As I wrote yesterday, real estate investment trusts (REITs) are really struggling this year.

The sector was the worst-performing in the S&P 500 last week. And in a year that has seen the index rise by about 17%, REITS are essentially flat in 2025, dead money.

Why are REITs having such a bad time? Well, there are a couple of core reasons…

First, the AI economy is booming. That’s where the explosive growth has been, and that’s what has captured investors’ attention. Rental real estate just isn’t all that interesting in a world where reality looks more and more like science fiction by the day.

Adding to this, sticky inflation makes it harder for the Federal Reserve to aggressively cut interest rates. REITs are often used as bond substitutes by many investors.

Falling interest rates boost REIT prices, and vice versa. So, when we see Fed Chair Jerome Powell insist that further rate cuts are by no means a foregone conclusion, that takes away a major short-term catalyst.

And finally, the brick-and-mortar economy has yet to fully right-size after the pandemic made offices and physical retail space less critical for business success. That shift created an overhang in many markets that has taken time to dissipate.

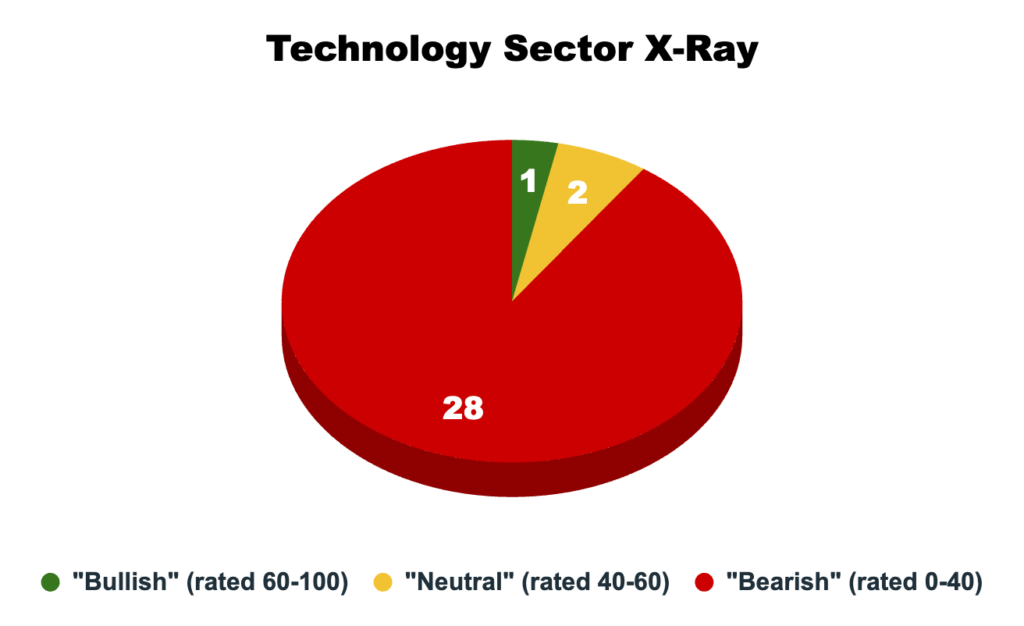

Not surprisingly, REITs as a whole rate exceptionally poorly on my Green Zone Power Ratings system. Of the 31 real estate stocks in the S&P 500, 28 rate as bearish. Two rate as neutral, and only one solitary REIT rates as bullish.

Of course, as I mentioned yesterday, REITs also have quirky accounting that tends to depress their Green Zone rating. Specifically, their high debt levels (most real estate is leveraged) and high non-cash expenses, such as depreciation, tend to depress their quality, value, and growth factor scores.

So, keeping all of that in mind, might there be a few hidden gems in the real estate sector?

Let’s do a proper sector “X-ray” to check.

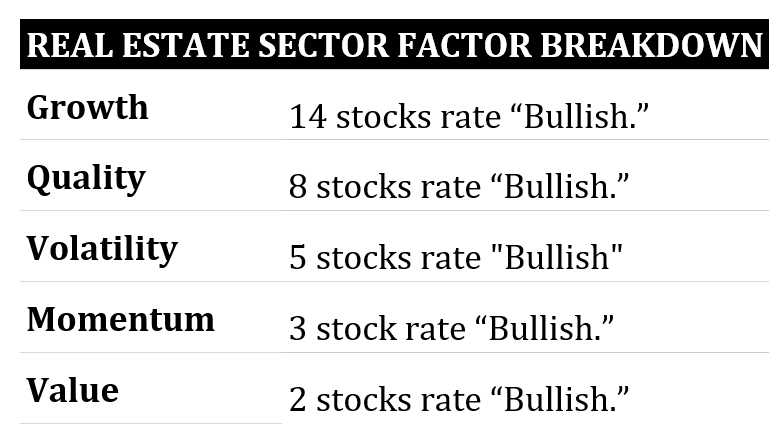

Factor Breakdown of Real Estate Sector

A couple of observations right off the bat…

Quirky REIT accounting can obscure the fundamental factors – growth, value, and quality – but the technical factors are straightforward. The momentum and volatility scores are functions of price and volume action in the stock. There’s nothing quirky or different there. The numbers are the numbers regardless of the sector.

It’s notable that only three real estate stocks out of 31 rate as bullish on the momentum factor, and only five rate as bullish on the volatility factor. In a choppy and volatile stock market, real estate stocks have been choppier and more volatile than most of the rest of the market.

It’s been a rough market for REITs, and there’s really no sugarcoating that.

Still, the stock market is a market of stocks, and not all real estate is the same. REITs are a diversified lot that can include everything from apartments and office buildings to data centers and cellular towers.

Let’s dig a little deeper…

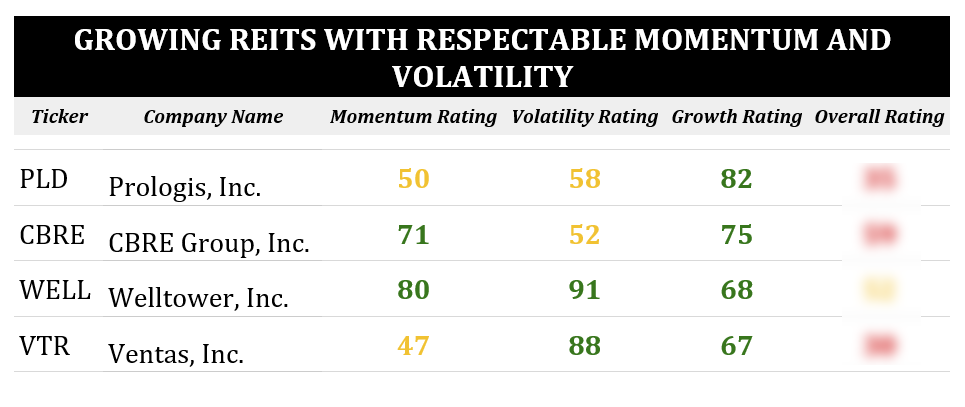

I screened for all real estate stocks that received a bullish rating (60 or higher) on their growth factor. Ultimately, we aim to support healthy landlords with thriving businesses. I then further limited it to REITs that had momentum and volatility factor ratings that were at least neutral.

In other words, we’re looking for growing real estate firms with tolerable volatility that are, at a minimum, not the proverbial falling knives.

This narrowed our search down to four names:

CBRE Group (CBRE) isn’t a REIT. It’s a real estate management and investment firm. We’ll set this one aside and focus on the remaining three REITs.

Prologis (PLD) is one of the greatest success stories in the history of traded REITs. It was an early mover in the “Amazon.com economy” and has grown into the dominant logistics and e-commerce REIT. In a sector known for its stodgy income plays, Prologis has been a true growth dynamo, and it sports a “Strong Bullish” rating of 82 on its growth factor. It’s also solidly middle of the pack on its momentum and volatility scores. The shares are up about 17% this year and have been trending higher since April. They yield about 3.3% in dividends.

Welltower (WELL) and Ventas (VTR) both specialize in senior living and elder care properties, so it’s not surprising to see them boasting bullish growth factor ratings. America is graying, and this trend will only accelerate as the Baby Boomers advance into their golden years. The largest cohort of Boomers are still in their mid-60s, so the senior living economy should enjoy a long runway for growth.

Both Welltower and Ventas also rate as “Strong Bullish” on their volatility factors, and Welltower in particular rates a “Strong “Bullish 80 on its momentum factor.

If you’re looking to dabble in REITs, each of these three should give you a good starting point for additional research.

But there’s also a pretty massive “elephant in the room” for most investors that bears mentioning. I’m talking about the looming AI Stock Crash that my colleague Harry Dent is currently warning investors about.

Harry’s made a name for himself as one of the market’s most influential forecasters — predicting everything from the early 1990’s recession to the 2008 financial crash and beyond. But this promises to be his biggest prediction yet, potentially making a fortune for those lucky few investors who hear and heed his advice.

I’ve scheduled a special LIVE broadcast for tomorrow afternoon to share Harry’s urgent warning with Money & Markets readers. Click HERE to reserve your spot and make sure you don’t miss out on his critical and potentially life-changing insights.

I’ll send you an email as soon as we go live.

To good profits,

Editor, What My System Says Today