There’s good reason for the popular advice to “buy when there’s blood in the streets” …

It’s because sentiment often lags price in a forward-looking stock market. So by the time that it’s become obvious that a recovery is under way … higher prices can only benefit those who stepped into the carnage while sentiment was at its worst.

Time will tell whether the recovery is actually sustainable, but so far, it does appear to be underway.

Consider that last Friday marked the ninth consecutive day of gains in the broader stock market. That’s the longest such streak in over 20 years!

Regardless, it’s been a much-needed break from the widespread pessimism that’s dominated the markets since mid-February, even though some have said the sell-off could be worse …

Warren Buffett commented at Berkshire Hathaway’s annual meeting that “this has not been a dramatic bear market or anything [of] the sort.”

Of course, one could argue he’s a bit more detached from the market’s volatile spell, given that he raised an historic pile of cash heading into it and is planning to retire at the end of the year.

For the rest of us, we still have to figure out whether the market is up, down or sideways ahead … and which sectors are the best (and worst) places for our hard-earned money.

That’s what this edition of What My System Says Today is all about.

I’ll breakdown how the 11 major sectors did in comparison to the S&P 500. Then, I’ll show you the stocks that were the “biggest movers” on both the positive and negative side.

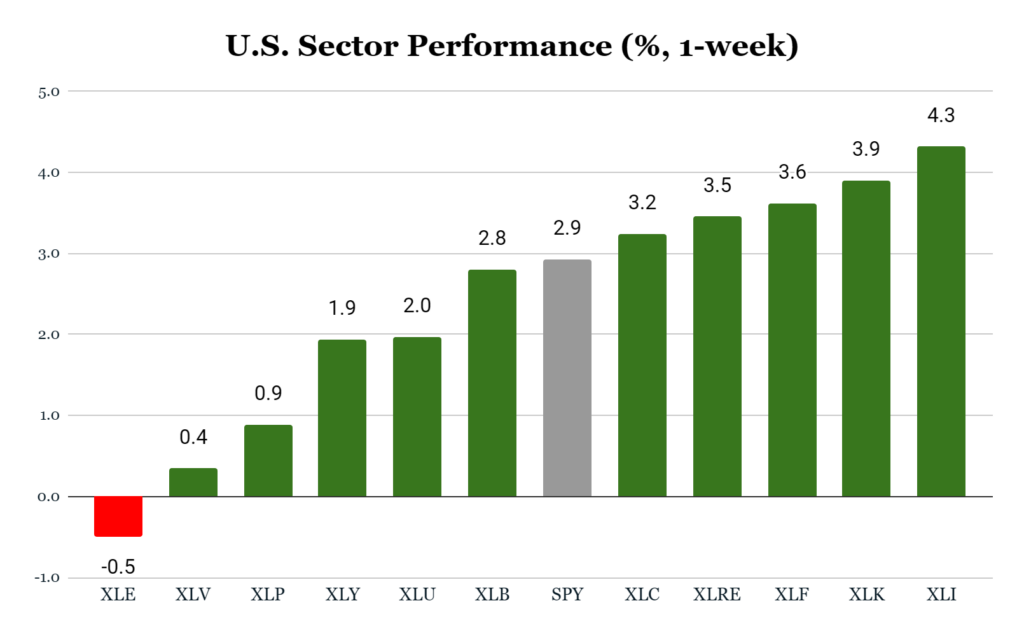

Let’s get right to it by looking at how major U.S. stock sectors fared last week:

Key Insights:

- The S&P 500 (SPY) closed the week 2.9% higher.

- 10 out of 11 sectors showed a positive gain for the week.

- Five sectors outperformed the S&P 500.

- The industrial sector (XLI) gained the most, up 4.3%

- The energy sector (XLE) posted a marginal loss of 0.5%.

Now, let’s take a closer look at the top-performing sector’s stocks through the lens of a simple momentum screen…

The Best-Performing Sector: Industrials

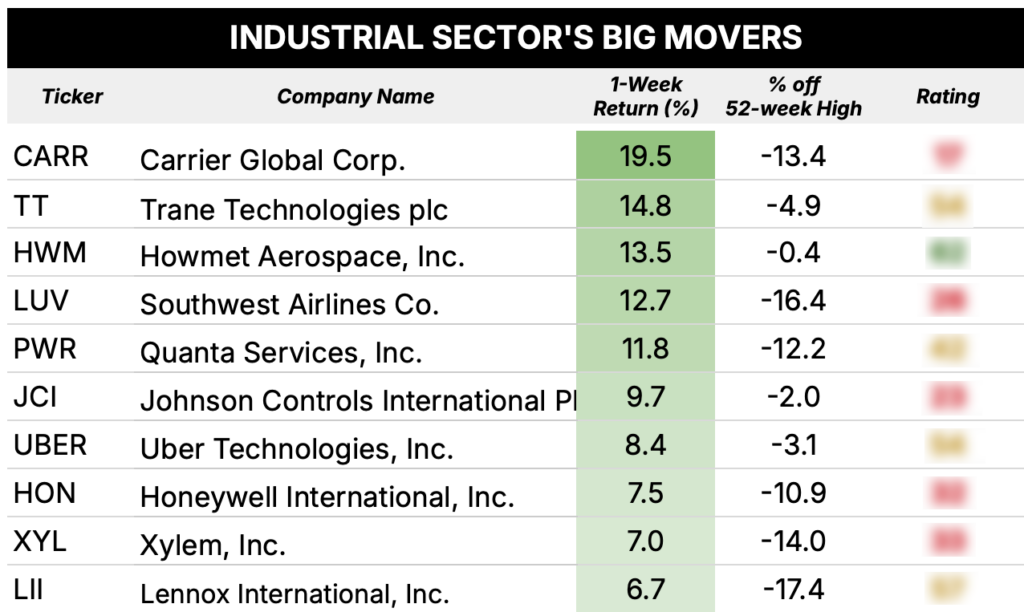

The industrial sector came out on top of last week’s broad market rally.

This may suggest investors are enthusiastic about an eventual uptick in American manufacturing, which is one of the aims of Trump’s tariff policy.

I looked past last week’s performance to see if that sentiment could be validated over a longer time horizon …

Since Trump’s November 5th election win, the industrial sector (XLI) is down 1.1% and smack in the middle of the pack of 11 sectors.

However, since Trump’s April 2nd Liberation Day announcement of sweeping tariffs, industrial stocks are up 1.1%, the second-best performing sector and only one of two sectors in positive territory.

The latter of those timeframes does hint at the market’s belief that, over time, a tougher stance on global trade can boost the prospects of American industrial companies.

That said, realize that the sector is far more diverse than you’d expect – this isn’t a monolithic group of manufacturers, per se.

Have a look at the following list of industrial stocks that are currently within 20% of their highs …

Here we have manufacturing companies (CARR, TT, LII) … a commercial airline (LUV) … a utility contractor (PWR) … and even Uber Technologies (UBER), which is arguably more of a technology company than a traditional industrial company (and even has “technology” in its name!).

Speaking of which, in an era when technological advances have dominated the zeitgeist, it’s important to remember there are physical needs that must be met to keep everything in the digital and AI world humming along.

This is true in the semiconductor manufacturing space, of course. And it’s applicable to Quanta Services (PWR), a Green Zone Fortunes top-performer, whose work has been in high demand for getting additional power to the data centers that are fueling AI’s tremendous growth.

All told, the industrial sector is a core component of our country’s economy and should only strengthen ahead.

The stocks in this diverse sector can hand you “hit or miss” results, so we urge you to use a tool like the Green Zone Power Rating system to find only the best companies.

Now let’s see which stocks pulled the energy sector lower last week…

Last Week’s Laggard: Energy

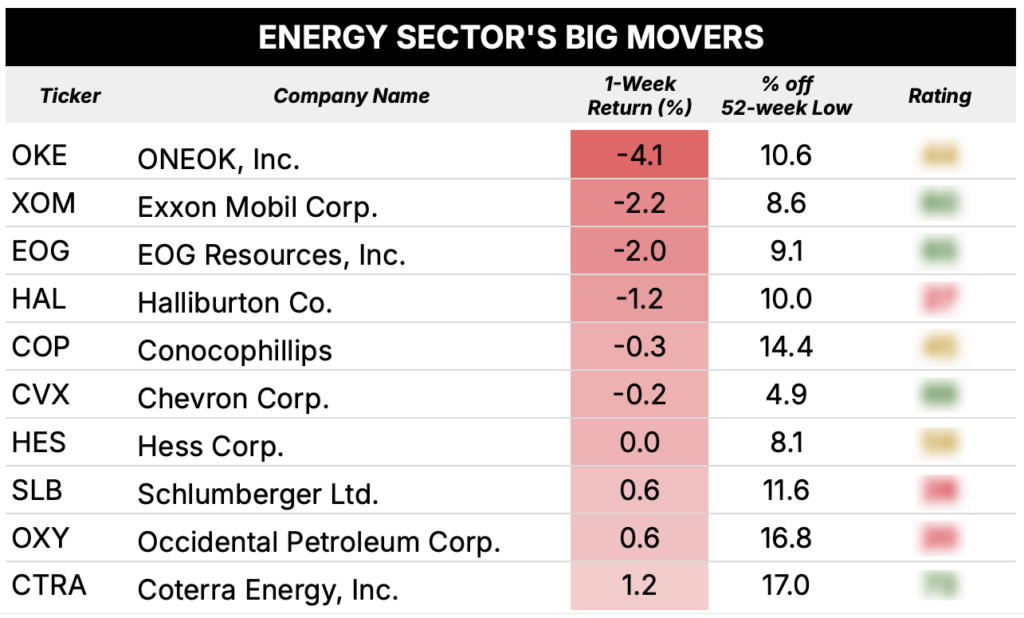

While investors were broadly enthusiastic last week, that sentiment did not carry through to the lagging energy sector.

This is true of last week’s performance, but also over longer timeframes …

Consider that the energy sector is down 10.7% since Trump’s election, and off 14.4% since Liberation Day – putting energy stocks in last place over both lookback periods.

These moves certainly fly in the face of Trump’s “drill, baby, drill” energy policy. It also points to concerns that trade disruptions could lead to a widespread recession that in turn takes a meaningful bite out of global oil demand.

Crude oil has traded as low as $55 a barrel in the wake of tariff announcement.

OPEC hasn’t helped much, either, after announcing a larger-than-expected output hike on Saturday.

All told, the lagging energy sector may be better for finding “short” candidates, which is also the aim of our “weakest stocks in the weakest sector” screen, here:

That said, a handful of these S&P 500 energy stocks held up better last week than the broader sector … some netting small gains.

And even more encouraging, four of the 10 stocks list above have earned “bullish” or better ratings on my Green Zone Power Rating system – you’ll need to subscriber to my Green Zone Fortunes newsletter to gain full, complimentary access to that system.

I can tell you this …

There are some incredible deals to be had in the energy sector. But not all stocks with dirt-cheap looking valuations (i.e. price-to-earnings ratios) are worth buying … some are so-called “value traps.”

The key, particularly in this beaten-down sector, is to identify quality businesses that are also now trading at attractive valuations.

As I mentioned, my Green Zone Power Rating system is up for the task and you can gain access here.

To good profits,

Editor, What My System Says Today