In physics, Isaac Newton’s laws of motion laid the foundation for classical mechanics, explaining how objects move and interact.

His first law — the law of inertia — states that an object will remain at rest or in uniform motion unless acted upon by an external force.

This principle revolutionized our understanding of physical forces — and offers a compelling analogy for momentum investing.

In the stock market, a stock in motion — one that is already trending — tends to continue its trajectory unless significant external factors disrupt it.

This concept of financial inertia is at the heart of momentum investing, where investors seek to identify and invest in stocks that are in strong, sustainable uptrends.

But the best investment strategies don’t rely on momentum alone.

Newton’s own investment experience shows the pitfalls of this approach.

One of the greatest minds in history couldn’t avoid the euphoria of the world’s second stock market bubble…

And with markets hitting fresh highs now (the Nasdaq just crossed 17,000 for the first time during intraday trading yesterday), it’s the perfect time to see what we can glean from Newton’s experience.

How Newton Lost His Fortune

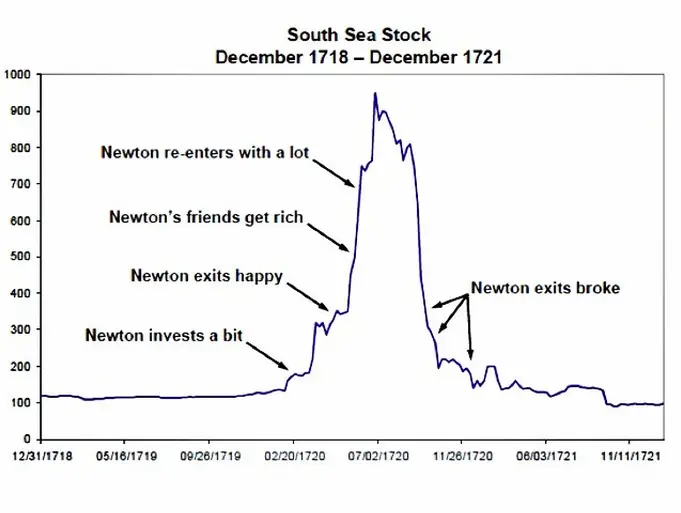

The South Sea Bubble of 1720 was one of the most infamous financial bubbles in history. The South Sea Company got a monopoly on trade with South America, and its stock price soared on rampant speculation and overly optimistic expectations of profits.

Newton was initially cautious, but he still invested early and wisely and made a substantial profit before succumbing to a feeling you may be familiar with in your own investing pursuits.

Newton caught FOMO (Fear of Missing Out) and reinvested as the bubble peaked. When the bubble inevitably burst, Newton suffered heavy financial losses.

Here’s a look at the timeline over which Newton lost his fortune:

Source: Business Insider

After that, he supposedly said: “I can calculate the motions of the heavenly bodies, but not the madness of men.”

The South Sea Bubble summarizes momentum investing. Investors buy on the way up, expecting to sell at even higher prices. As the chart above shows, the strategy works until it doesn’t.

The Key to Momentum

Momentum strategies perform well. In the long run, they beat the market. Academic research proves this, with the first paper dating back to 1967. Since then, dozens of researchers have shown that momentum strategies work in markets around the world.

One study applied the strategy to more than 200 years of data and found it has been effective for centuries.

Researchers have also identified a problem with these strategies: “…the strong positive average returns and Sharpe ratios of momentum strategies are punctuated with occasional crashes … momentum returns are negatively skewed, and the negative returns can be pronounced and persistent.”

Many investors don’t like to experience these “momentum crashes,” even if they expect a recovery in the long run.

My colleague Adam O’Dell certainly doesn’t. That’s why he doesn’t rely on momentum alone…

In his Green Zone Power Ratings system, Adam combines Momentum with five other factors — Size, Volatility, Value, Quality and Growth — to help him uncover the best stocks.

In this way, he captures the benefit of momentum while minimizing the worst qualities of the strategy.

You can use Green Zone Power Ratings, too, by entering the company name or ticker in the search bar here to see both its Momentum rating as well as how it stacks up in the current market:

- “Strong Bullish” and “Bullish” stocks (rated 61 to 100) are expected to beat the broader S&P 500 over the next 12 months.

- “Neutral” stocks (rated 41 to 60) should track the broader market’s ups and downs.

- “High-Risk” and “Bearish” stocks (rated 0 to 40) are expected to underperform.

Click here or on the image below to try it out now…

Until next time,

Mike Carr

Chief Market Technician