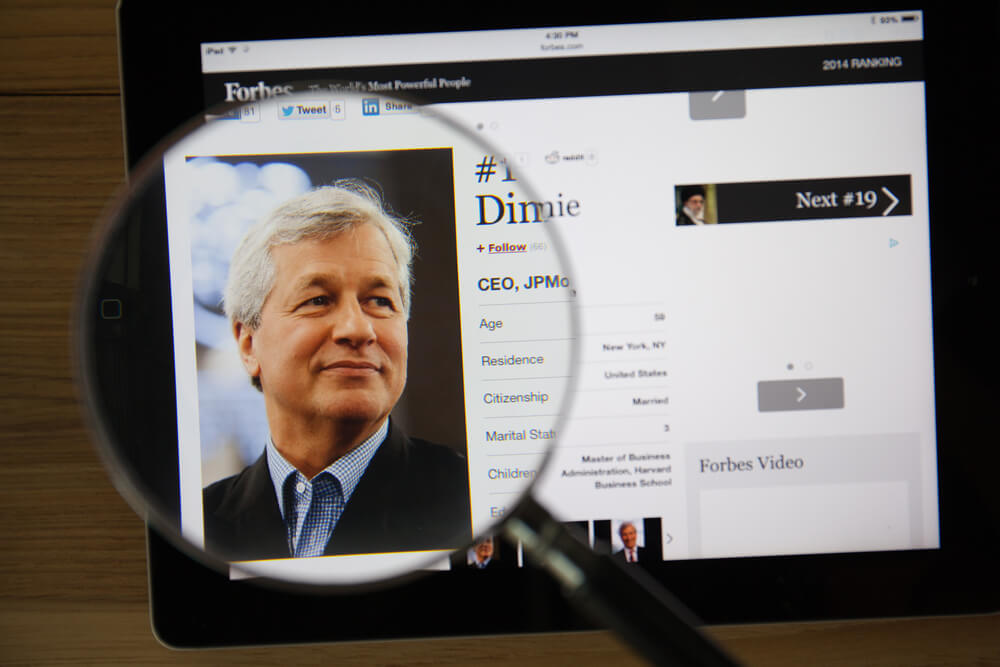

JPMorgan Chase & Co. CEO Jamie Dimon was making the rounds at the World Economic Forum in Davos, Switzerland, and touched on a number of topics including negative interest rate policy (NIRP) in the U.S., socialism and what he sees as the biggest market bubble right now.

Dimon on NIRP

While President Donald Trump continues to push for NIRP in the U.S., which would help people like him who take out massive loans but crush savers, Dimon said negative rates are his one big worry.

“The only thing I have trepidation about is negative interest rates, QE, and the diversion between stock prices and bond prices and yield and stuff like that,” Dimon said on CNBC’s “Squawk Box” program Wednesday. “It’s kind of one of the great experiments of all time, and we still don’t know what the ultimate outcome is.”

NIRP has been used by Japan and Europe to try and stimulate their economies by encouraging borrowing, but economists are divided on whether its ultimately good or bad for an economy. Dimon lamented already low rates — let alone negative rates.

“I think it’s very hard for central banks to forever make up for bad policy elsewhere,” he said. “That puts them in a trap. We’re a little bit in that trap today with rates so low around the world. I would never buy a negative rate bond, not unless I was forced. In history whenever you’ve seen anything like that, it doesn’t necessarily end well.”

Trump, however, is all for NIRP.

“Even now as the United States is by far the strongest economic power in the world, it’s not even close. … We’re forced to compete with nations that are getting negative rates, something very new,” Trump said Tuesday in Davos. “Meaning, they get paid to borrow money, something I could get used to very quickly. Love that.”

Dimon on the Sovereign US Debt Bubble

Dimon said the only major bubble he sees is the federal government’s ever-ballooning sovereign national debt. The federal government’s deficit is expected to top $1 trillion a year for at least the next decade, and it ran a $357 billion deficit in the fiscal quarter ending in December.

The total outstanding U.S. national debt is over $23 trillion and only growing while debt held by the public is over $17 trillion. Dimon said low interest rates have kept outcry over the debt subdued — for now.

“Right now people think central banks around the world can do whatever they want. They can’t,” he said. “They’re intelligent, looking at all the facts trying to figure out what to do. But (inflation) would be the big negative surprise.”

If inflation were to suddenly take off, governments would be forced to raise rates, making the debt far more expensive and pushing bond yields down.

Dimon on the Rising Tide of Socialism

Socialism has failed just about everywhere it’s been tried and ultimately leads to an “eroding society,” Dimon said.

Of course, Sen. Bernie Sanders, a Democratic Socialist, has been rising in popularity, trailing only former Vice President Joe Biden in primary polling for the right to challenge the incumbent Trump.

“I honestly don’t think they understand what socialism is,” Dimon said. “Most state-owned enterprises don’t do a particularly good job. You look around the world and they become corrupt over time. That doesn’t mean that capitalism is perfect. That doesn’t mean that every public company is perfect. No, there are flaws.”

Dimon declined to name any candidates (like Sanders) by name, but said socialist governments do a bad job allocating where all the taxpayer money will go and end up funding “bridge to nowhere” projects.

“Once you do that, you will have an eroding society,” he said. “They do need to fix inner-city schools, infrastructure, health care. We can fix all of those in a capitalist society.”