Bear markets don’t provide a lot of places to hide.

That said, defensive low-volatility stocks can hold their own. In some cases, these companies make their investors money while the rest of the market melts down.

Volatility is one of the six factors that drive my Stock Power Ratings system. All else equal, I prefer less volatile stocks. At a minimum, I need to know that the volatility is “worth it” based on my expected returns.

Low-volatility stocks haven’t escaped the turbulence this year, but as a whole they’ve managed to avoid major losses. The Invesco S&P 500 Low Volatility ETF (NYSE: SPLV) is down around 5% year to date. To put that in perspective, the S&P 500 is down about 16%, and the Nasdaq is down around 25%!

So low-volatility investing, while not perfect, has helped investors preserve capital in a brutal year.

Of course, even within the world of boring low-volatility stocks, there are winners and losers. So let’s run SPLV’s holdings through my Stock Power Ratings system to see if there are any potential trades to help you weather the market storm.

SPLV: Low Volatility Is in the Name

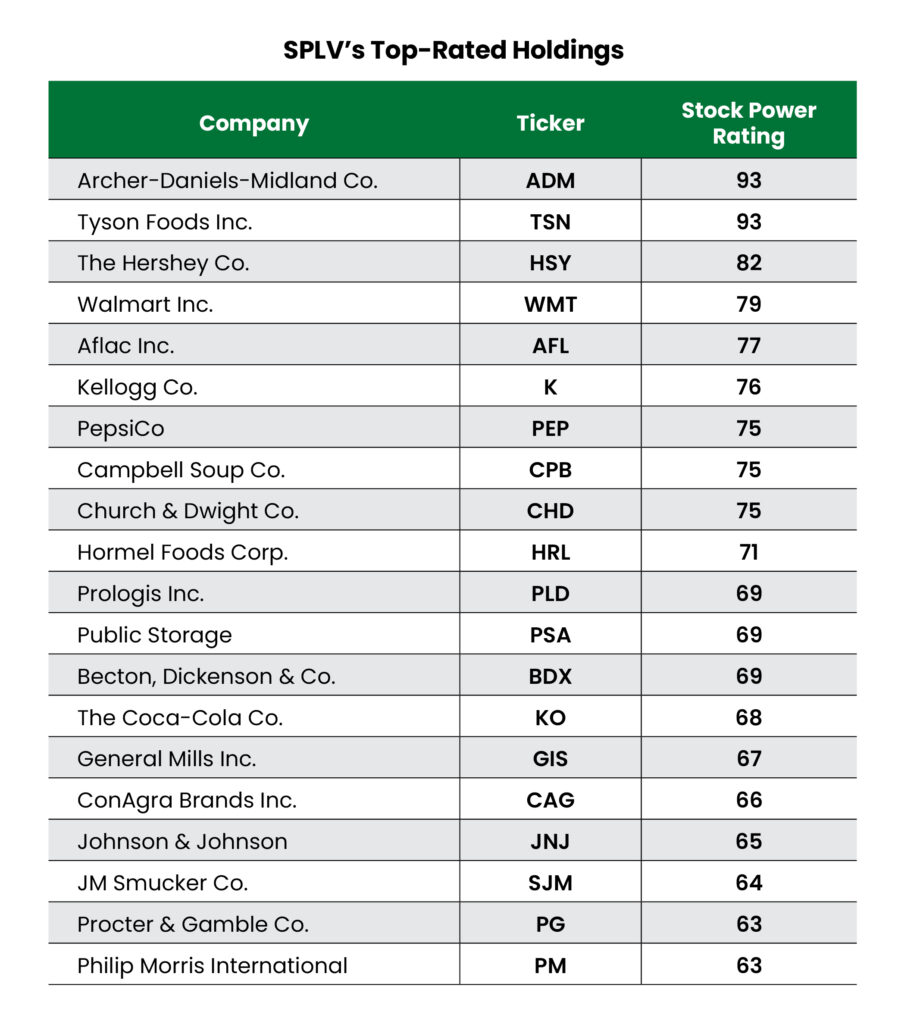

I ran a screen to look for SPLV holdings that rated “Bullish” (61 to 80 points) or “Strong Bullish” (81 or higher) on my ratings system.

For the sake of this particular analysis, I eliminated sectors that are more sensitive to interest rates, such as utilities and higher-yielding REITs. I then further narrowed the list down to 20 stocks with well-known brands and a history of being recession-resistant.

Call this the “low-volatility, recession-proof portfolio,” if you will.

If you’d like to do a deeper dive on any of these stocks, I’d encourage you to go on MoneyandMarkets.com. Look for this button on our site:

Just type in the tickers yourself and see a breakdown of the rating of each stock.

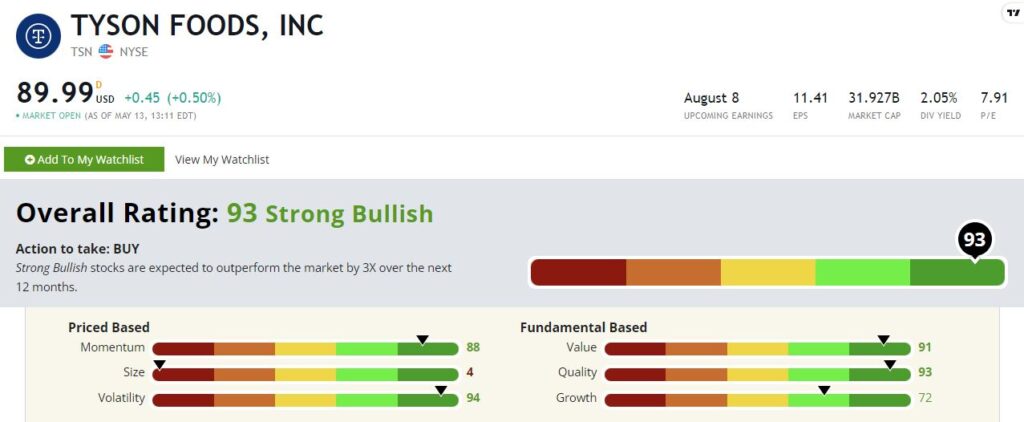

Just for grins, let’s look at the two highest-rated stocks on this list, Archer-Daniels-Midland Co. (NYSE: ADM) and Tyson Foods Inc. (NYSE: TSN). Shares for both are higher this year, though both are also off of their recent highs.

If You Want Low Volatility … Go Big

ADM and TSN both rate poorly on size, with factor ratings of just 2 and 4 respectively. But that’s fine. Even though the low-size score knocks some points off of the composite score, their size is a contributing factor to ADM’s and TSN’s lack of volatility.

ADM boasts exceptional ratings across all of our remaining factors, too:

This is a low-volatility and high-quality stock trading at a solid value and exhibiting strong momentum. What more do you want?

The story is similar with Tyson Foods:

Again, in Tyson we see a low-volatility stock with high-quality metrics trading at a good price. And you can see it’s beating the pants off the market in the chart above!

Bottom line: Should you put your entire portfolio in a basket of stocks like these? No, I wouldn’t.

I’m a trader and I’m always looking for that next great opportunity in revolutionary mega trends. (Click here to see how we’re investing in renewable energy in Green Zone Fortunes.)

But I do think some of these stocks could help you weather this volatile market.

I know this market is brutal right now.

But it will turn around one day. And that’s going to move a lot of money into the mega trends that will drive markets higher for years (and decades) to come.

To see how we’re following some of these mega trends, join us in Green Zone Fortunes.

I mentioned it earlier, but I am incredibly bullish on renewable energy.

And one tiny Silicon Valley company is about to turn the multitrillion-dollar global energy industry on its head.

How? By unleashing the largest untapped energy source upon the world.

Click here to find out more in my “Infinite Energy” presentation.

To good profits,

Adam O’Dell

Chief Investment Strategist