For several months now, I’ve been predicting that the U.S. Federal Reserve would start cutting rates in June — unleashing a whole new wave of investment in stocks.

My prediction (as always) has been rooted in hard economic data.

And the latest economic data points to a rate cut being practically locked in for June.

Here’s why:

Video transcript:

Welcome to Moneyball Economics. I’m Andrew Zatlin and I would like you to prepare for a rate cut next month…

If the Fed cuts rates as I think they will do, and for reasons I’m going to share with you today, you will see the stock market and the bond market surge. In particular, rate cuts love high tech and construction. Gold, on the other hand, you can expect to take a punch in the mouth.

Why do I think the Fed is going to cut rates?

Well, partly because they should and largely because they can…

When I say they can cut rates, it’s because their boogeyman, their fear of inflation is non-existent. And so that means that all signals coming out of the economy favor a rate cut. More critically, they should because they’re supposed to front run any kind of inflection. Let me explain what’s going on.

The Fed is very afraid of inflation right now and they have reasons. The two reasons are, number one, we’ve had some inflation earlier in the year that was kind of bubbling up.

But then more critically, they’re looking at these tariffs that Trump is throwing out there and they’re concerned that higher prices of goods coming onshore will lead to just generally speaking, higher prices for the American consumer and factories. Factories having to pay more for chemicals and parts will just pass that cost on to consumers. Short answer, they’re wrong. Let me explain.

The economic data is coming in and it is signaling uniformly that the Fed does not need to worry about inflation and so the Fed is going to see a softening economy without inflation and that means rate cuts.

Let me take a step back though and talk about the inflation story. Earlier in the year, inflation started to bubble up. It did in both CPI, the consumer inflation and PPI, the producer or factory inflation. Both went up and so the Fed was right to be concerned or were they see, understand.

As you know, recently I said that inflation was going to come down a little bit on CPI. That of course was contrary to what all the talking heads said and consensus believed. And sure enough, inflation did come down for exactly the reasons I stated.

What was my belief and why was inflation going up earlier in the year? Well, basically because everyone was scared of tariffs, so they front ran it. If you look at all economic data out there starting in November, you’re going to see a surge in commercial activity. This wasn’t just, Hey, we’re excited to have Trump on board. He’s an economic leader. Oh my god, this guy’s going to go crazy on the economy.

We know he’s threatening tariffs. Let’s take him seriously and let’s front and run. Let’s pull in all this demand. Let’s get ready for it now. And so as a result, when you get all this activity, inflation’s going to go up a little bit.

Guess what? It ended by March a month before tariffs kicked in. You can look at import information. You look at the data coming in from the port of Los Angeles Long Beach. You look at what’s happening in Savannah, New York, you look all over at our major ports and what you will see is basically a crashing in container imports and I mean crashing.

What was going up eight, nine, 10% year over year in terms of volume suddenly goes down to 0% at the port of LA and that’s because we basically brought in everything we needed from China. And so now we’re back to a steady state and we’ll see We got a couple of months of supplies sitting in warehouses.

So as a result you see a cessation in activity and that cessation in activity, that mellowing out, gets transferred into — you got it — inflation. inflation’s mellowing out. But the problem is with this data, for example, the port data, it stops in March and this is the constant problem we face. We need real time data. We need current data.

So it’s one thing for us to postulate that, hey, this bubble of activity has ended and so now we’re going to see a mellowing out and then we’re seeing that mellowing out in more current data like inflation, but we want to project outwards.

Is this trend, is this what we’re going to see? Because remember, if inflation mellows, the Fed’s going to cut, so what’s going to happen over the next few weeks? Well, for that I turn to a different kind of economic data. I look at rail car shipments.

The US economy depends on moving stuff from point to point and rail cars are the major way goods are shipped in particular industrial goods. You want chemicals, ores, metallic ores, you want autos. It goes largely via rail and there are two kinds of rail car shipments and we want to talk about both and I’m going to share with you some of the data here because to cut to the chase all the data through May rail car shipment data says this economy is steady as you go.

There is no recession, there is no spiking up or a collapse in demand. It’s steady as you go, and I want to talk about the implication of that in a moment, but let’s talk the data. There are two kinds of data that we can track when we talk about railcar. Now, railcar data by is fantastic because it is released weekly, so the data I’m looking at is not just what’s going on every week, but it’s only a week old, so that means I’ve got into mid May, I see what’s going on.

The type of railcar data we have is what comes into the US and then gets shipped around and then what’s happening within the us, it’s two different things. What China ships to US lands at the port and then gets moved around and then hey, coal. Coal that we dig and then move around or metal oars or cement, you name it that we develop here domestically and then move from point to point. The second one’s important because a lot of that speaks to industrial activity, but so does intermodal.

Let’s talk about intermodal.

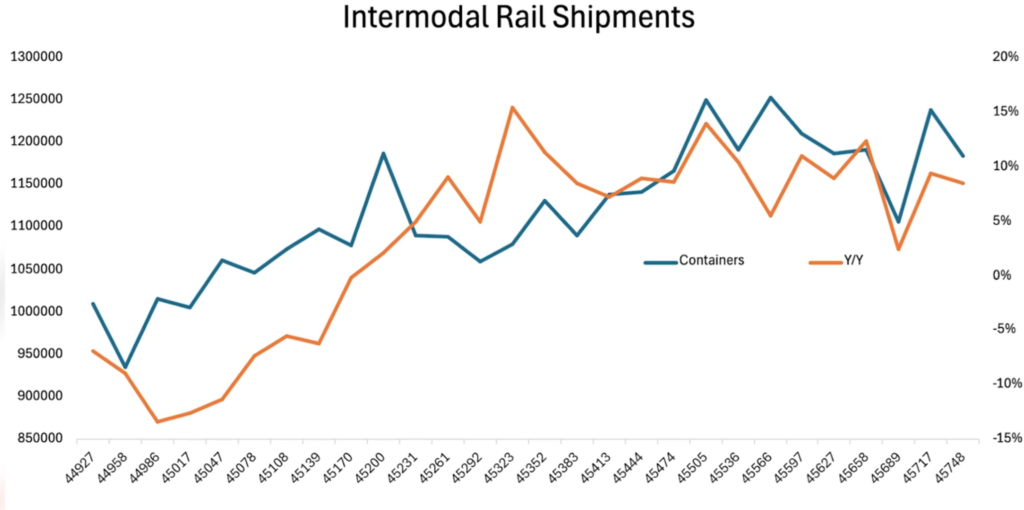

Here’s a chart showing you intermodal rail car shipments year over year and what is really interesting is you’ll see this bubbling up that I mentioned happens in November:

Stuff lands at the docks. We know that from the dock information, but unfortunately DOC information stops in March, but you can see how it kind of mellow out, but it doesn’t collapse.

It’s continuing on. What this means to me is on a year over year basis, the US economy, the demand, once we get past this front running of the tariffs, it’s steady as you go. How do I know that if the intermodal stuff reflects a little bit of a bubble, it’s the railcar stuff that doesn’t, the domestically produced and consumed stuff that doesn’t.

If we look at industrial supplies that are moved from point A to point B that are produced domestically, what we see is huge growth. We’re talking about 5% year over year. This is huge. I’m talking volumes not prices. This is not distorted by inflation or any other pressure. This is a message that industrial activity hasn’t slowed, so that’s a good sign.

If we assume that the US GDP and US economy overall is ticking away steady 2% and inflation is not moving up, then we’ve got all the reason for the fed to cut rates a little bit. Just trim a little bit.

I’m still concerned about the second half, but not as much. If you remember, my main concern here was that when we get to the summertime, we get to June. If Trump hasn’t fixed the 401(k) situation and if he hasn’t tamped down a lot of the uncertainty, people are going to go away pissed on summer vacations and come back pissed and that’s a problem. They’re going to withhold their spending.

Well, guess what? He did it. He’s tamped down a lot of the uncertainty and we’ve got the 401(k)s back up, so the situation has calmed down. I said Trump had through the month of May, he has won this battle. We are now going to see the economy moving in the direction that he wants. The Fed will have to respond to June because if they don’t, it’s all summertime. They will not do rate cuts until they come back from summer holidays and that’s months away and that is a time problem for the fed rate cuts are coming, economic data is uniformly signaling. The economy is starting to slow and we do not have inflationary concerns.

As a result, the Fed will announce a rate cut 25 basis points is what I expect. It could be 50, doesn’t matter. Any amount of rate cut before we go away for the holidays will push this market back up to where it was at its peak in January and then got the second half going from there. I’m excited.

Can you feel it? Because we’re in it to win it and we are. Zatlin out.

Andrew Zatlin

Editor, Andrew Zatlin’s Superforecast Trader