Editor’s Note: On Fridays going forward, Chief Research Analyst Matt Clark is taking the reins in What My System Says Today. Read on to see what crossed our earnings radar for next week!

Hey everyone, it’s Matt here with the Earnings Friday edition of What My System Says Today.

Currently, about 90% of companies in the S&P 500 have reported first quarter earnings.

You wouldn’t believe it if you only read the news (much of it negative, of course) … but a full 78% of them have reported earnings per share (EPS) above Wall Street estimates.

That’s reassuring, as it suggests Corporate America’s earnings engine was humming along nicely to start the year.

As investors and traders, we really need to know how the market reacts to companies reporting above or below their estimated EPS. That’s particularly true now, given how trade war headlines have been affecting sentiment.

Good news there, too …

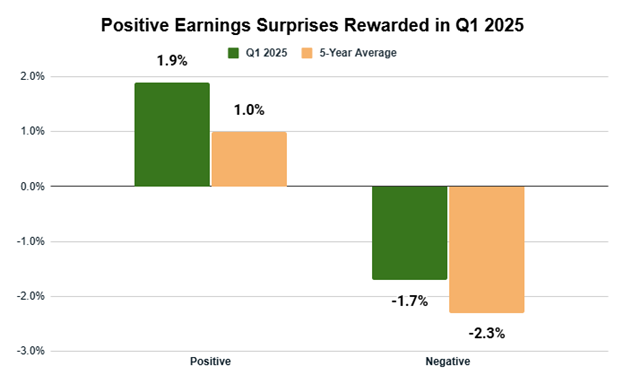

Even though the market has exhibited higher volatility, it has been more generous in rewarding positive earnings surprises this quarter than average.

Companies reporting positive EPS surprises have seen their stock price increase 1.9% on average from two days before earnings to two days after earnings. That’s almost double the five-year average for positive EPS surprises, at 1%.

Meanwhile, companies with negative surprises aren’t being penalized as much as they typically are. In the first quarter of 2025, the average price action for companies with negative surprises is -1.7 % in the five days surrounding the earnings announcement. The five-year average is -2.3%.

All told, this analysis confirms the bullish sentiment we’ve seen in the broad market’s trend since mid-April.

Now, let’s have a look at the companies scheduled to report next week. But first, we should revisit a report Adam had his eye on last week…

Walmart Beats on Earnings, Issues Tariff Warning

As earnings reports go, Walmart Inc.’s (WMT) quarterly numbers were a bit of a mixed bag.

The big box retailer reported a beat on earnings per share but a slight drop in revenue. It wasn’t the best quarter, nor the worst.

The most significant part of the retail giant’s quarterly earnings was management’s take on tariffs.

As Adam mentioned last week, estimates show Walmart imports 60% of its goods from China, meaning it is operating in the epicenter of tariff drama.

However, Walmart also imports grocery products from Costa Rica, Peru and Colombia — countries also with high tariffs. This means prices will go up on more than just televisions and toys.

Even with an agreement to lower duties on Chinese imports, Walmart management said those tariffs are still too high and prices will have to come up.

Walmart CFO John David Rainey told CNBC that those higher prices could be seen as early as this month. Better stock up now!

Speaking of the retail sector…

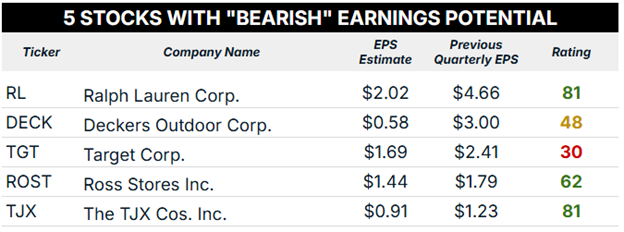

Retail Dominates Our “Bearish” Earnings Season Screen

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

The screen returned these results:

What’s interesting is that every company in the table above is a retailer, so we’re about to get a truckload of new insights on the state of consumerism amid this ongoing trade war.

Whether it’s clothes made in Vietnam and Thailand or other discretionary merchandise (think shoes, electronics or toys) imported from China, tariffs are impacting the cost of goods for every company on that list.

Of note, only one company on the list — Target Corp. (TGT) — earns a rating below “Neutral” on Adam’s Green Zone Power Rating system. Its price-based factors are all in the red as the stock has dropped 31% in 2025.

However, I’ll also highlight how TGT rates high on Value (93) and Quality (83), meaning its current valuation (trading at 11X its earnings, compared to the industry average of 26X) isn’t a “trap,” as Target is a quality company that maintains higher net and operating margins than its peer average.

Like Adam with Walmart, I’ll be interested to see how Target’s management responds to the threat of future tariffs on the price of its goods.

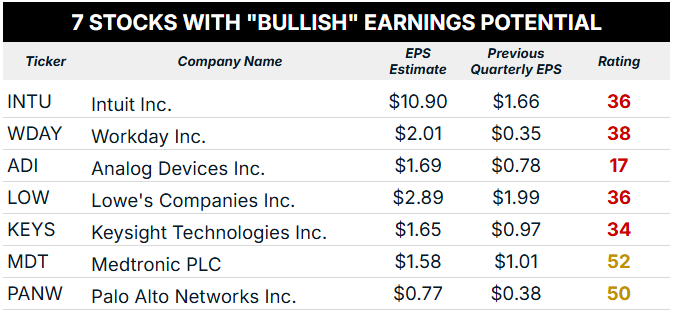

“Bullish” Stocks to Watch

Now let’s look at the companies expected to beat their previous quarter’s earnings and, thus, potentially trade higher if those expectations are met… or even exceeded.

For this screen, stocks must meet four criteria:

- The stock is covered by 10 or more analysts.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

The screen returned these results:

These seven companies report next week and all have the potential to surpass their previous quarter’s earnings per share.

A couple of things stand out here:

- All but one, Lowe’s (LOW), is in technology. Medtronic (MDT) is technically considered health care, but it develops and sells medical devices.

- All but two (MDT and PANW) are rated “Bearish” or lower.

Information technology stocks have so far had a robust earnings season, reporting nearly 18% year-over-year earnings growth.

I’ll be interested to see if the tech companies reporting next week continue the trend of strong earnings growth … and whether the market continues to reward positive earnings surprises as robustly as it has been.

That’s all from me today. Have a great weekend, everyone!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets