Editor’s Note: Adam is out on assignment today, but we won’t leave you hanging…

Since Adam’s Green Zone Power Rating system drives his analysis in What My System Says Today, we wanted to highlight how the six factors Adam uses help us find stocks that are set to outperform and adapt to the current market.

Investors have spent the last few months glued to their trading stations — poring over every new headline as they try to puzzle out President Trump’s next move…

Will he issue a raft of new tariffs?

What if he boosts key industries to drive investments even higher?

There’s no mistaking it: President Trump is an iconoclast. He’s an agent of change who’s setting out to transform America for a new generation.

But even with all that in mind, it’s important to remember that news flow is not the true driver of lasting, market-beating stock returns.

At the end of the day, fundamental and technical factors drive returns. They always have.

That’s why they’re the sole informant of my Green Zone Power Rating system…

Green Zone Factors for Maximizing Profit (in Any Market)

The six factors I included in my Green Zone Power Rating system are…

- Momentum: Stocks trending higher, faster than their peers, tend to outperform stocks that are moving higher at a slower rate (or trending down).

- Size: Smaller stocks tend to outperform larger stocks.

- Volatility: Low-volatility stocks tend to outperform high-volatility stocks.

- Value: Stocks that trade at low valuations tend to outperform stocks that trade for high valuations.

- Quality: Companies that exhibit certain “quality” characteristics — such as healthy balance sheets and persistently strong profit margins — tend to outperform the stocks of lesser-quality companies.

- Growth: Companies that are growing revenues, earnings and cash flow at higher rates tend to outperform the stocks of companies with slower growth.

All told, my system considers 75 individual metrics, each of which falls into one of these six “factors.” Research has proven over decades that these are persistent drivers of market-beating stock returns.

This rating system gives me, my team and our community of investors an immensely powerful tool…

If we’re curious whether a stock is “cheap” or “expensive,” we can quickly check my system and see the stock’s Value rating.

If you want to judge how fast a company is growing, you can easily check its Growth rating.

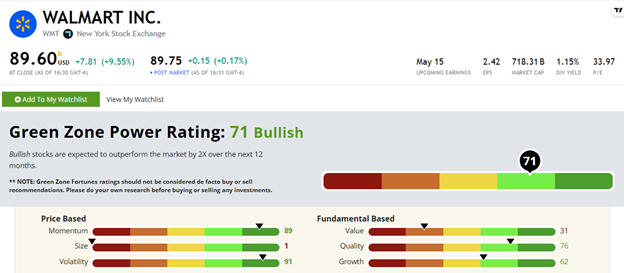

Here’s what that looks like with the big box retailer Walmart Inc. (WMT)…

WMT’s Green Zone Power Rating in April 2025.

My Green Zone Power Rating system gives ratings between 0 and 100 for each of the six return-driving factors and an overall rating.

As you can see above, WMT lands in the “Bullish” zone of my system.

Walmart’s lowest factor rating is on Size. It earns a 1 out of 100 because it is a massive retailer with a market cap north of $718 billion. It also has a low Value rating of 31, meaning it is trading at an expensive valuation compared to the broader market and its peers.

But otherwise, WMT rates “Bullish” on the other four factors…

- 89 on Momentum.

- 91 on Volatility.

- 76 on Quality.

- 62 on Growth.

And that’s helped Walmart’s stock price run almost 50% higher over the last 12 months!

But you might be asking…

How is it that WMT can be a “momentum” stock…

And a “quality” stock…

And a “growth” stock?!

This is one of the biggest misconceptions about investing … the idea that a stock can only be classified as one thing — either a “value” stock or a “growth” stock … a “momentum” stock or a “low-volatility” stock. Nothing could be further from the truth.

There are stocks out there that only rate highly on one of the six return-driving factors my system considers.

For instance, a stock that trades at a low price-to-earnings ratio is a good “value” … but otherwise, it is large, volatile, has no growth and is trending downward.

A stock like that may earn a high Value rating on my system but would be rated relatively low overall.

Those are not the stocks my team and I are looking for!

Instead, we leverage my system to find “well-rounded” stocks that rate well on four, five or all six factors and thus earn a high overall rating. Specifically, any stock that rates 80 or above overall earns our “Strong Bullish” label.

My research shows that stocks rating 81 or higher on my system have historically gone on to beat the overall market’s return by 3X!

In other words, when you can find a company and stock that’s beating the market on each of the return-driving factors … that’s the stock you want to get into!

However, that’s far from the only thing my system exposes…

It’s Not Just About Finding the Best Stocks…

My system, as you probably guessed, doesn’t just rate great stocks. It rates poor ones, too.

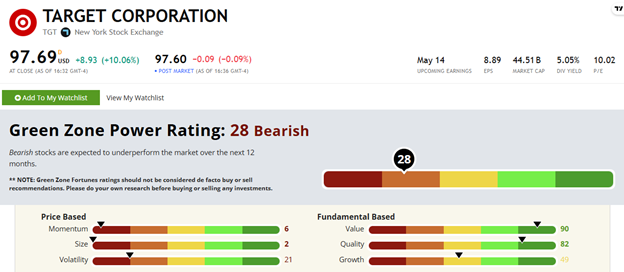

One of Walmart’s biggest competitors is firmly in the “Bearish” territory of my Green Zone Power Rating system.

TGT’s Green Zone Power Rating in April 2025.

Target Corp. (TGT) rates a Bearish 28 on the Green Zone Power Rating system. Stocks in this category are slated to underperform the broader market over the next 12 months.

While its fundamental factors look strong, TGT’s price-based factors are all deeply in the red.

This is a massive company whose stock price is volatile and trending in the wrong direction. It’s lost 43% over the last year.

Will Target’s stock stay “Bearish” forever? Not likely…

But my Green Zone Power Rating system says that this market is not favorable for TGT now, and it’s probably best to look elsewhere.

These are just two out of thousands of stocks my system tracks. My Green Zone Fortunes subscribers have full access to my proprietary indicator … and that’s just one benefit they enjoy.

If you’d like to join them and start running your own stock screens, click here.

Otherwise, I hope you have a great rest of your week!

To good profits,

Editor, What My System Says Today