As I’ve mentioned in my previous articles, I am a born and raised South Floridian.

That means I am a self-proclaimed Publix snob.

The one thing that stands out for Publix compared to other grocers for me is its subs (“Pub subs” for those who know).

There is no competition, or so I thought.

When I visited a relative in Virginia, she told me I needed to try a Kroger sub.

So she took me to her local grocery store and bought me a sandwich.

To my dismay, Kroger made a decent sub. Maybe even better than Publix.

Now, the market for a decent grocery store sub for me had grown exponentially.

So I had to learn more about the Midwestern-based grocery chain.

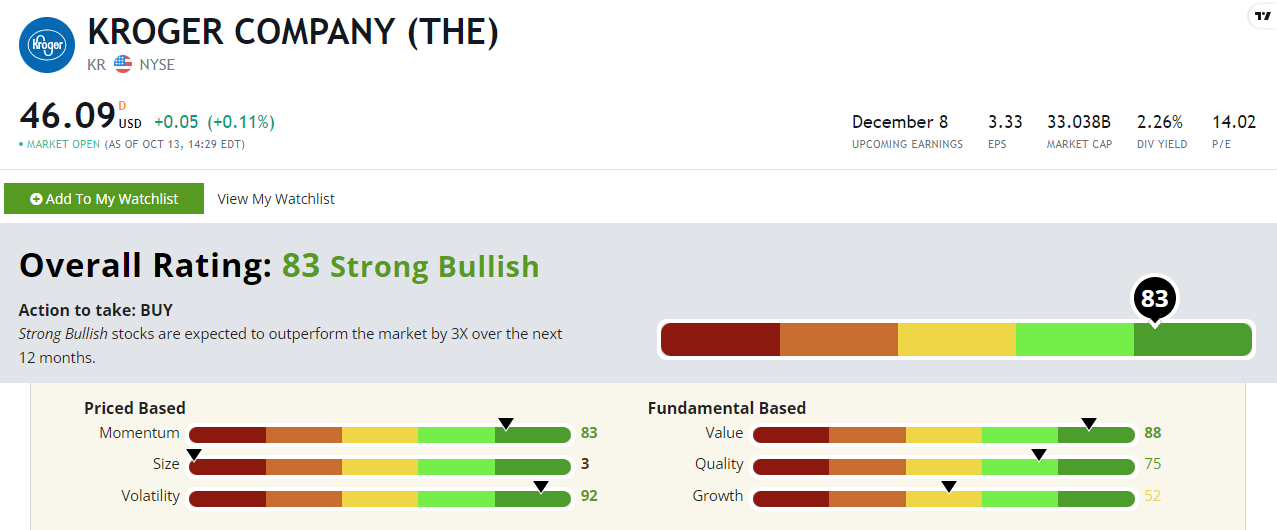

Kroger Co. (NYSE: KR) rates a “Strong Bullish” 83 out of 100 on our proprietary Stock Power Ratings system.

Let’s find out more.

Kroger’s Latest Merger

Kroger is a massive supermarket operator in the U.S., and its popularity is set to grow even more with a recent merger announcement.

As a supermarket chain that has expanded across much of the U.S., Kroger has a field full of competition.

One of its known rivals in the Midwest is the beloved grocery chain Albertsons.

In a groundbreaking move, Kroger just announced it would acquire Albertsons to create a new grocery giant.

The merger of these two companies would increase Kroger’s reach to about 5,000 stores across the U.S. KR’s annual revenue would jump to more than $200 billion.

The news sent both stocks higher. Albertsons shares soared almost 12% on October 13, while shares of Kroger climbed 1%.

Kroger hopes the merger can put it in the front-runner position against its head competitor, Walmart, the largest grocery store in the U.S.

But it’s not all good news.

Critics have stated the deal could lead to higher prices for shoppers, which could drive them to less expensive competitors on the market.

And the deal isn’t set in stone either. When two massive companies in the same industry announce a merger, the word “monopoly” comes up often. This acquisition could face its own line of antitrust battles.

But until then, we can focus on KR stock’s current ratings.

Let’s take a closer look at how it stands in our proprietary Stock Power Ratings system.

Kroger’s Stock Power Ratings Breakdown and Momentum

Kroger rates a “Strong Bullish” 83 out of 100 on our Stock Power Ratings system.

KR’s Stock Power Ratings in October 2022.

It rates in the green on four out of our six metrics.

A high value (88) and quality score (75) are something to note.

This means the stock is undervalued and is set to outperform its peers.

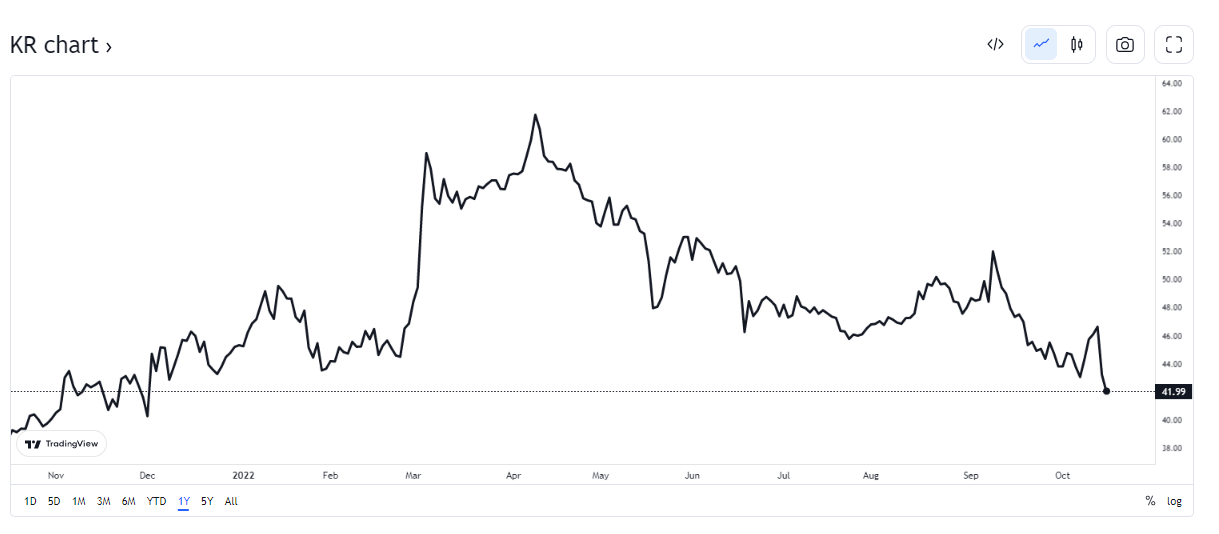

Let’s zoom in on momentum to see how Kroger’s stock performed over the last 52 weeks.

Source: Tradingview.

Since hitting its 52-week low of $38.22, Kroger‘s stock had a solid upward trajectory heading into the summer months.

It has sold off a bit during the broader market downturn, but its current stock price is about 10% higher than its 52-week low.

This explains why Kroger stock rates an 83 on our momentum factor.

The Bottom Line

Kroger scores a “Strong Bullish” 83 out of 100 on our Stock Power Ratings system.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock that scores 80 or above on our system and tells you why you should add it to your portfolio — for free!