JPMorgan regional investment head John Richert told CNBC that even though the stock market has been ticking to record highs the past couple of weeks, that doesn’t exactly mean corporate executives are feeling bullish on where the market is headed with 2020 just a month away.

Actually, according to Richert, CEOs are most worried about delivering on earnings amid increasingly uncertain times with slowing global growth due to the ongoing trade war with China, and due to uncertainty surrounding the 2020 presidential election (Goldman Sachs actually sees the opposite, with uncertainty in politics fueling the bull market in 2020).

Most CEOs are easing back on capital spending and investments while bracing for a possible recession in the new year.

“Everybody looks at the stock market and sees share prices going through the roof right now, but few of the CEOs I talk to feel good about that,” Richert said, according to CNBC. “There is an increased worry about their ability to deliver results amid prolonged periods of uncertainty next year.”

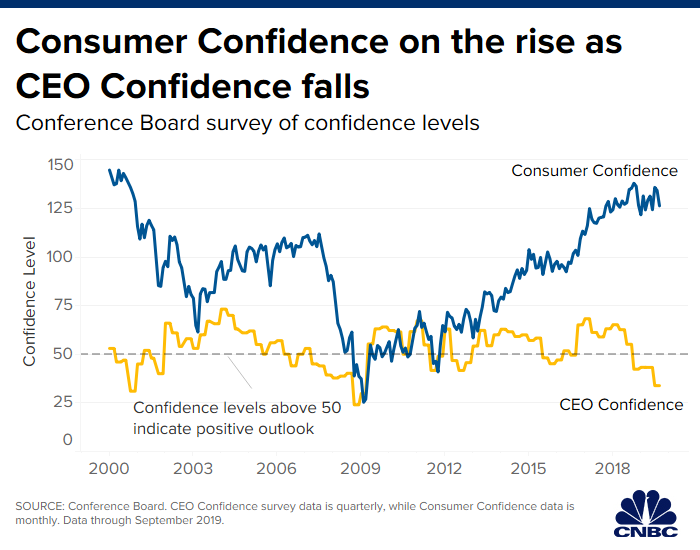

So heading into 2020, CEO confidence is at its lowest level in a decade, but consumer spending is still strong, mostly due to the lowest unemployment levels seen in a half-century.

In fact, we can thank U.S. consumers for keeping us out of a recession so far, despite President Donald Trump’s tariff wars — but there is a shelf life for this and the tariffs eventually will start to kill growth.

Per CNBC:

CEOs are so anxious they’re engaged with corporate clients at record levels, said Richert, whose focus for JPMorgan is companies that generate $500 million to $5 billion in annual revenue. There is never-before-seen potential for deals in this climate as banks are being called in left and and right to examine the capital plans of companies and offer strategic possibilities, such as divesting non-core businesses.

“There’s a lot of discussions among industry players to figure out the best way to put companies together,” Richert said, adding that CEOs are looking at “mergers of equals” to shore things up and help weather a potential recession.

CEOs are basically bracing for two distinct possibilities to emerge from the 2020 election: Another four years of pro-business Trump in office, or the potential massive, sweeping changes if someone like Sen. Elizabeth Warren becomes president.

Richert also said that the level of anxiety is different depending on what sector it is, such as manufacturing, transportation and consumer retail companies under more pressure than technology and service companies.

“You talk to any industrial, old-line economy company here in the U.S., they’ll tell you we’re in a recession right now,” he said (manufacturing has seen contraction for months now, as we’ve covered here on Money and Markets). “The service economy and tech is keeping the cycle going for now.”