A decade ago the U.S. was hit by a market collapse and the subsequent worst recession since the Great Depression. It’s happened before and it will undoubtedly happen again.

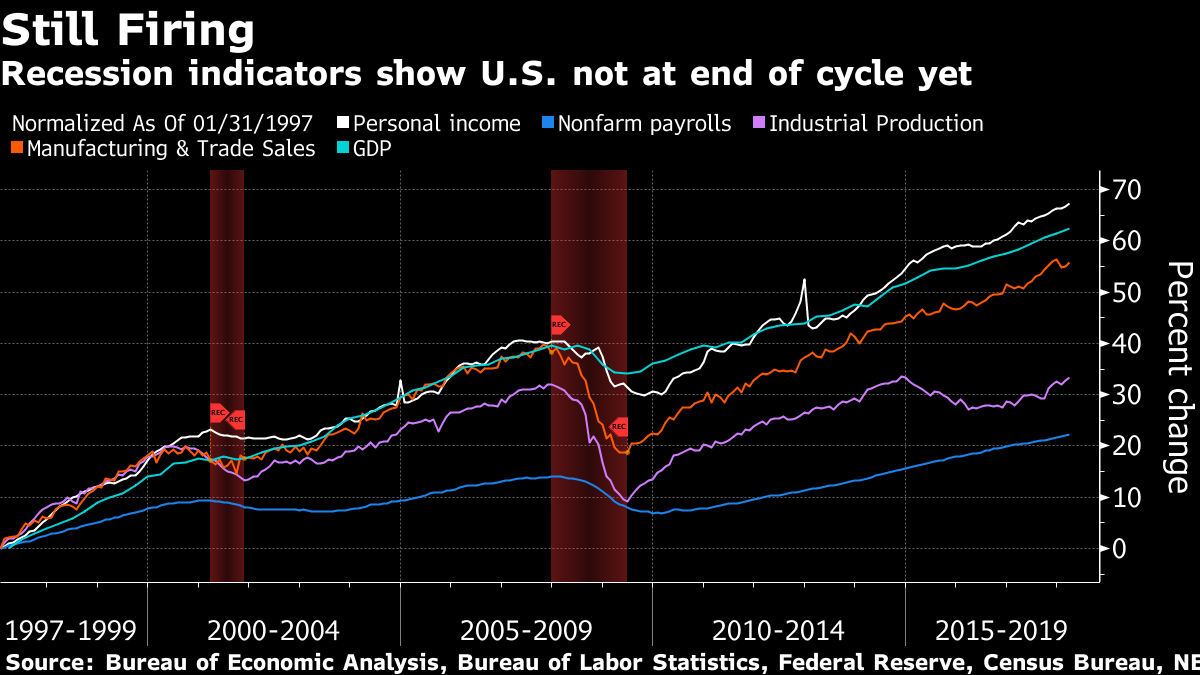

We are currently in the longest bull market run in history, but the big question investors want to know is when will it come crashing down?

JPMorgan Chase, the biggest bank in the United States, is predicting 2020.

It isn’t all bad news as JPMorgan’s analysts don’t expect the next market collapse and the aftermath to be as bad as things were in 2008, though, diminished financial liquidity remains a wildcard.

According to a recent article by Bloomberg, there are several factors that play into JPMorgan’s calculations:

The JPMorgan model calculates outcomes based on the length of the economic expansion, the potential duration of the next recession, the degree of leverage, asset-price valuations and the level of deregulation and financial innovation before the crisis. Assuming an average-length recession, the model came up with the following peak-to-trough performance estimates for different asset classes in the next crisis, according to the note.

In a nutshell, JPMorgan is predicting a crash of about 20 percent as well as a jump in corporate-bond yield premiums of about 1.15 percentage points, a 35 percent drop in energy prices and a 29 percent decline in base metals. In addition, it predicts a 2.79 point increase in emerging-nation government debt, a 48 percent drop in emerging-market stocks and a 14.4 percent decline in emerging currencies.

“Across assets, these projections look tame relative to what the GFC delivered and probably unalarming relative to the recession/crisis averages” of the past, JPMorgan strategists John Normand and Federico Manicardi wrote, noting that during the recession and ensuing global financial crisis the S&P 500 fell 54 percent from its peak. “We would nudge them all at least to their historical norms due to the wildcard from structurally less-liquid markets.”

JPMorgan noted the potential for a “great liquidity crisis” in the future.

“The shift from active to passive asset management, and specifically the decline of active value investors, reduces the ability of the market to prevent and recover from large drawdowns,” Joyce Chang and Jan Loeys wrote in the Monday note. Actively managed accounts make up only about one-third of equity assets under management, with active single-name trading responsible for just 10 percent or so of trading volume, JPMorgan estimates.

A silver lining: the liquidity worries mean assets in developing countries are cheaper this year, which helps limit the peak-to-trough declines of the next crisis, offsetting a buildup of leverage.

Ultimately, Normand and Manicardi said the length of the next downturn is a critical unknown in determining how bad the downturn will be.

“The recession’s duration is a powerful drag on returns, which should dovetail with some readers’ concerns that policy makers lack the necessary monetary and fiscal space to extract economies from the next recession,” they wrote.

Are you prepared for the next market collapse, and what do you think of JPMorgan Chase’s 2020 prediction? Discuss in the comments below.