headwinds from the storms.

So if you get something in the high 100s, say 190, and you factor in storms as having been a headwind, a lot of folks will say that’s a pretty good number.

We aren’t seeing an economic slowdown. And if that happens, well, I think in this case, good news is good news for the markets. I think the markets will sigh a little bit of relief that we aren’t heading to stagflation or recession. Let’s see what happens Friday. We’re in it to win it folks. Zatlin out.

Andrew Zatlin

Editor, Superforecast Trader & Moneyball Economics