There’s a lot of optimism right now in the stock market as the S&P 500 closes in on its best first six months of a year in a decade. The Dow Jones Industrial Average is also having its best June since 1938, but JPMorgan has spotted something odd about the market’s current rally.

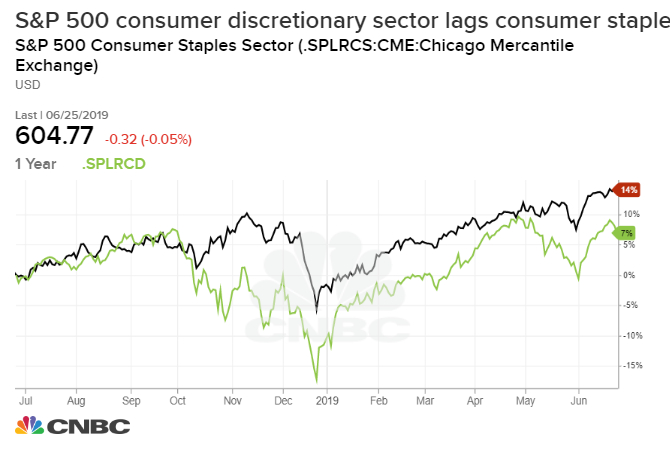

Economic growth and cyclical stocks, like technology and consumer discretionary, usually go hand-in-hand. JPMorgan chart analyst Jason Hunter says those stocks have failed to regain losses from May while defensive sectors like utilities and consumer staples have stuck with the rally.

“Rally leadership doesn’t inspire a lot of confidence yet … In our view, that cross-market divergence can only persist for a short period of time, and the S&P 500 Index rally potential is limited under the current conditions,” Hunter said in a note on Tuesday.

The June comeback is being driven by a hope of two events: The Federal Reserve easing up on its monetary policy and the U.S. and China edging closer to a new trade deal after tit-for-tat tariffs sent the market on a downward spiral through the month of May. The Fed has signaled that an interest rate cut may happen soon after raising rates nine times over three years.

Hunter argues that cyclical stocks must overtake defensive stocks in order for the bull rally to continue, but cyclicals have been lagging since October 2018.

“We do not believe the divergence between Cyclicals and Defensives can persist if the S&P 500 Index is set to extend the rally through the summer. In our view, either cyclical markets need to start outperforming and take the leadership role in a rally, or the broad equity market is vulnerable to a material setback,” Hunter said.

Warning signs are flashing in another market area as well. Small caps have underperformed throughout the year, which are linked to economic growth. Not only is the Russell 2000 index underperforming, but it has also been lagging behind the market as a whole. May saw the index dip into correction territory as global trade tensions led investors to sell off riskier endeavors, according to CNBC.

“From a technical standpoint, until the small-cap index’s relative performance starts to improve or ’the market breaks through the 1,600 area resistance zone, it’s hard to have high conviction in a positive outlook, ” Hunter said.