The big news out over the weekend is what appears to be substantial progress in the trade war stand-off between the U.S. and China.

Tariffs on Chinese goods imported to the U.S. have been dropped from 145% to 30%, while U.S. goods headed for China will incur a 10% tariff, down from 125%.

Clearly, tariff rates in excess of 100% were likely never intended to be real or lasting. They were simply negotiation starters, albeit wildly high ones.

Now that the recently agreed upon rates are in the realm of being reasonable, we can conclude that both China and the U.S. are serious about reaching a sustainable deal and getting bilateral trade moving again.

That said, the deal only covers the next 90 days.

During that time the two countries will continue negotiating a more permanent and detailed deal.

It might be a bit naïve to presume these next 90 days will be smooth sailing. Both sides will almost surely fight to get more and give up less … and may be quick to revert to the hardline stances they took over the last six weeks.

When this whole drama began in early April, I characterized the environment as one in which you “can’t trust anything.”

Part of that was based on the market’s whipsaws around a fake news story. Besides that, though, it was clear that this situation would take many twists and turns, sometimes painting a picture that’s 180-degrees opposite what had been painted just a few days before.

All told, I’m relieved to see progress in the negotiations … but I remain only cautiously optimistic, per usual.

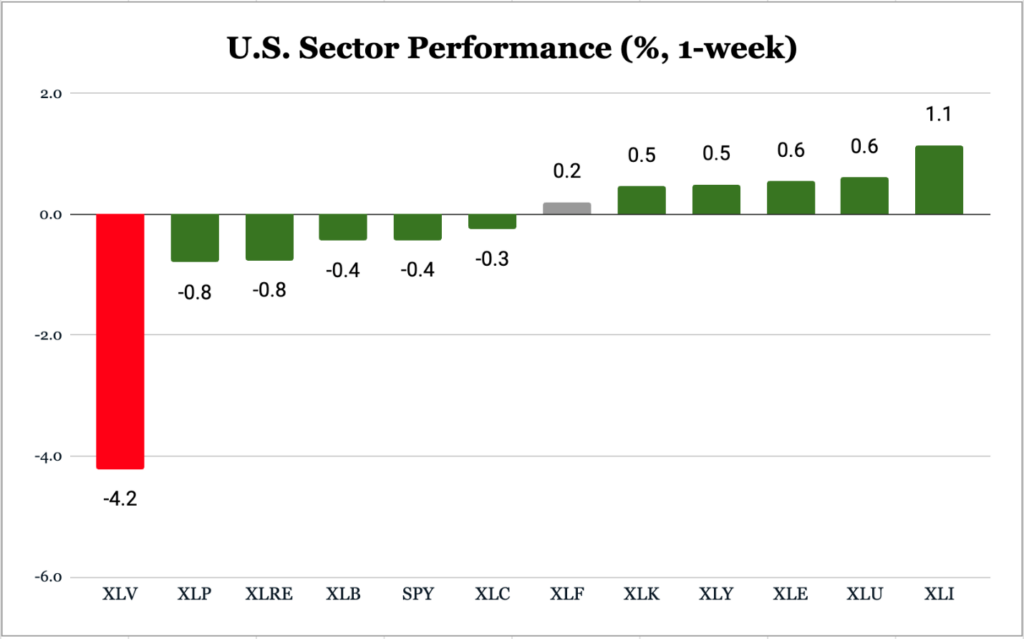

Today we’ll review the performance of U.S. sectors last week, which in a way is already stale data.

What’ll be truly important to size up is the spread between top- and bottom-performing sectors this week, as the market digests the varied implications of a thaw in the trade war stand-off.

Nonetheless, let’s have a look at last week’s moves …

Key Insights:

- The S&P 500 (SPY) closed the week a slight 0.4% lower

- 6 out of 11 sectors showed a positive gain for the week.

- Seven sectors outperformed the S&P 500.

- The industrial sector (XLI) gained the most, up 1.1%

- The health care sector (XLV) declined a meaningful 4.2%

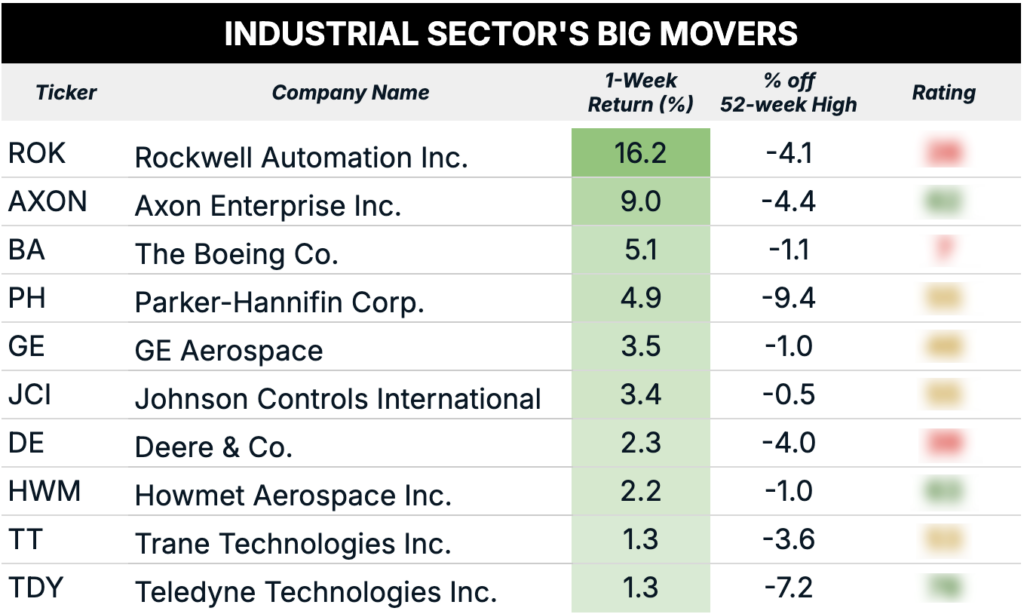

Now, let’s take a closer look at the top-performing sector’s stocks through the lens of a simple momentum screen…

The Best-Performing Sector: Industrials

The industrial sector was the top-performing sector for a second week in a row.

As I mentioned last week:

This may suggest investors are enthusiastic about an eventual uptick in American manufacturing, which is one of the aims of Trump’s tariff policy.

Now that we’re hearing of progress in the tariff negotiations, I’ll be particularly interesting to watch how the sector performs this week.

I suppose there are two ways to interpret a thawing of tensions between the U.S. and China, as it pertains to the U.S. industrial sector.

On one hand, averting a global slowdown in trade and economic growth could be seen as a positive, for all sectors but particularly for the notoriously cyclical industrial sector.

On the other hand, a return to “normal” trade relationships could be seen as easing the pressures on and motivations for U.S. manufacturers to invest in future production capacity.

As we typically do, we advise taking a stock-picker’s approach … whereby you neither shun nor dive headlong into an entire sector, but use a robust tool to identify the “best” and “worst” stocks in any given sector.

My Green Zone Power Rating system is up for that task!

Have a look at the following list of industrial stocks that are currently within 10% of their highs …

While full access to my Green Zone Power Rating system is reserved for paid-up subscribers to my Green Zone Fortunes newsletter, I do feel obligated to offer a word of warning on one of the names above: Boeing (BA).

The stock currently rates as “high risk,” with a rating of just 7 out of 100.

We’ll watch to see if that improves over the next quarter or so, but for now we recommend avoiding the troubled airline manufacturer.

Psst: Teledyne Technologies (TDY) is the top-rated stock on the list above. Clear here to see why.

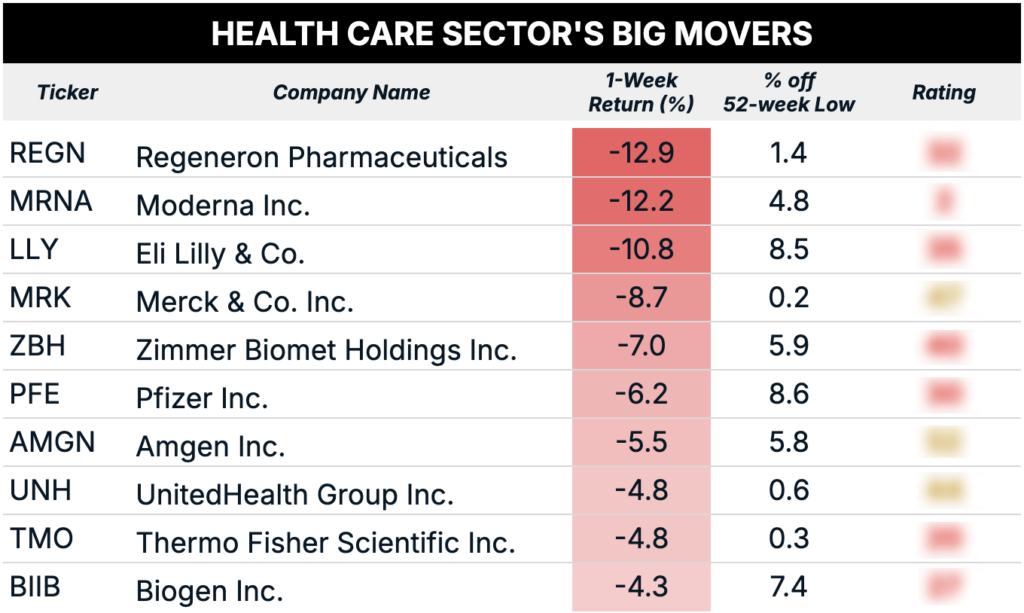

Now let’s see which stocks pulled the health care sector lower last week…

Last Week’s Laggard: Health Care

While the broader market and most sectors were within a rather narrow range last week, the health care sector sank a meaningful 4.2%.

As mentioned, it’ll be more interesting to see how all sectors perform this week. That’s especially true for the health care sector in the wake of Trump’s second-most interesting weekend announcement … that he may sign an executive order to cut the cost of prescription medications by as much as 90%.

If that actually happens, it could be a boon for patients, but a serious threat to Big Pharma’s profit margins.

As if they saw it coming, have a look at the poor performance of a number of major pharmaceutical manufacturers last week, all of which are now within 10% of their 52-week lows:

The health care sector was already hesitant about what Trump 2.0 would hold for it … shares of the SPDR Health Care Sector ETF (XLV) are down 9% since Trump’s November election win, the worst of all 11 sectors we track.

What’s more, XLV has been the weakest sector since Trump announced the 90-day pause on April 9, up just 1.4% versus a majority of sectors that have gained in the high-teens to mid-20% range.

We do believe an extra degree of caution is warranted in the space due to policy risk. However, there are surely still good opportunities to be had.

As is always the case with a laggard or beaten-down sector, the key is to identify quality businesses that are also now trading at attractive valuations.

My Green Zone Power Rating system can help you identify those on your own, and my Green Zone Fortunes newsletter comes with additional “hand-holding” for anyone who wants to follow my model portfolio.

Big Pharma is ripe for the “shakeout” that’s underway in the broader market, which is why I recommended a very unconventional health care stock last November — a stock that’s already up more than 130% … with much room still to run!

To good profits,

Editor, What My System Says Today