As a South Carolina business reporter, I got to watch robots assemble cars at the BMW manufacturing plant in Greenville.

Robots worked hand-in-hand with people to assemble every model of the X Series SUVs that the plant produced.

We’re just beginning to see how robots will transform assembly lines worldwide.

As you can see in the chart above, the global industrial robotics market is skyrocketing.

By 2028, the market for robots will hit $165 billion, increasing almost 200% from 2020.

The Power Stock that will benefit from this growth is Lincoln Electric Holdings Inc. (Nasdaq: LECO).

Lincoln Electric is known for its welding products.

However, the company has entered the robotics sector by creating a robotic welder similar to this one:

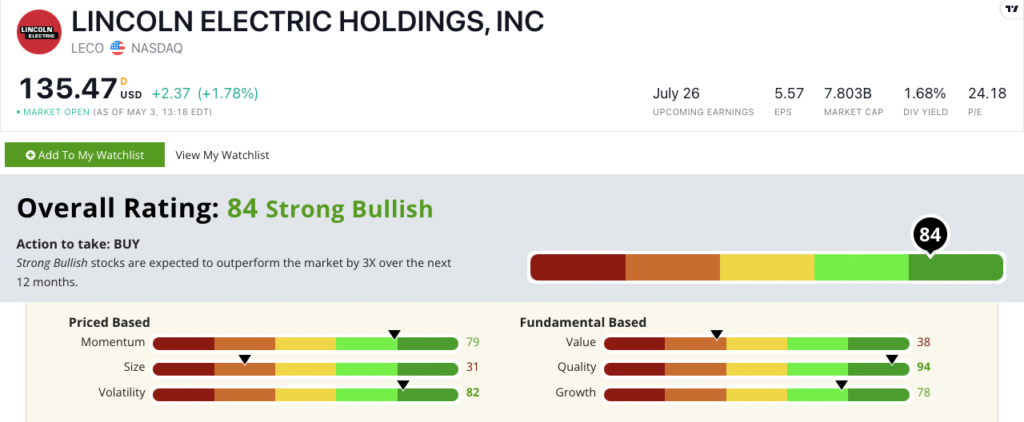

LECO scores a “Strong Bullish” 84 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

LECO Stock: Strong Quality + Low Volatility

When I was digging into LECO, two items stood out to me:

- In the first quarter of 2022, LECO reported $154 million in sales from its automation and robotic products. It forecasts more than $600 million by the end of the year.

- The company grew its net sales by 21.6% on a year-over-year basis in 2021, setting a company record.

LECO is a strong quality stock … rating in the top 6% on that metric of all the stocks in our universe!

Its returns on assets, equity and investments are all double-digits — including an excellent 39.4% return on equity.

This crushes the broader machinery manufacturing sector’s single-digit returns.

On top of its one-year annual earnings per share growth rate of 34.5%, the company’s quarter-over-quarter growth rate is an impressive 73.1%!

LECO grew its annual sales by 21.6% in 2021. It started this year strong with a 22.2% increase in the first quarter.

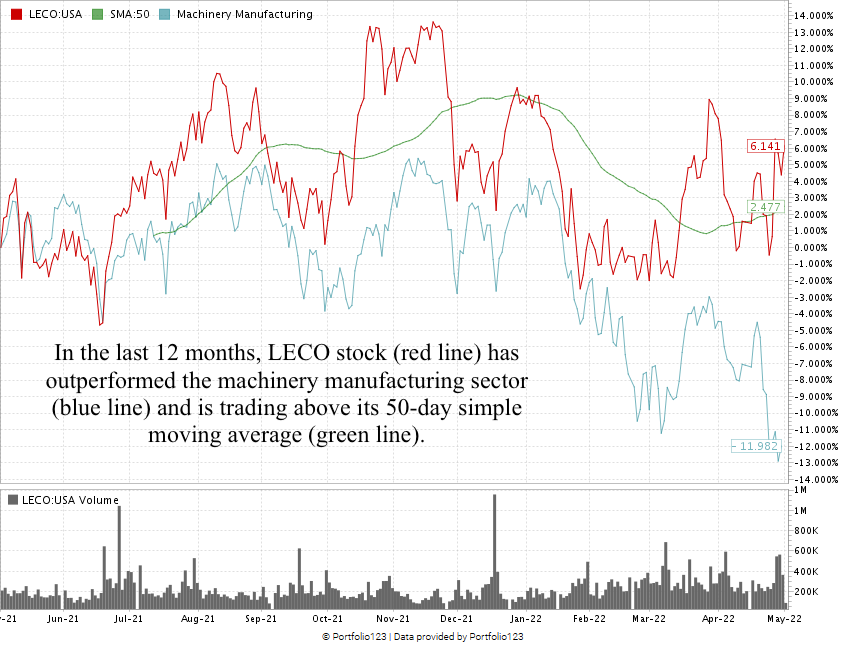

LECO stock hit its 52-week high of $144.88 in November 2021, as you can see in the stock chart above.

Since then, it has moved down due to market headwinds.

Now, however, we can see the stock testing resistance at $135, and it seems poised to break through that in short order.

Over the last 12 months, LECO is up 6.1%, while the broader machinery manufacturing industry is down 12%.

Lincoln Electric stock scores a terrific 84 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Forecasts for its robotics and automation division are strong, which points to solid growth in the future.

Bonus: LECO’s forward dividend yield is 1.68%. It will pay us $2.24 per share, per year, to own the stock.

Stay Tuned: Industrial REIT With Outstanding Technicals

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a real estate investment trust that manages about 5.2 million square feet of space across several states!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets