Interest rates are the price of money. If a bank charges a borrower 5%, for example, they are saying the price of using money for that borrower is 5%.

From the borrower’s perspective, the interest rate describes the value they assign to that money. If they buy a car with a loan, economists say the borrower believes the car will increase the quality of their life by at least 5%. Otherwise, they wouldn’t agree to that interest rate.

This assumes the borrower does complex calculations. In many cases, they do not. Borrowers simply want the car and pay the market rate.

Lenders, usually banks and other large institutions, are rational. They set rates based on factors history says are important.

Interest rates generate a profit for the lender. The rate also compensates for the expected loss of purchasing power caused by inflation. Finally, interest rates compensate the lender for risks associated with defaults.

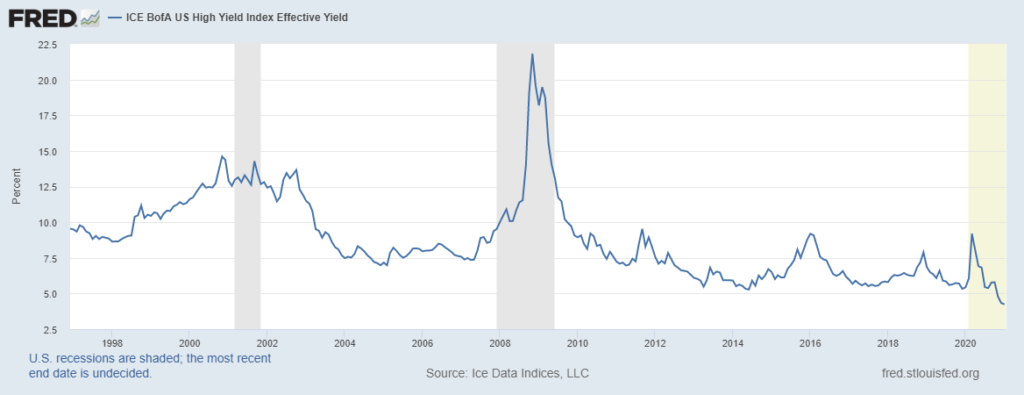

These factors are included in all interest rates. That means with high-yield bonds paying just 4.2%, the lowest rate in history for this risky asset class, investors are ignoring risks of inflation and default.

Junk Bonds Paying Less Than Ever

Junk Bond Traders Are Acting Like Default Isn’t a Risk

More commonly called junk bonds, high-yield bonds are issued by the riskiest companies.

Because of the risk of losses from default, lenders generally demand relatively high rates. Now, junk bonds yield just 3.2% more than ten-year Treasury notes. At the end of the last recession in 2009, junk bonds traded with average interest rates of more than 10.5% higher than ten-year Treasurys.

Despite the low amount of risk priced into the bonds, the risks of default are higher than average. According to CNBC, “S&P Global Ratings said the default rate for high-yield, or junk, bonds is heading to 10% over the next 12 months, more than triple the rate of 3.1% that closed out 2019.”

If defaults triple, junk bond investors will lose trillions of dollars. This risk isn’t priced into the market. In fact, interest rates indicate junk bond traders are ignoring all risks and pricing in the best economy seen in more than twenty years.

If you own junk bonds, now could be the time to sell.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.