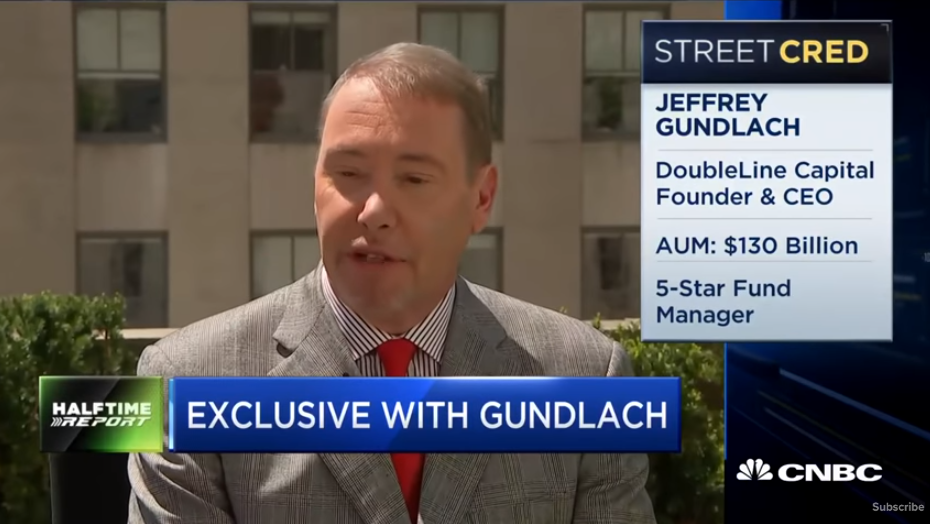

DoubleLine Capital CEO and Wall Street’s “Bond King” Jeffrey Gundlach said he’s no longer worried about a recession cropping up in 2020, even if the U.S. and China don’t end up signing a new trade deal.

“I think that there is unlikely to be a recession at this point. The odds are against a recession occurring before the end of 2020,” Gundlach said Wednesday on CNBC’s “Fast Money Halftime Report” program. “What’s happened is consumer confidence has really held up and the year over year leading indicators from the Conference Board, we were at 7% year over year 15 months ago, which is really strong. And you have never had a recession the last several decades without leading indicators first going negative. So that’s really the canary in the coal mine.

“You sometimes have negative leading indicators without a recession, but we’ve never had a recession without negative leading indicators, so it’s a necessary, not sufficient condition.”

Gundlach said that while the numbers have fallen sharply from 7% year over year to just 0.4%, his forecast is that the figure will improve over the next several months. That, along with strong consumer spending and low unemployment, should stave off a recession for the foreseeable future, at least into 2021.

“So our forecast is that those will improve in the next couple of months, which makes it very unlikely that we’ll have a recession in the next six to 12 months. So (recession chances) are down about 35%. In the summer, don’t forget that there were white papers being released on Wall Street encouraging the Fed to do an inter-meeting 50-basis point emergency cut (to its benchmark interest rate),” he explained. “That’s how bad some of the manufacturing data was getting globally.

“To forecast a recession at this point there are two things you have to watch: the consumer view of the present would have to deteriorate, and it’s still pretty high, and you’d have to see those weekly initial employment claims going up to about; they’d have to up from about 200,000 where they are now to 250,000. And there’s no reason to believe that’s going to happen.”