When we started our Stock Power Daily, the mission was simple: Find opportunities to profit, no matter what the market was doing.

In the first three months, we’ve found several solid stocks — even amid the broader market sell-off.

Every weekday morning, I send out one stock that rates “Strong Bullish” or “Bullish” according to our Stock Power Ratings system. (Check out the archive here.)

And these recent selections look like maximum momentum plays as market volatility continues.

Let’s check out four of June’s top performers.

Power Stock Solves the Nursing Shortage

In a 2021 survey of health care executives, 83% said they expect the greatest staff shortage to come from nursing.

To help combat that shortage, I found a top Power Stock: AMN Healthcare Services Inc. (NYSE: AMN).

AMN provides health care workers to hospitals and other facilities in the U.S.

In addition to nurse and physician staffing, it specializes in filling leadership and tech jobs within health care.

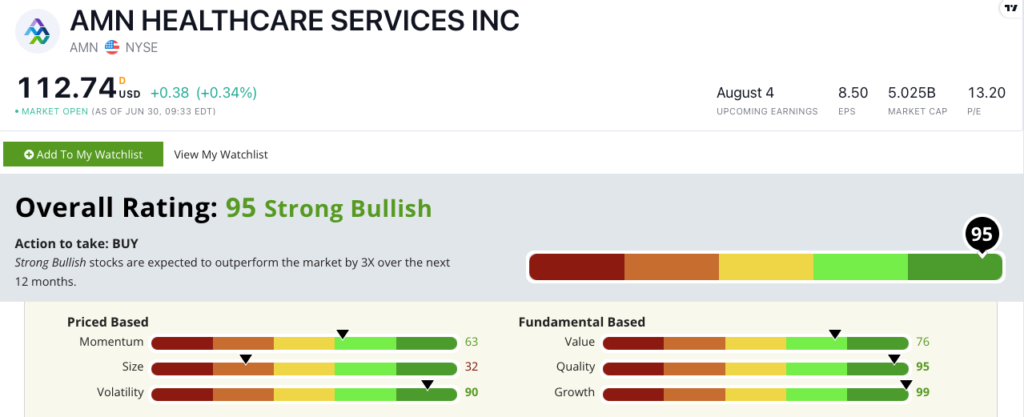

AMN scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

AMN’s growth potential is another reason I like this stock.

Its one-year annual earnings-per-share (EPS) growth rate is 359.9%, and its sales growth rate is 66.5%.

AMN is also a strong quality play: Returns on assets, equity and investment reflect double-digits. Its industry peers, on the other hand, average negative returns.

AMN Shows “Maximum Momentum”

During the market sell-off in April and May, AMN stock dropped 22.5%. After hitting its 52-week low in May, the stock has gained around 30%.

Since I told you about AMN in June, the stock has rocketed as much as 11% higher! The stock is still up around 8% after this week’s volatility.

The S&P 500 has lost almost 8% since AMN was featured in Stock Power Daily.

That shows the maximum momentum we look for in stocks.

Congratulations on your gains if you bought in when I told you about AMN!

It looks like there are more gains on the horizon. Here’s why…

As I mentioned earlier, 83% of hospital executives expect nursing shortages. That’s a massive void to fill.

Because AMN specializes in filling those positions, its stock would make a terrific addition to your portfolio.

But it’s not the only recent winner we’ve had with Stock Power Daily:

- Lockheed Martin Corp. (NYSE: LMT) — The American defense stalwart is up around 6% since the middle of June.

- PetroTal Corp. (OTC: PTALF) — This Peruvian oil and gas provider is up around 5% since I told you about it recently!

- America First Multifamily Investors L.P. (Nasdaq: ATAX) — This company specializes in providing financing for multifamily housing in the U.S. It’s gained close to 5% since I recommended it nine trading days ago.

These are just a few of the stocks you get with our Stock Power Daily e-letter. If you are signed up for the Money & Markets Daily, look for the latest Stock Power Daily in your inbox each weekday around 7 a.m. Eastern.

If you aren’t signed up, we’ve got you covered. Just go to our homepage (www.MoneyandMarkets.com) and enter your email address in the box that looks like this:

Want More? Listen to The Stock Power Podcast

If you are looking for even more profit potential for your portfolio, check out new episodes of The Stock Power Podcast every week.

I do a deep dive into another highly rated Power Stock every Saturday.

This week, I’ll share a 99-rated company that’s a leading distributor keeping the heat up during a popular summer activity.

The stock has jumped around 8.3% in the last 10 days. That’s the maximum momentum we love to see in stocks!

You can check out the podcast on our YouTube channel, as well as on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Stock Power Podcast, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.