Adam O’Dell and I aren’t hiding our bullishness on energy, commodities and raw materials in general. It’s been a major theme in our investing service, Green Zone Fortunes.

Today, let’s see if that sentiment on energy carries over into the world of dividend stocks.

Even before the COVID-19 market rout, energy stocks were some of the highest yielding dividend stocks you could buy. But considering most energy stocks are still well below pre-COVID-19 levels, the yields are significantly higher today than they were before the pandemic.

Case in point: Kinder Morgan Inc. (NYSE: KMI).

Kinder Morgan is primarily a natural gas pipeline company. But it also transports gasoline, crude oil and other energy products. It’s one of the largest pipeline companies globally, with over 83,000 miles of pipelines spread across North America. Approximately 40% of all natural gas consumed in the United States flows through Kinder Morgan pipelines.

Kinder Morgan is not a master limited partnership (MLP). It’s a corporation, which means it pays regular, ordinary dividends and doesn’t generate annoying K1 tax forms.

To say it’s been a rough couple of years for KMI would be an understatement. In early 2015, Kinder Morgan’s share price topped out just shy of $45. But then, the energy market collapsed, taking KMI’s share price with it. Wall Street became uncomfortable with the level of debt the company was carrying. Before the dust settled, Kinder Morgan was forced to cut its dividend and use the excess cash to pay down its debt load.

It wasn’t fun to live through. But today, Kinder Morgan is a leaner, lower-risk and more sober operator that is less concerned with growth at all cost and more focused on delivering long-term returns to investors. At today’s price of around $16 per share, the yield is a very attractive 6.4%. Yields that high are not easy to come by in this market.

Why KMI’s Green Zone Rating Is Low

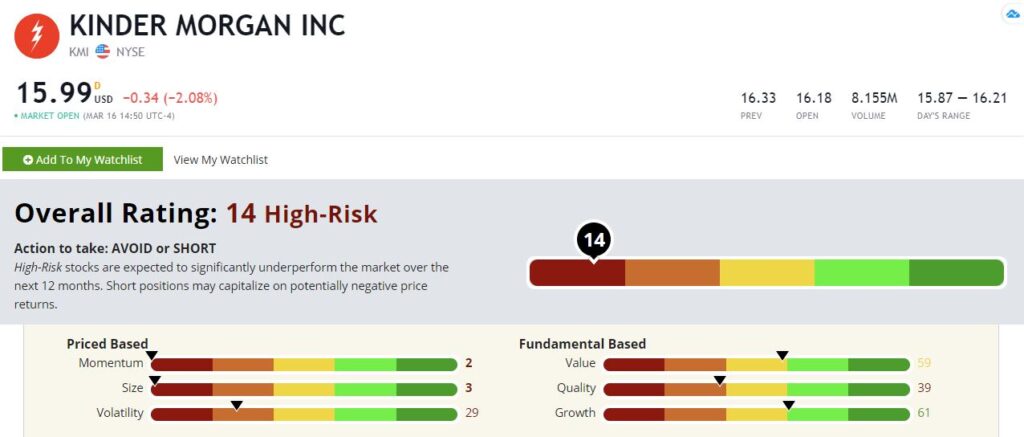

Kinder Morgan does not rate well in our Green Zone Ratings model. It scores a 14 out of 100. It’s important to look deeper here. Energy has been in a bear market for nearly a decade, as have most commodities.

Kinder Morgan Inc.’s Green Zone Rating on March 16, 2021.

Adam and I believe that we are in the early stages of a major bull market in energy commodities, and the results aren’t likely to show up in our rating system until the bull market is well underway. We trust our model, but we also understand that it pulls historical data. Sometimes the historical record is not indicative of the present and future.

Let’s dig a little deeper into KMI’s Green Zone Rating.

Growth — It’s telling that Kinder Morgan rates pretty darn well on growth, with a score of 61. KMI’s stock price has been battered since 2015, but its underlying business is strong and has grown at a healthy clip. For all the talk about solar and wind energy, our economy still mostly runs on natural gas. And Kinder Morgan has delivered the goods.

Value — The stock rates well on value at a 59. It’s also worth noting that KMI will always rate fairly low on some sub-metrics, such as the price-to-earnings ratio because the company’s official earnings tend to be artificially depressed by non-cash expenses like depreciation. I would argue that KMI is cheaper than its score suggests because of this issue.

Quality — KMI doesn’t rate well based on quality at 39. Pipeline companies tend to carry a lot of debt, and Kinder Morgan is no exception. Even after its deleveraging, the company carried $35 billion in debt. Furthermore, official earnings numbers, which affect the profitability ratios driving our quality rating, tend to be permanently depressed by high depreciation charges. So, Kinder Morgan will always likely be a little handicapped on this metric. It comes with the industry turf.

Volatility — Kinder Morgan also scores low based on volatility, rating a 29. This is what you get after six years of bear market conditions. Kinder’s underlying business is anything but volatile. Its pipeline operations are bond-like in their low-drama predictability. Nevertheless, the stock has been volatile since 2015. There’s no escaping that.

Size — This is a large company with a market cap of over $36 billion. So, we’re not going to get much of a small-cap bounce here. Kinder Morgan rates a 3 based on size.

Momentum — And finally, we get to momentum. It is what it is. Kinder Morgan has had an awful run over the past six years, and it rates an abysmal 2 based on momentum. This could rise as investors rotate into more downtrodden stocks.

Bottom line: I would argue that Kinder Morgan is a reliable dividend payer, and the stock’s financial strength is certainly better than its raw score would suggest. I believe KMI is a worthy addition to a diversified dividend stock portfolio.

That said, if you’re looking for solid total returns, you can probably do better in the energy space. In the last issue of Green Zone Fortunes, Adam and I recommend two energy stocks we expect to absolutely beat the pants off the market in the coming years.

Click here to find out how to get our two highest-conviction energy stock selections that we just released to our subscribers yesterday.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.