With inflation at 8.3%, prices seem sky-high for, well, everything.

But high inflation won’t last forever. And while certain retailers will struggle, not all are doomed.

Take a look:

This chart shows annual retail sales from 1992 to 2021.

As you can see, sales skyrocketed after 2009.

Even during the 2020 coronacrash, retail sales jumped from $5.6 trillion in 2020 to $6.5 trillion in 2021 — the sector's largest annual sales growth since 1992.

Today’s Power Stock is a household retailer: Macy’s Inc. (NYSE: M).

Macy’s is a retail giant that operates 725 department stores in the U.S., Puerto Rico and Guam, as well as Dubai and Kuwait. It sells everything from clothes to household items.

The company also sells merchandise through websites and mobile apps for its brands, which include Macy’s, Bloomingdale’s and Bluemercury.

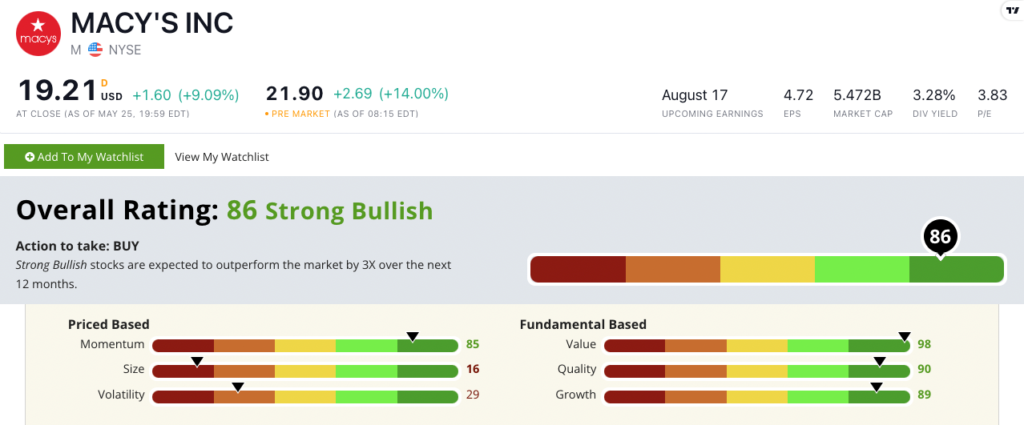

Macy’s stock scores a “Strong Bullish” 86 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Macy’s Stock: Inflation-Beating Momentum + Strong Value

Researching Macy’s, I discovered two interesting tidbits:

- In the first quarter of 2022, Macy’s reported sales of $5.3 billion — a 13.6% increase over the same quarter a year ago.

- More importantly, the company raised its sales guidance for 2022 — telling investors it expects even more sales despite inflation pressures.

Macy’s is a top-notch value stock, especially compared to its general merchandise peers.

It trades with a low price-to-earnings ratio of 4.2, while its industry cousins average an inflated 18.6.

Macy’s’ price-to-sales ratio of 0.2 is far better than its peers, which average 1.2.

Macy’s is an outstanding value stock — scoring a 98 on our value metric — but its low price is just one reason to buy today.

The company’s one-year annual sales growth rate of 39.8% shows tremendous growth.

Plus, its gross margin of 40.9% indicates outstanding quality.

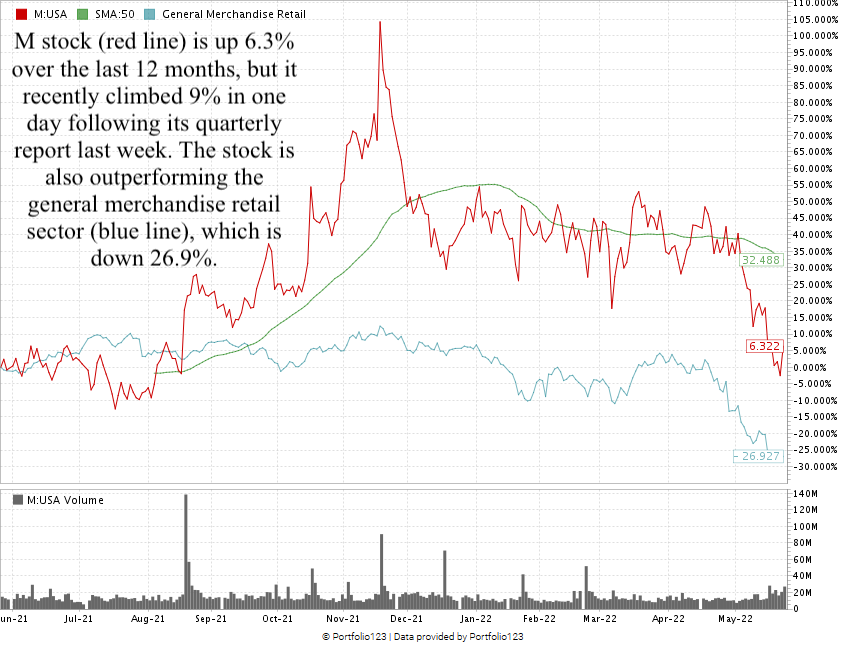

After reaching a 52-week high in November 2021, M pared some of its gains and traded sideways until the broader market sell-off pushed it lower.

However, its strong first-quarter report helped jump-start the stock, pushing it up 9% in one day.

M is up 6.3% for the past 12 months and crushes the general merchandise retail sector, which is down 26.9%.

Macy’s Inc. stock scores an 86 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The retail sector has taken a hit due to high inflation, but Macy’s projects a strong 2022. This is an excellent time to buy M stock.

Bonus: Shareholders earn a 3.3% dividend yield, meaning the company will pay you $0.63 per share, per year to own the stock.

Stay Tuned: No. 1 Poultry Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a leading poultry producer.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Write to Feedback@MoneyandMarkets.com!