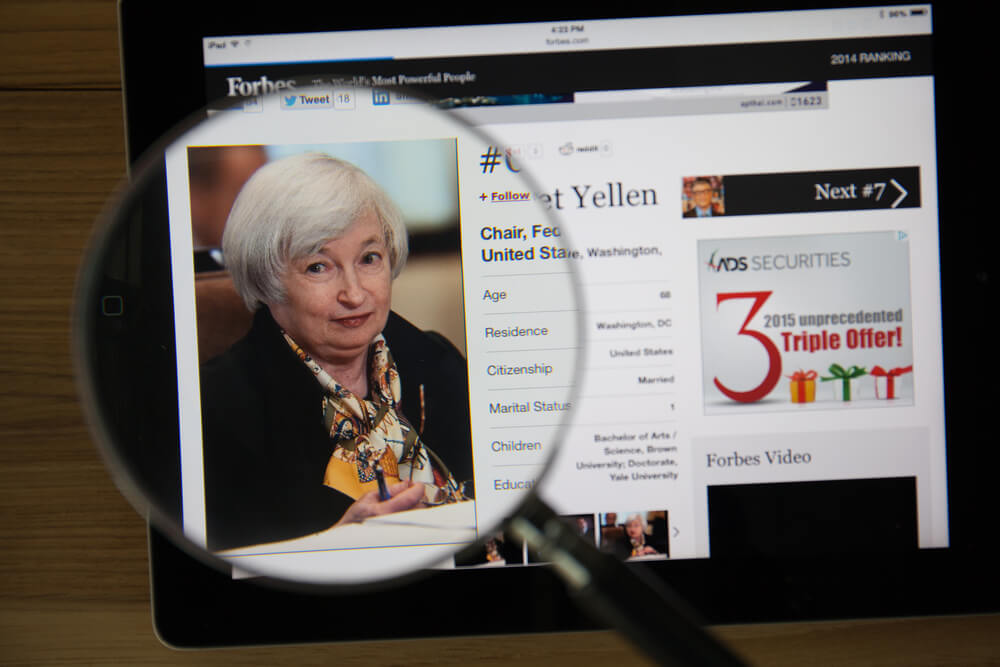

Former Fed Chair Janet Yellen said at Asian investors conference in Hong Kong that she is not a fan of modern monetary theory, and that its proponents are “confused” about how things like MMT can cause hyper inflation in an economy.

MMT is the theory that a government that borrows in its own currency need not worry about its growing debt because that government can simply print more money to pay that debt off. The theory has grown in popularity among those on the far left, where Democratic Socialists like Rep. Alexandria Ocasio-Cortez, D-N.Y., have touted it as a way to pay for things like her Green New Deal plan to combat climate change.

Per Bloomberg:

Yellen took issue with those promoting MMT who suggest “you don’t have to worry about interest-rate payments because the central bank can buy the debt,” she said at an Asian investors’ conference hosted by Credit Suisse in Hong Kong. “That’s a very wrong-minded theory because that’s how you get hyper-inflation.”

The former Fed chair said she was “not a fan” when asked about the decades-old theory, which has gained recent traction in the U.S. particularly amid a run-up in government debt. Yellen joins a list of well-known names such as billionaire investor Warren Buffett and former U.S. Treasury Secretary Larry Summers who have said they’re opposed to the theory.

More from Yellen in Hong Kong:

- Yield-curve inversion happens very easily and doesn’t alone signal a U.S. recession is imminent, though can signal that Fed might at some point need to cut interest rates

- For quite a long time to come we’ll need to worry that central banks are not going to easily have the tools to adequately respond to financial crisis

- Populism is source of great uncertainty as workers in Europe and U.S. blame lackluster wage growth and living standards on globalization

- Also concerned about buildup of corporate debt and leveraged lending; underwriting of some leveraged loans is weak

- Fed’s process of reducing balance sheet has been running smoothly; Fed will operate with a large balance sheet for a long time to come