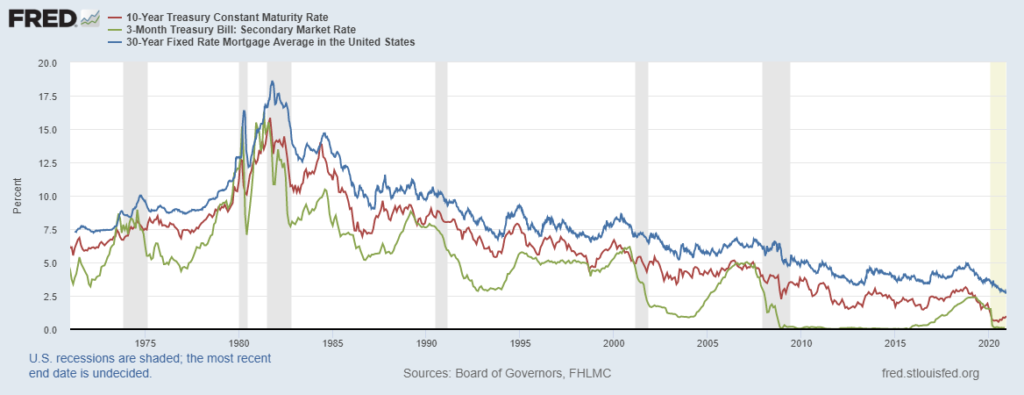

Over the past fifty years, interest rates rose and fell. That could be said of any 50 years, but the peaks and troughs of the last half-century might be telling us something about the next.

As shown in the chart below, long and short-term rates peaked in 1981. At that time, 10-year Treasury notes offered a yield of 15.8%, while 3-month Treasury bills paid investors 16.3%. Consumers were paying 18.4% on 30-year mortgages.

Interest Rates Fell Over 50 Years

Source: Federal Reserve.

Low Interest Rates Could Foreshadow a Sluggish Economy

Low rates are both a problem and an opportunity. It all depends on your perspective.

Income investors have struggled with the problem of low rates while borrowers have enjoyed the benefits.

Looking ahead, economists are asking interesting questions about what low rates mean for the future.

In the 1980s, high rates preceded rapid economic growth. High rates may help propel growth. They also allow institutions with endowments, like universities and nonprofit institutions, to spend more.

Because safety is a priority, endowments allocate part of their portfolio to bonds. Many institutions use part of the income their portfolio generates to finance current operations.

With lower rates, their investment income will drop, and as it does, spending is likely to decline. Among other things, this means there could be less money for medical research from foundations and less money for programs helping the impoverished.

Universities may have trouble raising tuition to offset the lost income, forcing them to spend less on operations and research.

Reduced research could have a significant and adverse impact on the rate of economic growth in the future.

Thinking of interest rates as a leading indicator of economic growth presents a frightening picture for investors.

Low rates not only scare income investors now; they should scare long-term stock market investors who face low returns in a low-growth environment.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.