Over five days in March, three U.S. banks failed, triggering a steep drop in bank stock prices.

While regulators provided swift action to prevent the mini-crisis from spreading, I’m not certain we’ve seen the last of bank failures this year.

Silicon Valley Bank failed because it mismanaged risk.

The bank took on massive deposits from tech startup firms. It then used those deposits to collateralize loans and invest in long-dated mortgage-backed securities when a strong inversion of the yield curve tightened its net interest margin.

In simple terms, SVB was very liberal in its lending and it backfired due to fast-rising interest rates and massive outflows of those startup deposits.

These runs on deposits spelled the demise of SVB and Signature Bank … over just five days … resulting in the second- and third-largest bank failures in U.S. history.

Let me tell you why the data points to more danger ahead.

How to Measure Bank Liquidity

One of the biggest ways banks earn money is by collecting interest on the loans they service.

The easiest way for banks to make more loans — thus, collect more interest and profit — is to increase deposits … giving them more money to loan.

That’s why the loan-to-deposit ratio is a fantastic way to analyze a bank’s health.

This measures the proportion of a bank’s total loans with its total deposits. The higher the ratio, the more risk the bank is taking on.

Why?

Because the less cash reserves a bank has … in this case, deposits … the harder it is to cover unexpected losses.

What you don’t want as a bank is a loan-to-deposit ratio greater than 100%. That means a bank is lending out more money than it has on hand. This is a massive risk and is similar to what happened to Silicon Valley Bank and Signature Bank.

The loan-to-deposit ratio also gives insight into two other important data points: growth in loans and a drop in total deposits.

Bank Risk Remains High

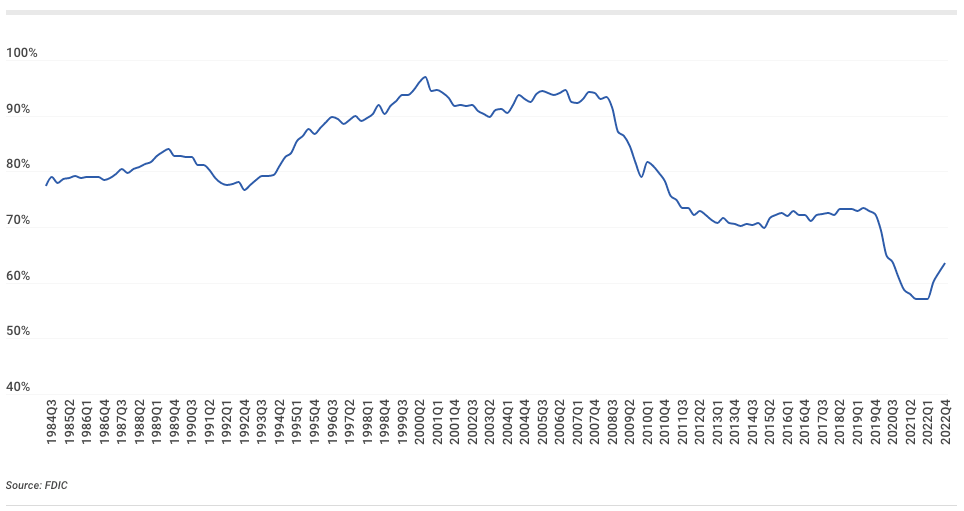

The latest data from the Federal Deposit Insurance Corporation (FDIC) tells us the average loan-to-deposit ratio for U.S. banks is on the rise again:

2023 Q1 Loan-to-Deposit Ratio Up

In the first quarter of 2023, the loan-to-deposit ratio average for U.S. banks was 65.2%, according to S&P Global Market Intelligence.

That is up from a ratio of 63.6% in the fourth quarter and 57% in first-quarter 2022.

In the 1980s through the early 1990s, the ratio was between 76% and 84%. The expansion of residential real estate loans leading up to the 2008 financial crisis pushed that average to as high as 97%.

Following the financial crisis, loan demand was curtailed and kept the ratio in the low 70% range through 2019.

Federal stimulus flooded the banking system during the COVID-19 pandemic and pushed the ratio below 60%.

Now, that ratio is back on the rise, meaning banks are exerting more risk in their liquidity. The trend was in when SVB and others failed earlier this year, and I’m curious to see where this ratio heads next.

Size Matters With Liquidity

If a bank has a loan-to-deposit ratio of more than 100%, there is a strong threat to that bank’s financial health.

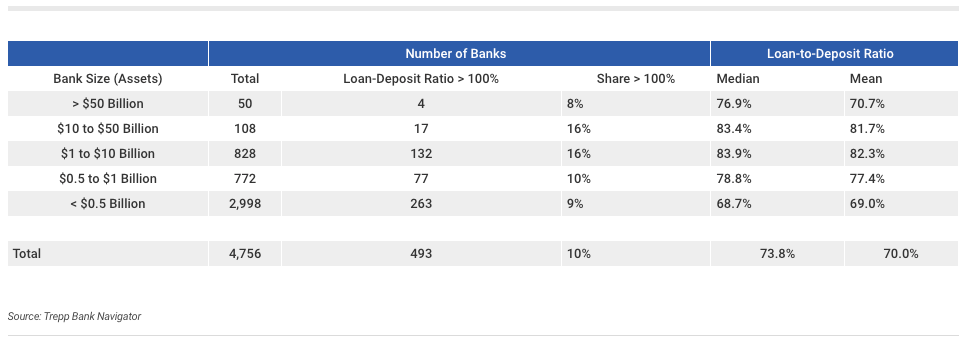

Recent figures from Trepp Bank Navigator suggest more banks than we realize are facing this kind of crisis:

10% of All U.S. Banks Are Off the Mark on Loans

Of the 4,756 banks under the umbrella of the FDIC, 493 of them had loan-to-deposit ratios greater than 100%. That’s almost 10% of all banks with the potential for liquidity issues.

Banks with assets between $1 billion and $10 billion or $10 billion and $50 billion have the greatest number of banks at risk (16% in both categories).

On the other side of the crisis, the largest U.S. banks have the fewest at-risk institutions based on the loan-to-deposit ratio.

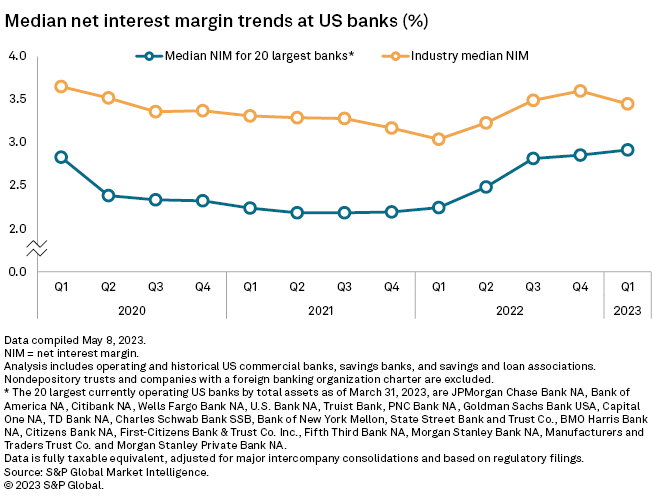

This liquidity issue is already taking a bite out of banks’ net interest margin — the comparison of net interest generated from loans and mortgages with interest paid on savings accounts and certificates of deposit:

In the first quarter of this year, the industry median net interest margin dropped 15 basis points to 3.45%.

Meanwhile, the 20 largest banks in the U.S. saw their net interest margin rise slightly in the quarter.

Bottom line: Bank deposit outflows continue to rise, as interest rate hikes and inflation fears are forcing many to move funds out of noninterest-bearing accounts into certificates of deposit and brokered deposits.

That’s putting more U.S. banks at risk of not being able to cover losses from events such as loan defaults.

Even as loan growth has slowed, banks remain at high risk because of these pressures.

And the loan-to-deposit ratio is likely to keep rising as a result … increasing the risk of bank failures like Silicon Valley Bank and Signature Bank.

Of course, our chief investment strategist, Adam O’Dell, has been tracking this crisis closely for months now, even before SVB and others crashed.

He’s curated a list of more than 280 financial stocks to avoid, including four bank stocks that he believes are at the greatest risk of collapsing next.

The best part is that he’s using an “off Wall Street” trade to profit, even as the share prices for these companies sink in the near future.

If you want to find out what four bank stocks Adam is targeting, click here before you miss your chance.

Stay Tuned: On Monday, I have another stock that you need to avoid in 2023. It’s a massive name that just reported abysmal quarterly numbers.

You’ll find this company across America, but I’ll tell you why it doesn’t deserve a spot in your portfolio in a couple of days.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets