Last week U.S. President Donald Trump told us he didn’t look at the stock market — he only cares about jobs.

This shook markets for a couple of days ahead of this month’s jobs report in hopes to signal he’d stay strong in trade negotiations with China. Then the jobs report came out and rallied the equity markets into the weekend.

For once, Trump didn’t have to take to Twitter to goose markets higher on Friday. I’ve talked in the past about his tendency to do this, making it difficult to even begin writing about markets on a Thursday.

Going back to what I said back in August before the SOFR spike, which led to the Fed opening up the Repo Window to bring down short term rates …

The strong dollar he is so angry about isn’t a function of the Fed’s raising interest rates. It’s not about policy bifurcation between the Fed and the ECB and the Bank of Japan.

It’s come about because of the continued application of the same mis-education Trump received about the role of interest rates that the Fed consistently (and wrongly) applies.

The world is just short dollars, Don. And lowering borrowing costs won’t help the situation. It’s what created it in the first place.

So this week, with the U.K. elections giving us a bit of a reprieve from dollar hoarding as the pound rallies hard on Boris Johnson’s huge victory and the euro bounces in sympathy, Trump seizes the opportunity to jump the gun on trade talks with China to declare a deal done.

Getting VERY close to a BIG DEAL with China. They want it, and so do we!

— Donald J. Trump (@realDonaldTrump) December 12, 2019

The Wall St. Journal reported that Trump folded on new tariffs and will be rolling back existing tariffs by 50%.

The markets responded to that, as always, with glee. Risk trades exploded higher. Gold got whacked back into its box after a post-FOMC rally pushed it toward $1,490. Equity markets around the globe are following through today thanks to the U.K. elections.

Those suffering under a strong dollar get a reprieve — for now.

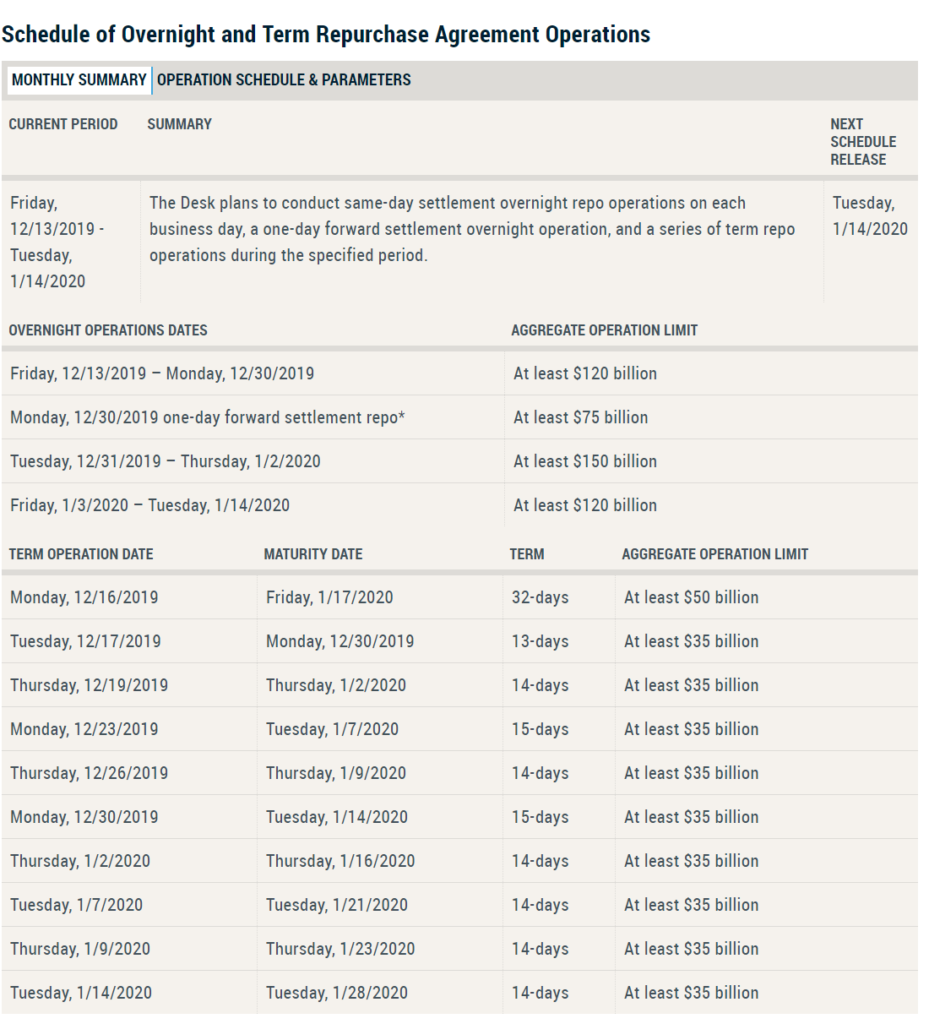

But there’s still a serious problem underneath all of this. If dollar funding in the interbank markets was strong, the Fed wouldn’t have announced that massive repo schedule for the next month, which was the reason gold exploded to the upside.

(H/T Zerohedge for this point)

More importantly than that, China hasn’t confirmed any of this as we head into the weekend.

Trump is not in trouble politically on this deal. His approval rating among Republicans is off the charts. His rallies are well-attended, and he understands his base well. They are convinced China is the enemy and will give him every latitude to pressure them publicly.

At the same time, however, Trump’s trade and sanction policies are contributing to the emerging dollar funding crisis. He’s helping to stuff mattresses around the world with dollars because no one knows what he’ll do next. Markets hate uncertainty. Just ask the Brits about this, vis a vis Brexit.

So he had to back down on his trade policy with China in the end.

He needed to make a deal. And China always knew this.

This is why they were never going to yield to him and his negotiators on basic issues of sovereignty, which is what they have been demanding. So now, after destroying export markets for U.S. farmers, timber producers, etc. he’s backing down with no tangible wins under his belt on all the issues he made such a big deal out of in the first place.

And this is the right thing for him to do.

The Fed gave Trump what he wanted, lower rates. But they didn’t cut rates for the reasons he wanted them to cut rates, which is why he’s still complaining about them. Now Trump has to do his part and that means working something out publicly.

Tariffs are always a tax on domestic producers and consumers. They retard trade and contract the division of labor. They are a subsidy of poor domestic producers, forcing consumers to buy inferior products at higher prices.

Tariffs are, in short, wealth destructive domestically.

China countering Trump’s stupidity with stupidity of its own wasn’t the right response either. Premier Xi Jinping et. al. should have ignored Trump and continued to accept U.S. imports tariff-free. If they had they wouldn’t be experiencing a supply shock in their pork markets, for example.

And that freed capital would be available to keep the dynamism of China’s economy high and spur demand growth. It would be the U.S. that would be missing out on the benefits of China’s manufacturing.

All tariffs do is pick winners and losers. This is all a government can do when it makes new policy. Trump explicitly said this when he imposed these tariffs, noting that now the opportunity for other countries to be our supplier arise.

That’s true. But at what cost?

I didn’t know his reelection campaign slogan was MVGA, Make Vietnam Great Again?

The right response from the beginning was to continue making U.S. labor and manufacturing more competitive through fighting the hard political battles at home. Winning deregulation skirmishes against the Democrats, undoing years of legislating through executive action.

The difference between the U.S. and China is our extensive labor socialism, which is what drives wage disparities. It’s not going to improve moving tool production to Vietnam.

And if you notice, all Trump did of note in renegotiating NAFTA, warmed over as the USMCA, was force Mexico to raise wages in its auto industry to protect union workers in the U.S. Mike Shedlock has a good rundown on the changes. It is his conclusion that I absolutely agree with, whatever the unions like, consumers should hate.

Anyone who wants to get ahead based on performance, not seniority, should not be a union supporter.

Moreover, corrupt union leaders get into bed with corrupt politicians. The combination is the biggest vote-buying racket in the world.

This puts the public at the mercy of militant teachers’ unions, police unions and firefighter unions all demanding and receiving untenable pension promises.

I am a proud union hater all my life.

They promote based on seniority, not talent. They keep incompetent teachers in jobs. They keep corrupt police officers in jobs.

They raise taxes for benefits the average person can't get, then demand more and more in return for less.

— Mike "Mish" Shedlock (@MishGEA) December 8, 2019

But until we reject the ideas that politicians can solve these basic problems, these issues will keep cropping up over and over again as political footballs to win elections and redistribute wealth. Unions are anathema to a free society. It’s the one trend in U.S. labor statistics that gives me hope, falling union participation.

In the end, however, economics always win. Tariffs and trade protectionism of all kinds yield to economic reality. Even Donald Trump can be taught this, especially during a reelection campaign.

It is the brewing crisis in the dollar the Fed is trying to stave off that is the biggest tell that neither they nor politicians like Trump and Xi have any control over what happens next.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.