One lesson my father always stressed to us growing up was that “life owes you nothing.”

And he wasn’t just talking the talk, either…

Instead of doling out an allowance, Dad showed me how to mow the lawn. When I was done, he put $10 in my hand. Then he nodded to the neighbors’ house and suggested they might be in need of my services.

Even from that early age, Dad showed us how to earn what we were owed, not just expect a handout.

The first $1,000 I ever made was $10 at a time … 100 weekly cuts for three neighbors, the summer I turned 13. It was the sweetest $1,000 I’ve ever made.

Because it took hard work … and there are no shortcuts in mowing lawns. So every one of those dollars meant something to me.

I know for a fact that many of my readers feel the same way about the hard-earned savings that funded their investment portfolio. Very few of you had it “easy” when it came to growing your wealth, and you take your investing decisions very seriously as a result.

And that kind of attitude, approach and enthusiasm can make all the difference when it comes to pinpointing the market’s top investments… I mention all this because the “easy way” — the same old mega-cap technology stocks in the Nasdaq 100 — was working throughout the first half of 2024. But now investors are starting to look elsewhere.

And this is when having an edge and a way to analyze markets differently will pay off.

It all comes back to a stock selection system I’ve been using for the past two decades now … and started sharing with others just a few years ago.

Nearly three-quarters of a million open-minded investors, business owners and savers have used my system to invest outside the mainstream. Our studies show that my system has given these people the opportunity to beat the market by at least 3-to-1.

I call this system the Green Zone Power Ratings system. And it’s the single biggest contributor to market-beating gains I’ve ever seen.

The True Driver of Lasting Returns

At the end of the day, fundamental and technical factors drive returns. They always have. That’s why they’re the sole informant of my system.

The six factors I included in my Green Zone Power Ratings system are…

- Momentum: Stocks trending higher, faster than their peers, tend to outperform stocks that are moving higher at a slower rate (or trending down).

- Size: Smaller stocks tend to outperform larger stocks.

- Volatility: Low-volatility stocks tend to outperform high-volatility stocks.

- Value: Stocks that trade at low valuations tend to outperform stocks that trade for high valuations.

- Quality: Companies that exhibit certain “quality” characteristics — such as healthy balance sheets and persistently strong profit margins — tend to outperform the stocks of lesser-quality companies.

- Growth: Companies that are growing revenues, earnings and cash flow at higher rates tend to outperform the stocks of slower-growing companies.

All told, my system considers 75 individual metrics, each of which falls into one of these six “factors.” Academic research and practitioner results have proven over decades that these are persistent drivers of market-beating stock returns.

This rating system gives me, my team and our community of investors an immensely powerful tool…

If we’re curious whether a stock is “cheap” or “expensive,” we can quickly check my system and see the stock’s value rating.

If you want to judge how fast a company is growing, you can easily check its growth rating.

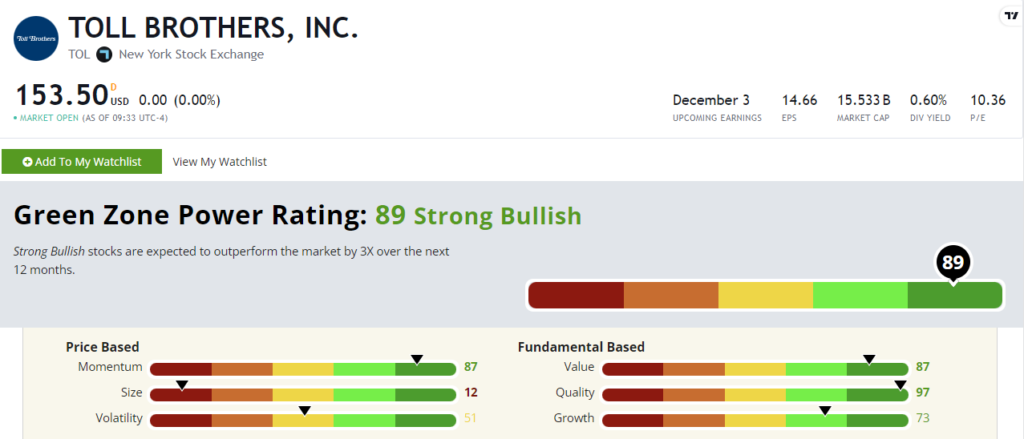

Here’s what that looks like, with highly rated stock Toll Brothers, Inc (NYSE: TOL)…

The Green Zone Power Ratings system gives ratings between 0 and 100 for each of the six return-driving factors, as well as an overall rating.

As you can see above, TOL rates very high, with an overall rating of 89 out of 100.

It’s lowest factor rating is on size. It earns 19 out of 100 because TOL is on the bigger side, with a market cap of more than $15 billion.

But otherwise, TOL rates good to great on the other five return-driving factors…

- 87 on Momentum.

- 51 on Volatility.

- 87 on Value.

- 97 on Quality.

- 73 on Growth.

But you might be asking…

How is it that TOL can be a “momentum” stock…

And a “value” stock…

And a “growth” stock?!

This is one of the biggest misconceptions about investing … the idea that a stock can only be classified as one thing — either a “value” stock or a “growth” stock … a “momentum” stock or a “low-volatility” stock. Nothing could be further from the truth.

There are stocks out there that only rate highly on one of the six return-driving factors my system considers.

For instance, a stock that trades at a low price-to-earnings ratio and thus is a good “value” stock … but otherwise is large, volatile, not growing revenues and is trending downward.

A stock like that may earn a high value rating on my system but would be rated quite low overall.

Those are not the stocks my team and I are looking for!

Instead, we leverage my system to find “well-rounded” stocks that rate well on four, five or all six factors and thus earn a high overall rating. Specifically, any stock that rates 80 or above overall earns our “Strong Bullish” label.

My research shows that stocks rating 81 or higher on my system have historically gone on to beat the overall market’s return by 3X!

And as it turns out, TOL has returned more than 50% year to date … more than double the Nasdaq 100 tech basket.

In other words, when you can find a company and stock that’s beating the market on each of the return-driving factors … that’s the stock you want to get into!

If you want full access to my system, click here to learn how to join Green Zone Fortunes.

I’m sending out my latest monthly recommendation this week, so it’s a perfect time to join up.

Regards,

Adam O’Dell

Chief Investment Strategist, Money & Markets