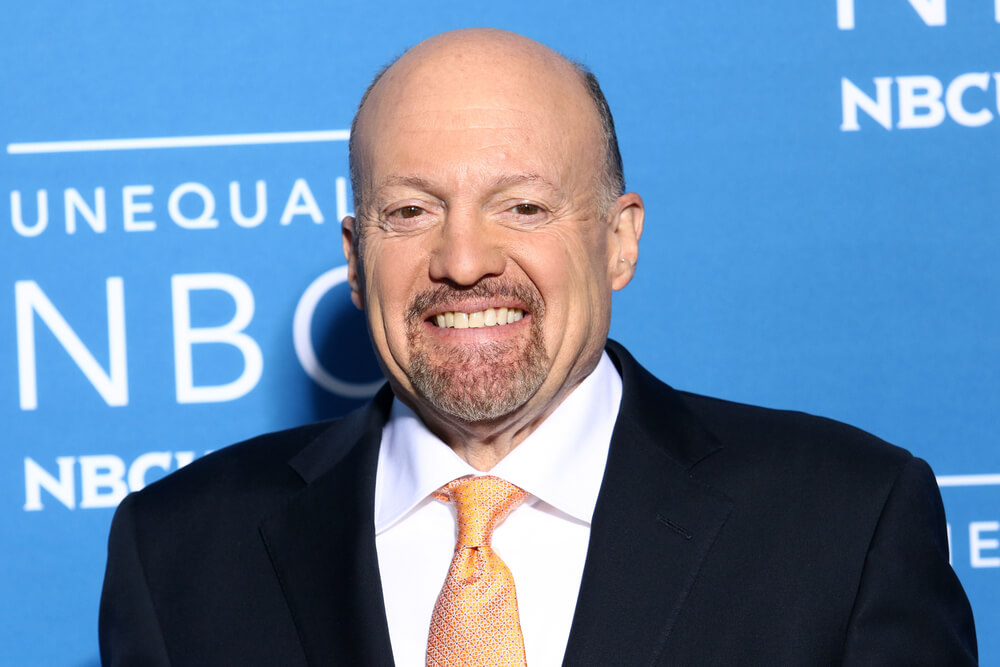

Donald Trump’s trade wars, now plural, and the House Democrats’ impeachment inquiry into the president have created the biggest headwinds the economy has faced since the 1970s when Richard Nixon was impeached, CNBC’s Jim Cramer said Friday.

“Washington is the biggest headwind to the economy that I can recall,” Cramer said on CNBC’s “Squawk on the Street” program. “I have not seen it since Nixon, such a headwind. It fights you at every turn. You have to check Twitter … I mean look at the lead headlines: China, Ukraine, Biden … .”

Cramer said it’s insane that the United States-Mexico-Canada Agreement hasn’t yet been ratified by Congress.

“When Speaker Pelosi said that we’re probably going to get a deal with Mexico and Canada, and I just don’t know how that’s possible,” he said. “That’s just a huge part of it, much bigger than China. How did we not get that deal (yet)? The Mexicans want to do it, the Canadians want to do it, the United States wants to do it and we can’t get it through Congress?”

The panel then went on to say if we can’t get that deal done, how will we ever get a deal with China done — particularly with the ongoing impeachment inquiry?

“The idea of Nancy Pelosi sitting down with Trump, how is that possible?” Cramer asked. He then questioned how it would work for Pelosi to go to Trump saying, “‘I’m trying to impeach you, let’s make a deal'” on trade.

“They are hurting the economy.”

Cramer went on to say that manufacturing is hurting because of the trade war, but the strength of the dollar has made it a wash, for the most part.

“This is a number that says to me that the Fed can still cut because the sector that’s being really stagnant is manufacturing and a lot of that is the fact that the dollar is so strong. It’s very interesting, on the Costco conference call yesterday they talked about how, ‘Hey listen, we have these tariffs but don’t worry about it because the dollar is strong and the Chinese currency (the yuan) is weak — it kinda makes up for it. That’s something we have to be thinking about, that we continue to lose because of the currency, so that gives the Fed the ability to move.”