Hold on to your next-day delivery packages. That’s because UPS is rolling out sleek new electric trucks that look like they’re making a delivery from the future.

The Global X Lithium and Battery ETF (LIT) is the easiest way to stake a position in this tsunami.

UPS says the trucks have a longer range than other delivery vehicles. In fact, they can travel about 150 miles on a single charge. As with all electric vehicles, they have zero emissions. And they show that the EV world is shifting into higher gear. This, in turn, will open up the throttle on global demand for lithium.

Image credit: Engadget

UPS already has more than 300 electric vehicles and 700 hybrids in the U.S. and Europe. It’s also ordered 125 of Tesla’s new semi-trailer trucks.

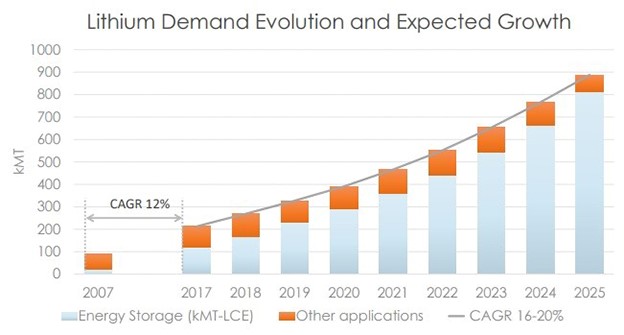

And it’s not alone. Lithium’s megatrend is booming, fueled by both demand in energy storage and in batteries for electric vehicles (EVs).

Bloomberg New Energy Finance reports that global energy storage should “double six times” from 2017 to 2030 …

… and by 2025, EVs will be 11% of all car sales. 28% by 2030!

And all those EVs need lithium in their batteries.

In fact, the advanced, high-density lithium-ion batteries that will dominate the market by 2022 will require several times more lithium than today’s batteries.

Plus, “next-gen” lithium-sulfur batteries, which debut in 2023, will need even more!

In spite of all this, lithium was one of the big disappointments last year. It peaked early and tumbled downhill, pushed by fears that production would exceed demand.

Those fears turned out to be baseless.

Prices for high-grade lithium are now firming up, and that means lithium miners are at bargain-basement levels.

The Global X Lithium and Battery ETF (LIT) is the easiest way to stake a position in this tsunami.

It’s coiling up now after bottoming in December. And the sky’s the limit!

One miner I just recommended to my Wealth Supercycle readers is exquisitely poised to ride this wave.

It’s trading way off its 2017 highs, despite the fact it has more buyers than it has lithium to sell — and its earnings rose 23% last year.

In fact, when the company reported earnings in February, it knocked the cover off the ball, posting a profit of $129.6 million, compared with a loss of $218.4 million a year ago.

Not only that …

It owns a slew of patents to protect its inventions for those next-gen batteries.

With a strong market for its product … and the fact that this company is a dividend-payer and -grower …

… It’s Full Speed Ahead!

The EV megatrend is real. The lithium supercycle is real.

Lithium demand IS going to crank into overdrive. And you’ll want to be in the driver’s seat when it takes off.

All the best,

Sean

P.S. It’s not just lithium on the launchpad. The next five years should be great for precious metals. At The Money Show Las Vegas, May 13-15 at Bally’s/Paris Resorts, I’ll explain why silver is poised for big gains. Click here to tell us you’re coming, and be sure to make time to see my other workshop, “Cannabis Picks for Maximum Profits.” And if you can’t make it, be sure to sign up for the livestream here. It’s free to attend in person or online.