According to the U.S. Department of Labor, the unemployment rate in the U.S. is 3.5% — which sounds good.

However, at the end of August, there were still 10.1 million job openings across the country.

Hiring is solid, but there are still plenty of open jobs on the market.

In 2020, American businesses spent $23.4 billion on outside professional staffing agencies to find qualified workers.

By 2024, the U.S. Census Bureau projects an increase of 16% to $27.1 billion!

That brings us to today’s Power Stock: professional and technical staffing agency Kforce Inc. (Nasdaq: KFRC).

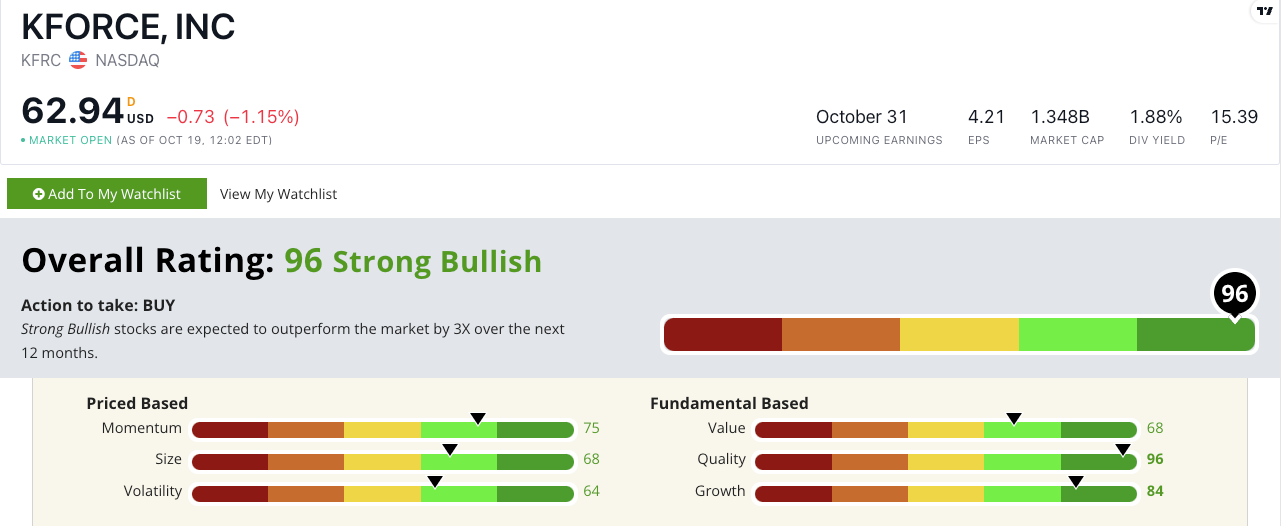

KFRC’s Stock Power Ratings in October 2022.

Kforce specializes in finding qualified workers for technology, finance and accounting firms.

KFRC stock scores a “Strong Bullish” 96 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

KFRC Stock: Strong Momentum + Outstanding Fundamentals

KFRC had a solid second quarter.

Highlights include:

- Revenue for the quarter was $436.5 million — an 8.2% year-over-year jump.

- Its gross profit margin increased 50 basis points from the same time a year ago!

Those sales numbers show why KFRC scores an 84 on our growth factor.

KFRC is also a high-quality stock.

Its return on equity is 43.8%. The professional services industry average, on the other hand, is a lackluster 9.7% — meaning KFRC knows how to turn a consistent profit.

For value, KFRC’s price-to-sales ratio is nearly three times lower than the industry average, telling me it is a stronger value stock than its peers.

It’s been a rough year for KFRC — the stock is down 1.2% after climbing higher to start 2022.

Since hitting a 52-week low at the end of August 2022, the stock has rebounded more than 16%!

And that’s why Kforce stock scores a 96 overall in the system.

We’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The national unemployment rate remains low.

Despite that, employers are still on the lookout for qualified employees to fill jobs.

This stock shows you how we can use our powerful Stock Power Ratings system to highlight companies in Stock Power Daily that are outperforming while the rest of the market sinks.

As a leader in the staffing industry, you can see why KFRC is a notable potential addition to your portfolio!

Stay Tuned: Copper Mining Stock to Beat the Bear Market

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a copper mining stock that rates a 99 on our value factor — making it a bear market bargain.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.