In today’s Marijuana Market Update I:

- Answer a couple of viewer inquiries about a popular Florida cannabis company.

- Provide an update on the Money & Markets Cannabis Index.

So, let’s start today with some stock analysis.

Chris messaged me on YouTube:

Would still love to hear about JUSHF and BFF. Thank you. — Chris

Thank you for the message, Chris! I’m more than happy to address your question.

Jushi Holdings Stock Analysis

I reviewed Jushi Holdings Inc. (OTC: JUSHF) some time ago, but now is a good opportunity to revisit this popular company.

It’s based in Boca Raton, Florida and focuses on cultivating and distributing both medical and adult-use cannabis in:

- Pennsylvania — where it has 11 medical dispensaries.

- Virginia — where it has one dispensary.

- Illinois — where it has four adult-use cannabis dispensaries.

- California — where it operates two adult-use dispensaries.

- As well as Ohio, Nevada and Massachusetts.

Its retail locations are branded under Beyond/Hello, and it also offers hemp-based CBD products like supplements, tinctures, soft gels and lotions under several brand names like:

- The Bank.

- The Lab.

- Nira+ Medicinals.

- Seche.

- Tasteology.

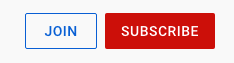

If you focus on the sales data for Jushi, things look pretty good.

The company has steadily increased its total quarterly sales in each of the last seven quarters.

In the third quarter of 2019, Jushi reported sales of just $4 million. That jumped to $42 million by the first quarter of 2021.

That’s a 950% increase in total quarterly sales in just a year and a half — which is impressive.

But here’s where it gets a little concerning for me.

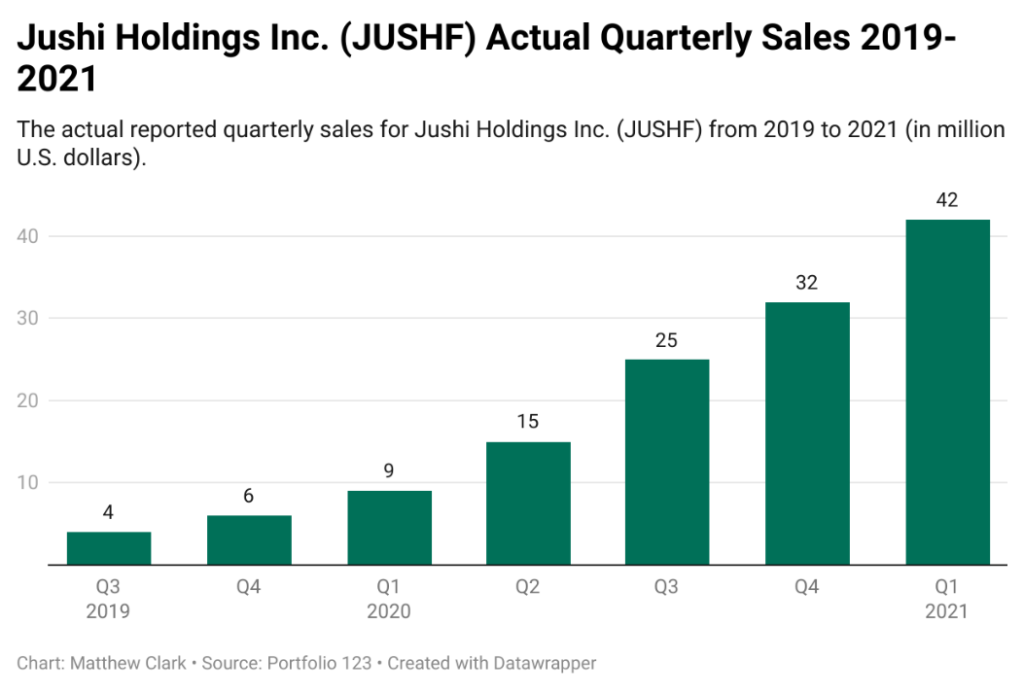

While its quarterly sales have gone up, Jushi’s quarterly earnings per share have stayed in the red.

In fact, the company experienced its worst quarterly EPS in the fourth quarter of 2020 with a minus-$1.35 per share.

It improved to minus-$0.18 per share in the first quarter of 2021, but it still speaks to the overall profitability of the company.

As a refresher, a company’s EPS is calculated by dividing the net income (profit) by the total number of shares outstanding.

A negative EPS means the company is not profitable as its net income (profit) is likely low while its outstanding shares are high. At last look, Jushi has about 151 million outstanding shares.

So, while its sales are good, Jushi continues to struggle to turn a positive EPS.

JUSHF Is Struggling

Jushi Holdings stock has also been hit hard by the recent headwinds in the cannabis market.

It hit a high of $8.59 on Feb. 4, 2021, but has declined 44% to around $4.80.

Additionally, its relative strength index — a measure of the stock’s momentum — has been trending down since the start of August, indicating a bearish move in the stock.

Jushi Holdings Stock Ranking

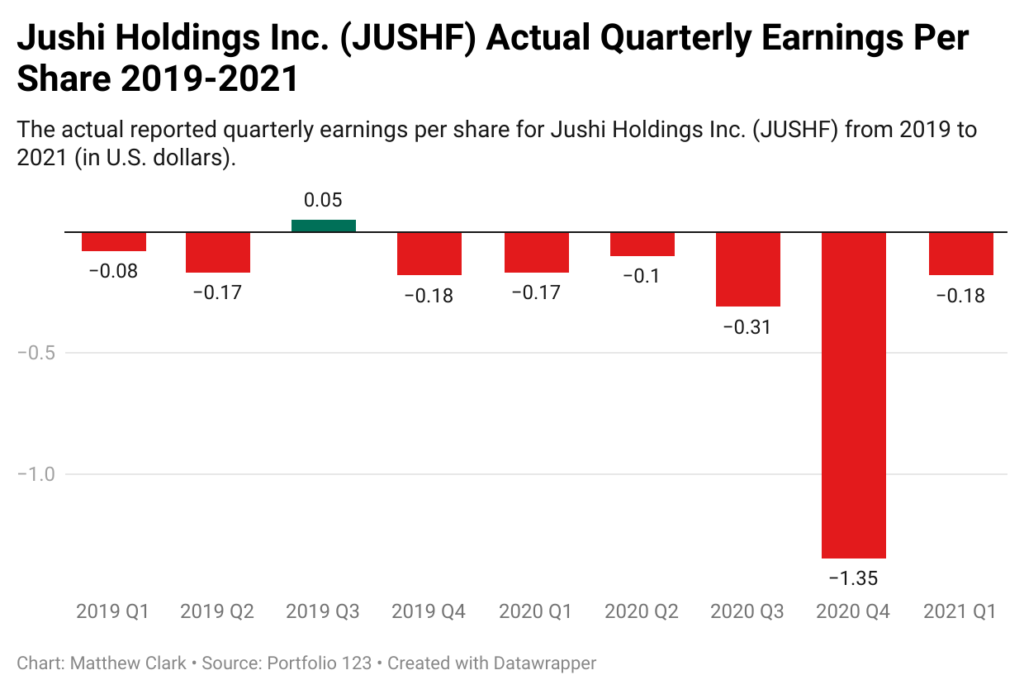

I also ran Jushi through our Cannabis Ranking System, which compares all cannabis stocks based on momentum and value.

Jushi Holdings stock earns an overall ranking of 25 — meaning 75% of all cannabis stocks rank higher. It earns a relatively low 30 on value and is in the midrange on momentum at 46.

I like to see stocks with a bit higher ranking and with better financials before I consider it a potential investment.

My takeaway: Jushi can certainly get there, but it is facing some challenges before it reaching that point. It needs to see a reversal in the downward momentum of its stock price and to see its EPS get closer to positive territory.

Thanks for the question, Chris. Look out for an email from my team as we will send you Money & Markets merchandise.

You, too, can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we use in any of our videos. Just send us your questions and feedback.

Money & Markets Cannabis Index Update

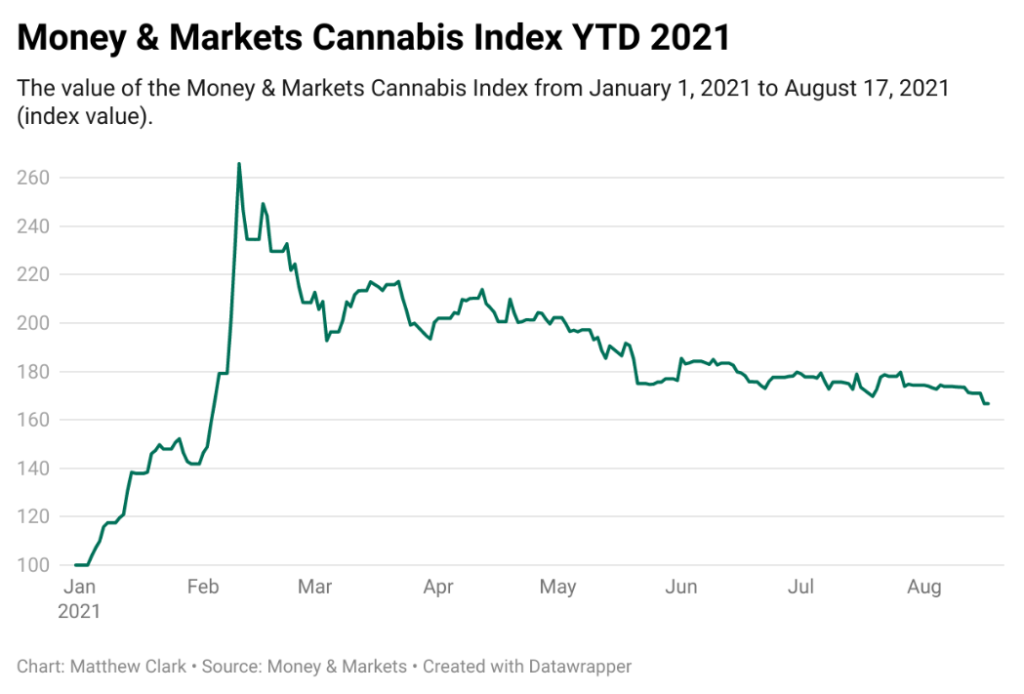

Now, let’s talk about the Money & Markets Cannabis Index.

The index tracks cannabis companies with market caps over $10 million.

Right now, 225 companies meet the criteria of market capitalization and being listed on either a major U.S. exchange or over the counter. I’ll reconstitute the list periodically.

Last week, the index had a value of around 173.6 — a slight jump from the previous week.

When I ran the index this morning, that value was 166.7 — indicating some resistance in the broader market.

As you can see in the chart, the entire cannabis market has been relatively flat during the summer.

It experienced strong upward movement at the beginning of the year … when the discussion of cannabis legalization first started … but started to fall after that once that conversation cooled.

This index gives you, a cannabis investor, a different look at how the broader cannabis market is performing from one day to the next.

I will update this index and let you know its performance every week here in the Marijuana Market Update.

YouTube “Join” Feature

We offer members exclusive content, including:

- Interviews with cannabis insiders.

- Blog posts, stock analysis and company breakdowns.

- More content related to our Cannabis Watchlist.

- Monthly live chats with me, where we’ll discuss cannabis stocks, the cannabis sector and much more.

I even unveiled another tool you can use to help point you in the right direction for cannabis stock investments.

Just click “Join” on our YouTube page to find out what you can access by joining.

If you have a cannabis stock you’d like me to look at, email me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, and our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.