A house on my block stepped up the Halloween decoration game for our neighborhood.

It started with one giant skeleton… And then the following year, their yard was covered in Halloween lawn ornaments.

This year, there was a shocking twist.

A second house entered the Halloween fray with their own 12-foot-tall mummy proudly displayed in the yard.

Now there is a Halloween war taking place in my neighborhood.

I couldn’t help but wonder: Is this battle going on at a larger scale?

It turns out Lowe’s Companies Inc. (NYSE: LOW) is competing with its industry peer Home Depot (NYSE: HD) for the title of Halloween decoration king.

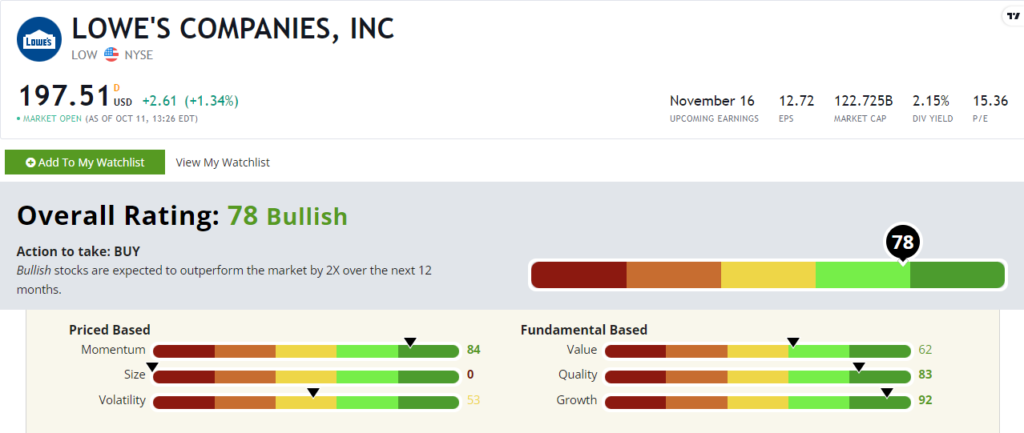

LOW stock rates a “Bullish” 78 out of 100 on our proprietary Stock Power Ratings system.

Let’s look at this decoration battle between the two companies.

Bring a Mummy to a Skeleton Fight: Lowe’s vs. Home Depot

Lowe’s and Home Depot historically have many similarities.

Both are home improvement giants that compete for the same consumers across the U.S. and Canada.

With word that a slow holiday season may falter earnings, the Halloween wars began.

Home Depot was ahead of the Halloween decoration race and released its affordable 12-foot skeleton in 2020.

It became a viral sensation — quick.

Source: Home Depot.

Bill Boltz, executive vice president of merchandising for Lowe’s, knew it was time to step it up.

He reported that Halloween merchandise would have a makeover this year.

By expanding its Halloween merchandise by more than 20%, calling to the hearts of horror fans with its scarier-themed products and leaving more space for larger outdoor ornaments in its stores, Lowe’s prepared for the holidays.

But there was one significant, notable addition…

A 12-foot mummy.

This giant ornament is priced at $348 to compete directly with Home Depot’s beloved “Skelly,” which is a bit cheaper at $299.

It’s too early to call the winner of the season.

But it is safe to say Lowe’s added some heat to the competition.

Though the companies are competing with similar products, they have significant differences.

Stay tuned: I’ll focus on the critical differences between the companies in my next piece on Home Depot.

Let’s return to LOW stock and look at its Stock Power Breakdown.

Lowe’s Stock Power Ratings Breakdown and Momentum

Lowe’s overall score wins the battle when it comes to the companies’ current ratings.

Lowe’s rates a “Bullish” 78 out of 100 on our Stock Power Ratings system. That means it’s set to outperform the overall market by two times over the next 12 months.

LOW’s Stock Power Ratings in October 2022.

Rating in the green on four out of six factors is great, but its high score in growth is something to note.

Its one-year annual sales growth rate is 7.4%, and its annual earnings-per-share growth rate is an outstanding 55.3%.

This means the company has a great track record of growing its profits.

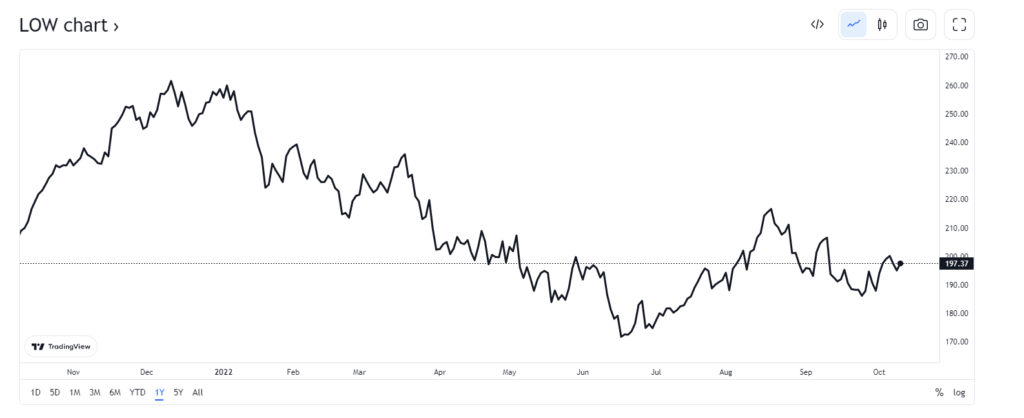

Let’s look at the stock’s recent price action to see why the stock is rated a “Bullish” 84 on momentum right now.

Source: Tradingview.

Lowe’s rates a “Bullish” 84 on our momentum factor.

After hitting a 52-week low of $170.12 in June, LOW’s stock price has had a pretty steady upward trajectory.

The stock price weathered the recent sell-off and has climbed 14.6% since then.

Compared to its industry, Lowe’s stock appears to be in solid shape over the next 52 weeks.

Broader market headwinds and inflation have pushed LOW down 4.8% over the last 12 months. Its home improvement retail peers, however, have lost an average of 15.7% over the same time.

The Bottom Line

Lowes scores a “Bullish” 78 out of 100 on our Stock Power Ratings system.

However, “Strong Bullish” stocks are no anomaly.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock that scores 80 or above on our system and tells you why you should add it to your portfolio — for free!