Green Zone Fortunes co-editor Charles Sizemore told me once that 99.9% of people who trade on headlines lose money.

Our proprietary Stock Power Ratings system helps get you out of the weeds of financial news headlines.

A case in point…

Last week, Tesla Inc. (Nasdaq: TSLA) CEO Elon Musk tweeted he was buying a sports franchise.

Shares of soccer team Manchester United PLC (NYSE: MANU) jumped 5.6% in after-hours trading.

MANU stock is the subject of today’s Stock Power Daily. But we’re changing it up. Read on to find out why I recommend you steer clear.

Also, I’m buying Manchester United ur welcome

— Elon Musk (@elonmusk) August 17, 2022

Later the same day, Musk tweeted that he was kidding and had no interest in buying a sports team.

But a quick look at our Stock Power Ratings system tells you investing in the franchise is risky anyway.

Manchester United is an English football (soccer in the U.S.) team that’s been around since 1878.

It was once the cream of the football crop.

After a horrible finish last season, it lost its first two games this season.

So fans have started to call on the owners, the Glazer family (which also owns the Tampa Bay Buccaneers in the NFL), to sell the club.

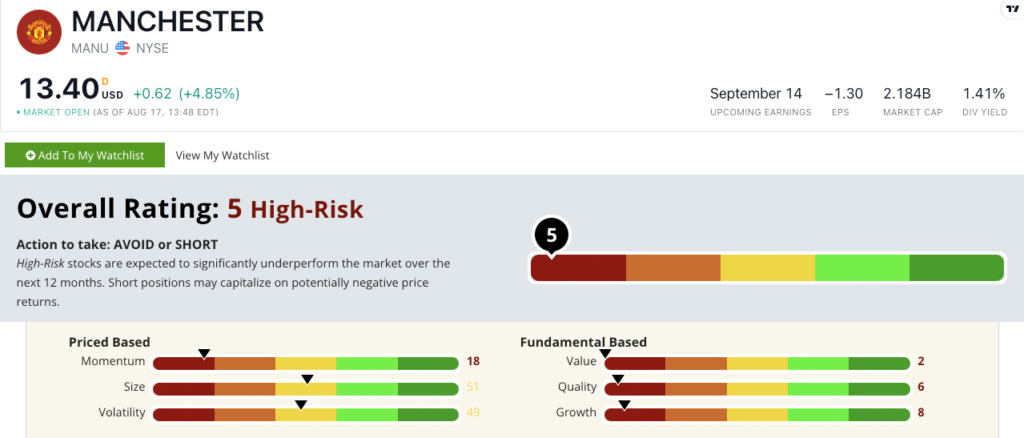

MANU Stock Power Ratings in August 2022.

Manchester United stock scores a “High-Risk” 5 out of 100 on our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

MANU Stock: Weak Momentum + Overvalued

Here is where I usually tell you about impressive company milestones.

Quite the opposite for MANU:

- For the nine months ending on March 31, 2022, MANU reported an operating loss of $32.1 million — that’s a 13,157% higher loss than the same time a year ago!

- MANU notched a $54 million total loss for the same period — a 390% greater loss than a year ago.

That illustrates why MANU scores an 8 on growth.

It also scores in the red on our other fundamental metrics (quality and value).

MANU’s negative price-to-earnings ratio tells us the company is hemorrhaging money. It scores a 2 on value.

All of its return-ons (assets, equity and investment) are in the red, earning it a 6 on quality.

These numbers tell us MANU is overvalued yet underperforming.

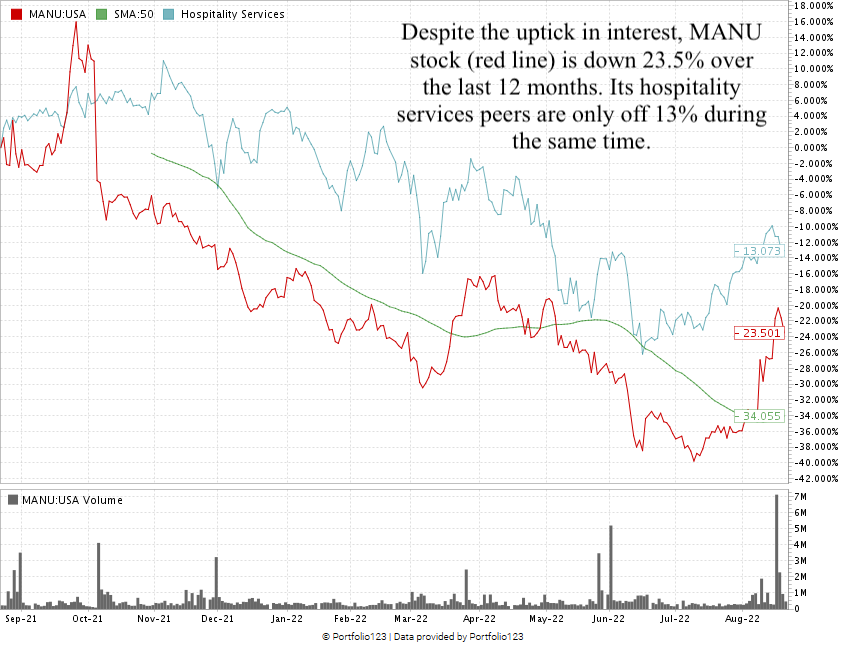

You can see in the stock chart above that MANU had a rough go over the last 12 months.

From its high in September 2021 to its low in July 2022, the stock lost 48%.

Despite the fake interest from Musk, the stock is still down 23.5% over the year.

Manchester United stock scores a 5 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

On the field, the team is a mess.

Its financials are a mess.

A quick glance at our Stock Power Ratings system shows that despite a tweet, MANU is still a stock to avoid.

Stay Tuned: Machinery Power Stock to Buy

Tomorrow, we’re returning to our original Stock Power Daily format.

Stay tuned — I’ll share all the details on one of the largest American dealers of agricultural and construction equipment.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion so you know what to stay away from?

Or would you prefer that we only share “Bullish” and “Strong Bullish” stocks?