Holiday shopping season used to be my favorite time of the year.

The hustle and bustle, the faint smell of cinnamon in the air and the feeling of gift-giving overwhelmed me with excitement as I shopped through the mall.

But this year, I don’t expect to feel that same energy as I shop.

Inflation is gripping U.S. consumers by the wallet, which influences the way they shop.

Holiday spending is expected to be much lower than usual.

E-commerce will be affected as well.

Adobe Analytics predicts that online sales will rise just 2.5%, compared to an 8.6% increase in 2021.

For the next few days, I want to look at department stores Macy’s, Nordstrom and Dillard’s to see how each company prepares for a thinner holiday season.

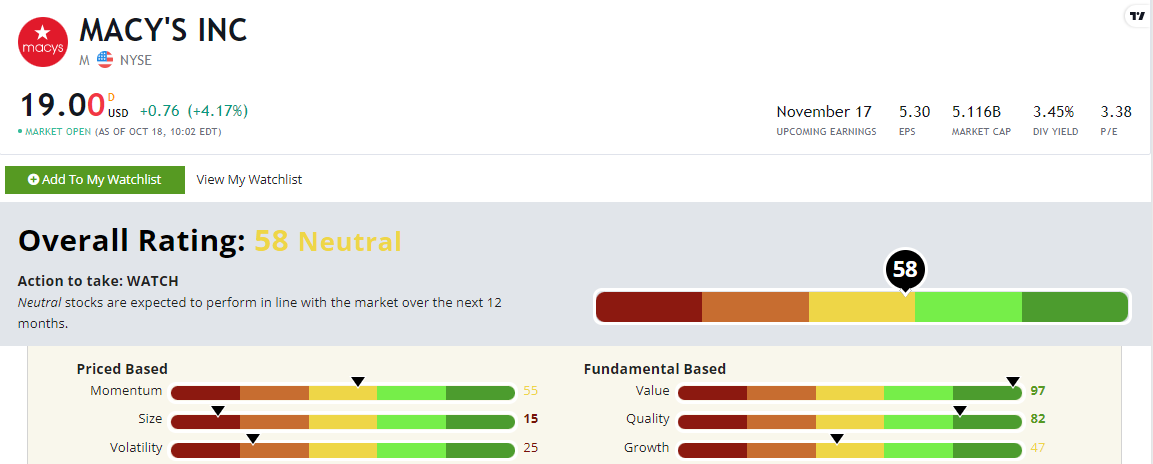

We can start with Macy’s Inc. (NYSE: M), which earns a “Neutral” 58 out of 100 on our Stock Power Ratings system.

First, look at how the company is preparing for the holidays before diving deeper into its ratings.

Macy’s’ Holiday Cutbacks

Macy’s is known for its holiday spirit.

With its beloved Macy’s Thanksgiving Day Parade, the department store knows how to get the holiday cheer started.

Macy’s is trying to put smiles on consumers’ faces by adding Toys R Us extensions to multiple stores across the U.S.

But this year, there is a noticeable difference.

Barron’s reported that Macy’s would hire more than 41,000 full- and part-time positions for the holiday season.

Compared to last year, that’s 46% fewer new hires to prepare for its busiest time of the year.

The seasonal staffing cuts are another red flag that holiday spending may be lower than anticipated.

Macy’s was one of the many retailers to announce a smaller holiday staffing plan.

Let’s look at Macy’s’ Stock Power Ratings to look deeper at its stock performance over the last 52 weeks.

Macy’s Stock Power Ratings Breakdown and Momentum

We’ll dig into its stock movement in just a second using the momentum factor. But first, let’s look at its overall score.

Macy’s rates a “Neutral” 58 out of 100 on our Stock Power Ratings system.

M’s Stock Power Ratings in October 2022.

As shown in the image, Macy’s scores all over the place to earn its mediocre rating.

It does rate in the green for two out of our six metrics.

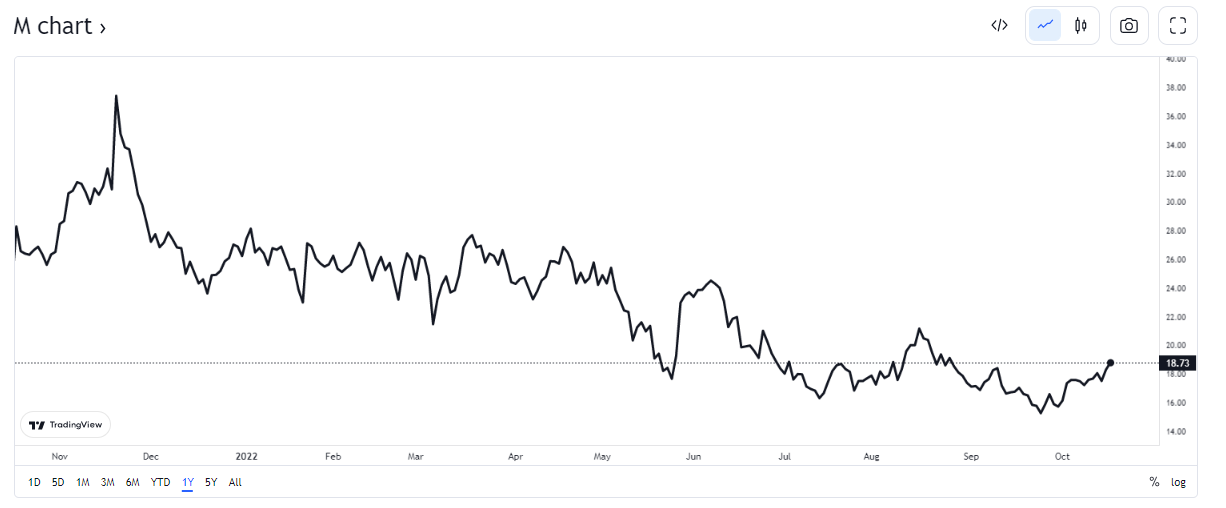

Let’s zoom in on the momentum factor to see how Macy’s stock performed over the last 52 weeks.

Source: Tradingview.

Macy’s stock plummeted to a 52-week low of $15.10 in September.

This drop in the stock price happened right after the announcement of the holiday staffing cut.

Its dominant downward slide over the last 12 months, however, earns Macy’s a neutral 55 on our momentum factor.

The Bottom Line

Macy’s stock scores a “Neutral” 58 out of 100 on our Stock Power Ratings system.

However, “Strong Bullish” stocks are no anomaly.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock that scores 80 or above on our system and tells you why you should add it to your portfolio — for free!