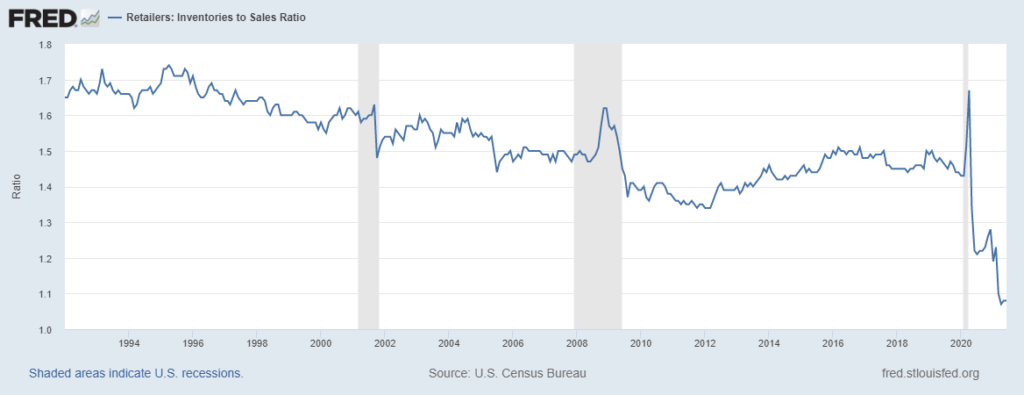

While many pieces of economic data indicate the economy is slowing, some data points to strength. Among those is the inventory-to-sales ratio for retailers.

This ratio shows the level of inventory in stores relative to sales. In theory, the lower the ratio is, the more efficient the company is at allocating capital since there isn’t money tied up in products that aren’t selling.

Taken to an extreme, the theoretically perfect value of the inventory-to-sales ratio is 1.0 since that means inventory levels precisely match sales. In reality, that indicates that retailers are missing out on sales since customers wouldn’t always find what they were looking for.

For most of the past decade, the ratio has been near 1.5. The ratio fell to a low of 1.07 in April before rebounding to 1.08 in the most recent report.

Inventory Is Lower Than Normal

Low Inventory Isn’t a Bad Thing

At the current level, it’s likely consumers aren’t finding everything they want in stores. There are reports that:

Grocery-store chains are still battling supply challenges that some executives said are as bad as what they saw in spring 2020 when hoarding left holes in stocks of some staples.

Industry executives say new problems are arising weekly, driven by shortages of labor and raw materials. Groceries, including frozen waffles and beverages, remain scarce as some food companies anticipate disruptions lasting into 2022. A wider range of products is running short and logistical challenges are compounding for many retailers.

While news stories and experience indicate there are shortages in stores, analysts like to explain why data deviates from its trend, and in this case, they blame auto dealers. Inventories at car dealerships are low, and that explains much of the decline in the ratio. That may be the case, but for investors, the cause of the low ratio isn’t important.

What is important is the fact that retailers will spend to rebuild inventories. This should boost manufacturers and shippers who will receive and process the orders from stores.

For now, the low inventory-to-sales ratio might be bullish for the economy.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking. Follow him on Twitter @MichaelCarrGuru.