Inflation’s at its highest level since 1981, but my local grocery store is still packed with customers buying food.

It’s more important than ever for stores to keep their shelves well-stocked.

The path from the warehouse to your house is critical, even!

And that’s where efficient logistics (i.e., transporting goods) comes into play.

Using Chief Investment Strategist Adam O’Dell’s proprietary Stock Power Ratings system, I found a “Strong Bullish” company that provides logistics support to companies in the U.S. and Canada:

- It just reported quarterly revenue of $460.9 million — a 94.9% increase over the same quarter a year ago.

- It’s only 9% off its recent high set in June.

- We expect it to beat the market by 3X over the next 12 to 24 months.

Here’s why the logistics stock I share with you today will continue its strong performance in the near- and long-term.

Logistics Market Expansion Continues Despite Market Woes

Logistics is the process companies use to get what we buy from the production line to our homes.

And this market is expanding steadily despite inflation and broad market headwinds:

The chart above shows the real and expected annual revenue of the North American logistics market through 2025.

Market data firm Statista reports annual revenue was $1 trillion in 2021. That’s expected to expand 20% to $1.2 trillion by 2025!

Bottom line: This kind of steady growth means logistics market leaders will bring in more profits for years to come.

Logistics Stock on the Rise: Radiant Logistics Inc.

With demand for goods rising, it is more important than ever that consumer staples like groceries get to shelves quickly.

Enter: Radiant Logistics Inc. (NYSE: RLGT).

Radiant transports goods via air, sea and land. It works with food and beverage, manufacturing and retail customers across North America.

Despite high inflation and a difficult market, RLGT’s annual revenue growth is strong:

Last year, RLGT recorded total annual revenue of $889.1 million.

By the end of this year, the company’s annual revenue is expected to jump to $1.4 billion — a 59.2% increase over 2021!

Now, let’s look at how this logistics leader’s stock has performed.

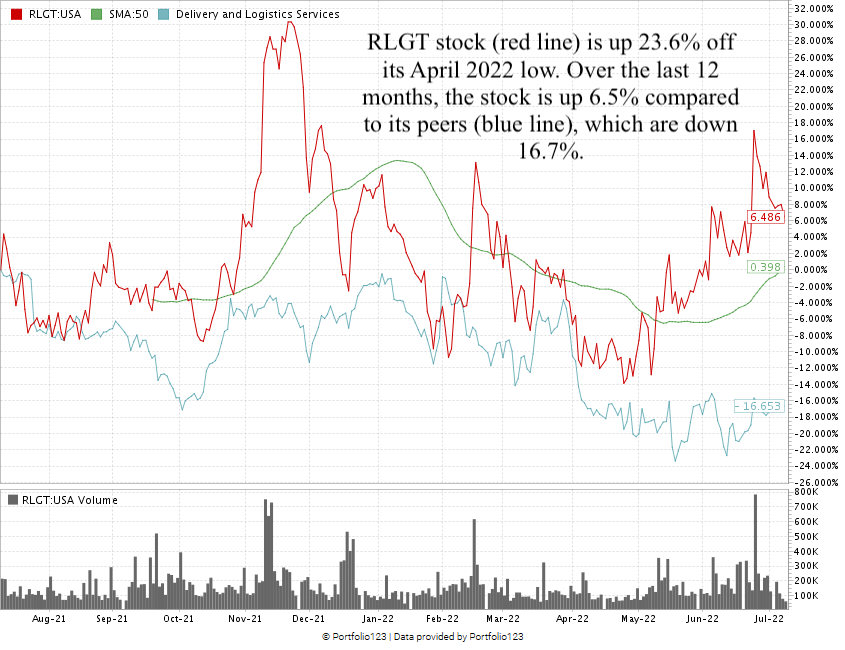

RGLT‘s Bounce off April 2022 Lows

In the last 12 months, RLGT stock is up 6.5%. The stock gained 23.6% from its 52-week low in April 2022 to its current price as I write.

It’s trading higher than its 50-day simple moving average — a bullish indicator for a stock.

And RLGT continues to beat its delivery and logistics service peers — down 16.7% over the same 12 months.

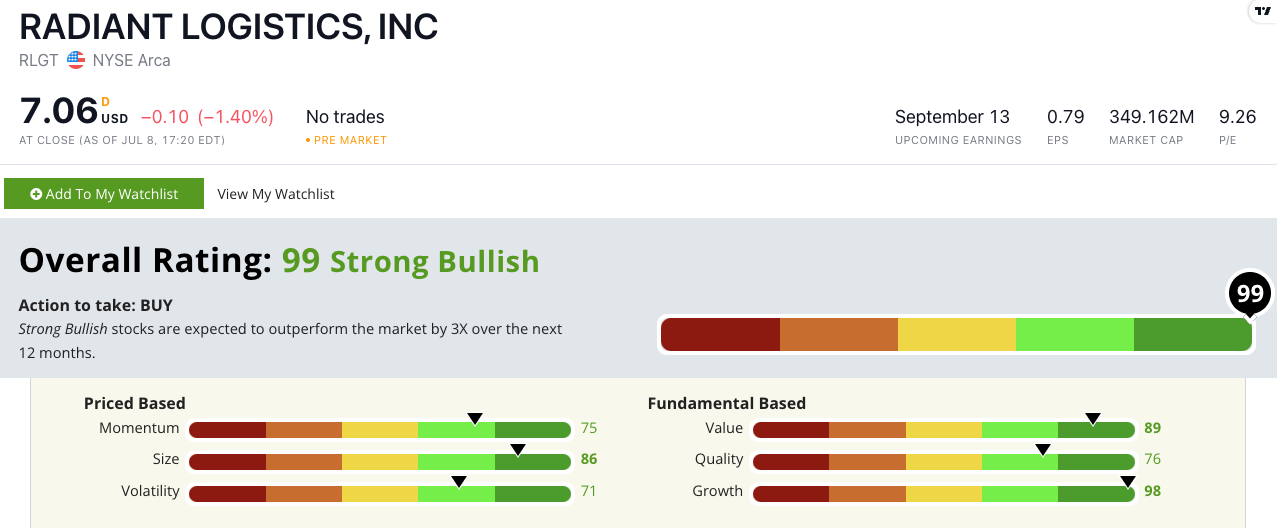

Radiant Logistics Inc. (RLGT) Stock Rating

Using Adam’s six-factor Stock Power Ratings system, Radiant Logistics Inc. stock scores a 99 overall.

That means we’re “Strong Bullish” on RLGT and expect it to beat the broader market by at least three times over the next 12 months.

Radiant Logistics Inc.’s Stock Power Rating on July 11, 2022.

RLGT rates in the green on all six of our factors:

- Growth — RLGT scores a 98 on growth with a one-year earnings-per-share growth rate of 117.2%. It also boasts 94.9% sales growth from its last quarter.

- Value — Radiant trades with a price-to-earnings ratio of 9.13, compared to its industry peers’ average of 13.47. Its price-to-sales ratio is 0.27 — 10 times lower than its peers’. It earns an 89 on value.

- Size — With a market cap of $349.1 million and a size rating of 86, RLGT is just the right size for us. All things considered, smaller companies tend to outperform their larger peers when they carry similar scores across our five other metrics.

- Quality — RLGT’s returns on assets, equity and investment are all higher than the averages in the delivery and logistics service industry. The company scores a 76 on quality.

- Momentum — Since this time a year ago, Radiant’s stock price is up more than 6%. RLGT scores a 75 on momentum.

- Volatility — Market headwinds pushed RLGT’s stock lower earlier this year, but it’s recorded a 23.6% run from its 52-week low in April to now. The stock scores a 71 on volatility.

Bottom line: Getting goods from the warehouse to your house is more important today than ever.

Companies need reliable transportation to fill grocery store shelves. They want to make sure product is ready for your table.

That’s why RLGT is a must for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Stock Power Podcast, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.